Liberty Energy (LBRT) is among the top players in the oil & gas services industry. However, as the core business faces headwinds, the company is silently pivoting towards an attractive growth option.

The oil services company, which used to be run by Trump’s Energy Secretary, Chris Wright, is therefore in the limelight. In the last month, LBRT stock has surged by 37% as the company outlined its plans for the power business.

The degrowth in the oil services business seems to be discounted in LBRT's stock price. The development in the power business is therefore likely to dictate the stock trend in the coming quarters.

About Liberty Stock

Liberty Energy is an energy services company. It’s among the largest providers of completion services and technologies to onshore oil and natural gas producers in North America.

With its Liberty Power Innovations subsidiary, the company has also pivoted towards advanced distributed power and energy storage solutions. Considering the data center boom, Liberty seems well positioned to benefit from this business diversification.

For Q3 2025, Liberty Energy reported revenue of $947 million. This implied a sequential decline in revenue of 9%. Further, for the quarter, adjusted EBITDA was $128 million, which implies a sequential decline of 29%.

LBRT stock has, however, trended higher by 30% in the last six months as the markets discount the pivot towards data centers.

Ambitious Growth Plans

It’s worth noting that for the first nine months of 2025, Liberty Energy reported a revenue decline of 12% on a year-on-year (YoY) basis to $3 billion. For the same period, adjusted EBITDA declined by 38% to $477 million. This weakness in results has been on the back of global macroeconomic challenges, which have resulted in oil oversupply.

Liberty Energy therefore plans to offset the weakness in the completions business by making some big power investments. To put things into perspective, Liberty Energy is looking to invest $1.5 billion to boost power capacity to over 1 gigawatt. The company plans a full-service offering that includes gas procurement, infrastructure development, and grid management.

It's worth adding here that in July, the company announced a partnership with Oklo (OKLO). This partnership will accelerate integrated power solutions for high-demand customers with a focus on data centers and industrial facilities.

On the flip side, the big investments will translate into higher leverage, and credit metrics are likely to worsen in the near term. Liberty Energy has mentioned in the conference call for Q3 2025 that it’s in “close engagement” with “customers with large, highly transient power demand.” Once the company has quality data center contracts, there will be clear revenue and cash flow visibility. This will translate into better credit metrics in the next few years.

What Analysts Say About LBRT Stock

Recently, Citigroup upgraded Liberty Energy to “Buy” from “Neutral” with a $21 price target. This would imply an upside potential of 38%. A key reason for the upgrade is the company’s decision to raise power investments towards $1.5 billion. Citi believes that this investment will translate into gains, contributing to 35% to 40% of EBITDA.

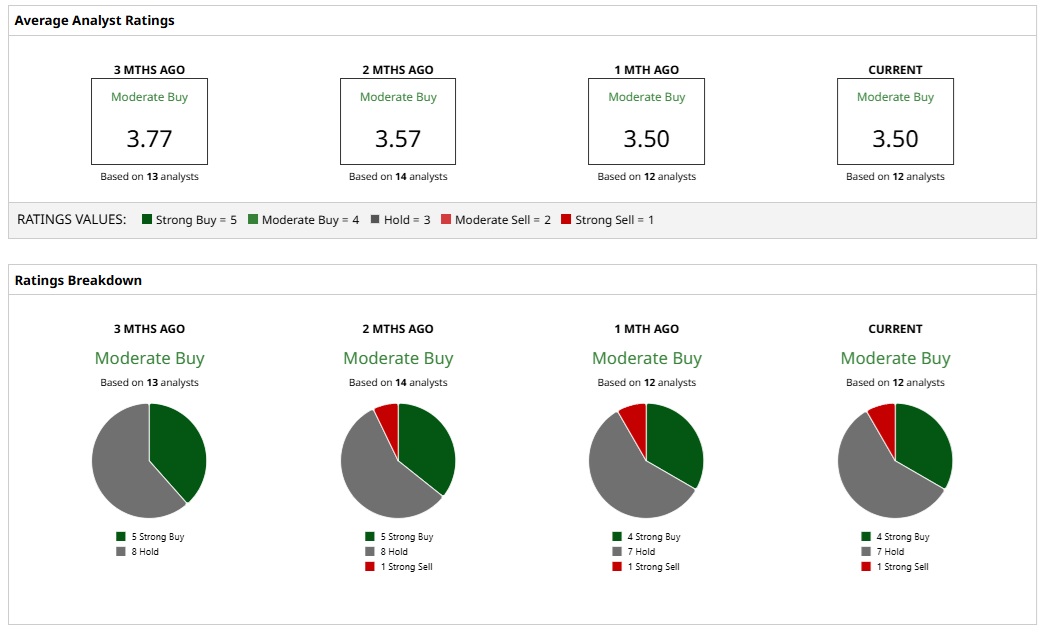

On looking at broader analyst estimates, LBRT stock has a “Moderate Buy” rating. Currently, four analysts have assigned a “Strong Buy” rating. Further, seven analysts believe that LBRT stock is a “Hold” and one analyst has assigned a “Strong Sell” rating.

Overall, the mean price target of $16 implies a marginal downside of 6%. However, if the most bullish price target of $19 is considered, the upside potential is 26%. Considering the pivot towards data centers, LBRT stock looks attractive. In addition, LBRT stock has witnessed dividend growth of 45% in the last five years. As the company implements its growth plans, it's likely that dividends will continue to swell.