Braze Inc (NYSE:BRZE) reported better-than-expected second-quarter results and raised its FY2026 EPS and sales outlook above estimates.

The company reported fiscal second-quarter 2026 revenue of $180.1 million, up 23.8% from $145.5 million a year earlier, beating the $170.1 million analyst estimate. Non-GAAP net income was $16.9 million, or 15 cents per diluted share, beating the 3-cent estimate and up from $9.1 million, or 9 cents per diluted share, a year earlier.

For the fiscal third quarter, Braze expects revenue of $183.5 million to $184.5 million, above the $178.6 million estimate, and non-GAAP net income of $6.5 million to $7.5 million, or 6 cents to 7 cents per diluted share, above the 2-cent estimate

For the full year ending January 31, 2026, the company raised its outlook, now projecting revenue of $717.0 million to $720.0 million, above the $697.7 million estimate, and non-GAAP net income of $45.5 million to $46.5 million, or 41 cents to 42 cents per diluted share, compared with prior guidance of 15 cents to 18 cents and ahead of the 17 cents estimate.

“Looking ahead, Braze is focused on AI solutions that will empower brands to transform the customer engagement experience for marketers and end users alike, driving high ROI for our customers and Braze,” commented cofounder and CEO Bill Magnuson.

Braze shares gained 10.5% to trade at $30.67 on Friday.

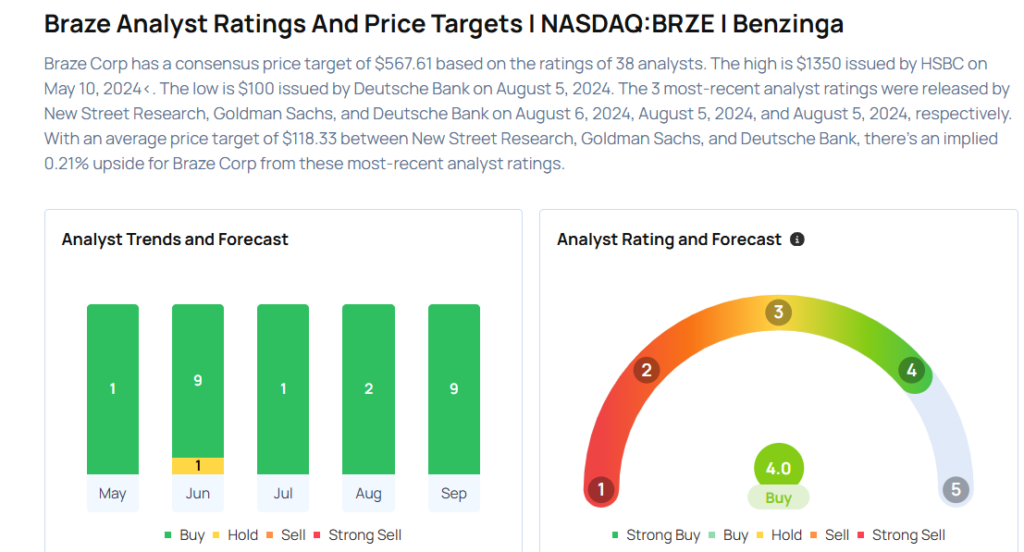

These analysts made changes to their price targets on Braze following earnings announcement.

- Piper Sandler analyst Brent Bracelin maintained Braze with an Overweight rating and raised the price target from $38 to $50.

- Barclays analyst Ryan Macwilliams maintained Braze with an Overweight rating and raised the price target from $35 to $39.

- Cantor Fitzgerald analyst Matthew Vanvliet maintained the stock with an Overweight rating and raised the price target from $35 to $38.

- UBS analyst Taylor McGinnis maintained Braze with a Buy and lowered the price target from $48 to $43.

- Mizuho analyst Siti Panigrahi maintained the stock with an Outperform rating and raised the price target from $40 to $45.

- Citigroup analyst Tyler Radke maintained the stock with a Buy and raised the price target from $50 to $52.

Considering buying BRZE stock? Here’s what analysts think: