“0% APR” balance transfer cards are everywhere, promising relief from high-interest debt. If you’re juggling credit card balances, these offers can look like a shortcut to financial freedom. But before you jump in, it’s important to know exactly what you’re signing up for. The truth is, these cards come with fine print that can cost you more than you expect. Understanding the hidden fees and pitfalls can help you make smarter choices with your money. Let’s break down what you really need to know about 0% APR balance transfer cards.

1. The Balance Transfer Fee Isn’t Always Obvious

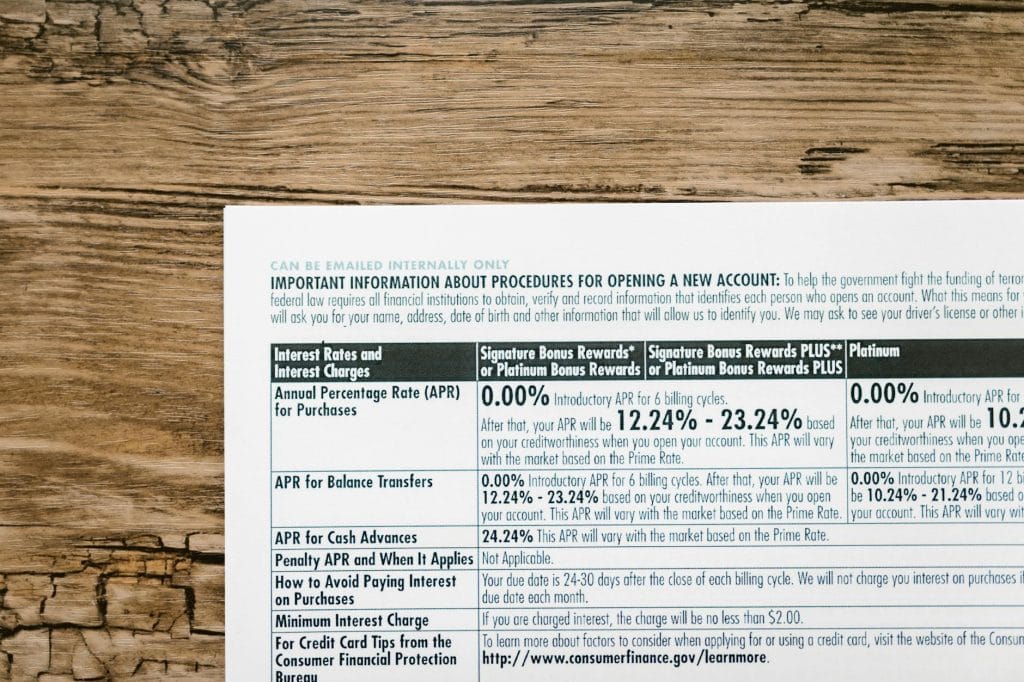

The term “0% APR” grabs your attention, but the real cost often hides in the balance transfer fee. Most credit card companies charge a fee to move your balance, typically between 3% and 5% of the amount transferred. For example, transferring $5,000 could cost you $150 to $250 right off the bat. This fee is usually added to your balance, so you start with a bigger debt than you intended.

Some cards advertise no balance transfer fee, but those offers are rare and usually come with other trade-offs, like a shorter 0% APR period or higher ongoing interest rates. Always read the fine print and do the math to see if the savings on interest outweigh the upfront cost.

2. The 0% APR Period Is Temporary

The main draw of 0% APR balance transfer cards is the promise of no interest for a set time. But this period is temporary—often 12 to 18 months. After that, any remaining balance will be subject to the card’s regular interest rate, which can be as high as 20% or more. If you don’t pay off your transferred balance before the promotional period ends, you could find yourself back where you started, or worse.

Mark your calendar with the exact date the 0% APR expires. Set a payoff plan that ensures you clear the debt before interest kicks in. Otherwise, you risk undoing any progress you’ve made.

3. New Purchases Might Not Be Interest-Free

It’s easy to assume that every purchase you make with your new card will also benefit from the 0% APR. But in many cases, the promotional rate only applies to balance transfers—not new purchases. Any new spending might rack up interest immediately, at the card’s standard rate. This can make it even harder to pay down your debt.

If you’re using the card to transfer a balance, avoid making new purchases until your transferred debt is paid off. Some cards offer a 0% APR on both transfers and purchases, but not all. Double-check the offer details before you swipe.

4. Late Payments Can End Your 0% APR Early

Missing a payment on your 0% APR balance transfer card can be costly. Many issuers will revoke your promotional rate if you’re late, meaning your entire balance could start accruing interest at the regular rate. You might also face a late fee, which can add up quickly.

To protect your savings, set up automatic payments or reminders. Even one slip-up can erase the benefits of the 0% APR period and leave you with unexpected charges.

5. Your Credit Score Matters—A Lot

Not everyone will qualify for the best 0% APR balance transfer cards. Lenders reserve these offers for people with good to excellent credit. If your credit score is below average, you might get approved for a card with less favorable terms or be denied altogether.

Applying for a new card also creates a hard inquiry on your credit report, which can temporarily lower your score. Plus, opening new accounts and shifting balances can affect your credit utilization ratio. Before applying, check your score and weigh whether the benefits outweigh the risks. If you’re not sure where you stand, you can get a free copy of your credit report from AnnualCreditReport.com.

6. Deferred Interest vs. True 0% APR

Not all “0% APR” offers are created equal. Some cards advertise 0% interest but actually use a deferred interest model. With deferred interest, if you don’t pay off the full balance by the end of the promotional period, you’ll owe interest on the entire original amount—not just what’s left. This can be a nasty surprise.

Be sure to distinguish between true 0% APR, where no interest is charged during the promo period, and deferred interest, which can backfire if you’re not careful. Always read the terms and ask questions if you’re unsure.

7. Hidden Fees Beyond the Transfer

Balance transfer cards can come with other fees that add up fast. Some cards charge annual fees, which can eat into your savings. Others may have cash advance fees, foreign transaction fees, or penalty APRs for certain behaviors. These extra costs can erode the benefits you hoped to gain from your 0% APR balance transfer card.

Before you apply, review all fees listed in the card’s terms and conditions. If you travel or plan to use the card for anything beyond the transfer, factor those charges into your decision.

Making the Most of Your 0% APR Balance Transfer Card

0% APR balance transfer cards can be a smart tool for paying down debt, but only if you know the rules and avoid the traps. By understanding the hidden fees, time limits, and other fine print, you can make an informed decision that actually saves you money. The primary keyword to focus on when researching these offers is “0% APR balance transfer cards,” as that will help you find the most relevant and up-to-date information.

Remember, these cards aren’t a cure-all for debt. They work best when paired with a solid payoff plan and disciplined spending. If you’re strategic, a 0% APR balance transfer card can give you breathing room to tackle your balances, but only if you’re aware of every potential pitfall along the way.

Have you used a 0% APR balance transfer card before? What hidden fees or surprises did you encounter? Share your experience in the comments!

What to Read Next…

- 7 Hidden Fees That Aren’t Labeled As Fees At All

- 7 Credit Card Features Disappearing Without Any Notice

- The Benefits Of Taking Personal Loans And Their Impact On Credit Scores

- 5 Things That Instantly Decrease Your Credit Score By 50 Points

- Why Credit Limits Are Being Lowered Without Consent

The post The Truth About “0% APR” Balance Transfer Cards and Their Hidden Fees appeared first on The Free Financial Advisor.