Science Applications International (NASDAQ:SAIC) reported mixed results for the second quarter on Thursday.

The company reported a quarterly sales decline of 3% year-on-year to $1.77 billion, missing the analyst consensus estimate of $1.86 billion. The adjusted EPS of $3.63 beat the analyst consensus estimate of $2.24.

Science Applications revised the 2026 revenue outlook to $7.250 billion-$7.325 billion (prior $7.60 billion-$7.75 billion), below the analyst consensus estimate of $7.65 billion.

The company revised its annual adjusted EPS outlook to $9.40-$9.60 (prior $9.10-$9.30) above the analyst consensus estimate of $9.17.

"Our revised guidance assumes that the operating environment remains stable but does not improve this year. We believe that this more cautious outlook is prudent, and we are confident in our ability to execute against it," said SAIC CEO Toni Townes-Whitley said.

SAIC shares fell 1.7% to trade at $104.41 on Friday.

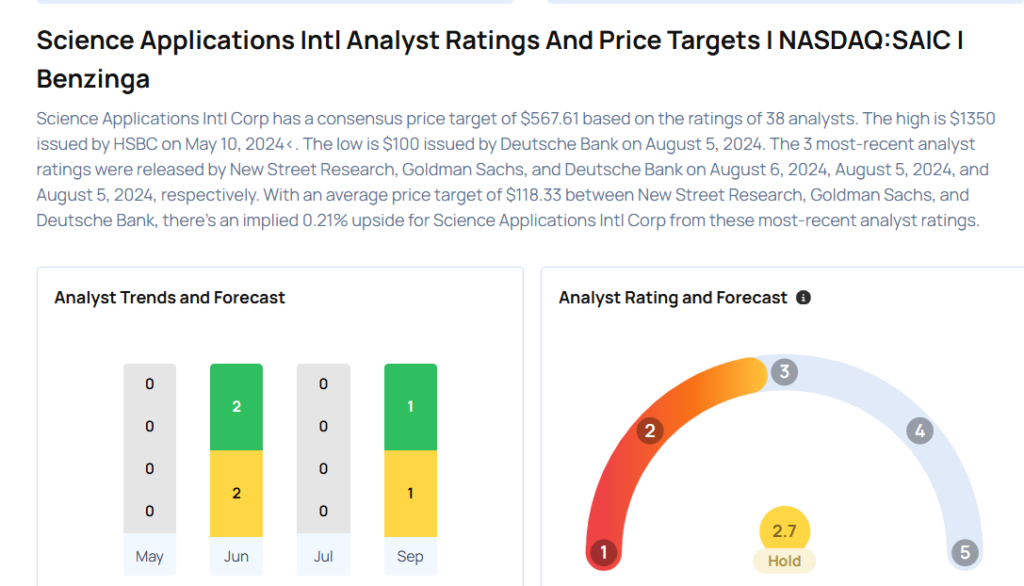

These analysts made changes to their price targets on SAIC following earnings announcement.

- Stifel analyst Jonathan Siegmann maintained Science Applications Intl with a Buy and lowered the price target from $130 to $128.

- UBS analyst Gavin Parsons maintained Science Applications Intl with a Neutral and lowered the price target from $111 to $110.

Considering buying SAIC stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock