Cannabis stocks have been on an absolute tear in the past month as investors are optimistic that marijuana will soon be legalized at the federal level in the U.S. Curaleaf (CURLF) stock has surged nearly 90% year-to-date, making it the top performer among pot stocks tracked by Barchart.

The rally intensified on Monday after President Trump suggested marijuana reclassification could happen within weeks and praised CBD's potential for senior healthcare. The broader market responded enthusiastically, with the largest traded marijuana ETF, the AdvisorShares Pure US Cannabis ETF (MSOS), climbing 28% in its best day since 2022.

Notably, cannabis stocks are seeing some pullback today, likely due to profit taking.

In this first stint as U.S. President, Trump eased hemp and CBD regulations through the 2018 Farm Bill. Now, the administration is considering moving marijuana from Schedule I to Schedule III status, which would reduce the tax burden on cannabis companies and open doors for institutional investment.

Industry experts believe reclassification could transform the $80 billion market, though the process typically takes about a year.

Is Curaleaf Stock a Good Buy Right Now?

Curaleaf posted mixed second-quarter results, highlighting both challenges and opportunities for the cannabis giant. In the June quarter, it reported revenue of $315 million, down 8% year-over-year (YoY), as domestic price pressures continue to squeeze margins.

While U.S. operations struggled with flat sales, the international division grew by 17% sequentially and 62% YoY, driven by surging demand in Germany and the United Kingdom.

Curaleaf now operates across 17 U.S. states and 15 countries worldwide, with international revenue on track to become one of the top three contributors by year-end. Germany remains crucial to top-line growth, as patient numbers have jumped from 150,000 to 1.2 million in just one year following regulatory reforms. The company recently secured a license to enter Turkey's nascent medical market, adding 87 million potential consumers to its addressable market.

Chairman Boris Jordan emphasized that domestic pricing challenges stem primarily from unregulated hemp products flooding the market rather than competition within the legal cannabis sector.

Curaleaf anticipates that these pressures will ease as federal enforcement intensifies and new hemp regulations are implemented over the next 12 months. Meanwhile, Curaleaf is hedging its bets by expanding its own hemp beverage business through partnerships with retailers like Total Wine and DoorDash (DASH). Product innovation continues with strong launches of Anthem pre-rolls and ACE oil extraction technology.

Curaleaf maintains its position as the number one vape brand in America through its Select line. Looking ahead, Curaleaf anticipates flat to low single-digit revenue growth in the third quarter while pursuing a debt refinancing expected to close by year-end. Management remains confident that the upcoming federal reform and rescheduling momentum will unlock significant value.

Is CURLF Stock Undervalued?

Analysts tracking CURLF stock forecast sales to rise from $1.34 billion in 2024 to $1.6 billion in 2029. It is forecast to end 2029 with adjusted earnings of $0.15 per share, compared to a loss of $0.17 per share in 2024.

Moreover, its free cash flow is projected to grow from $69.4 million in 2024 to $540 million in 2029. If the cannabis stock trades at 10 times forward FCF, it could more than double within the next four years.

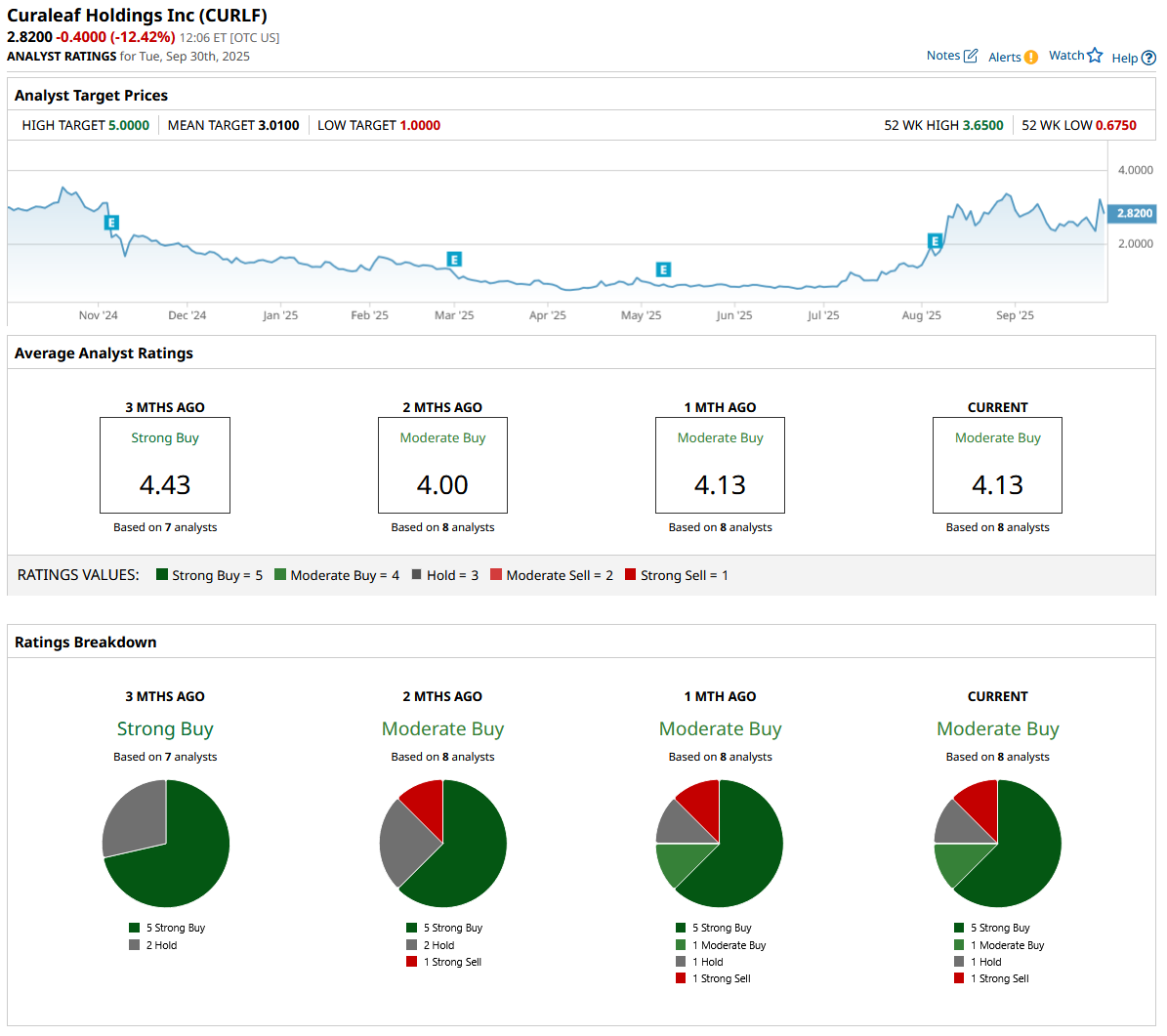

Out of the eight analysts covering CURLF stock, five recommend “Strong Buy,” one recommends “Moderate Buy,” one recommends “Hold,” and one recommends “Strong Sell.” The average CURLF stock price target is $3.01, which is 7% higher than the current price of $2.82.