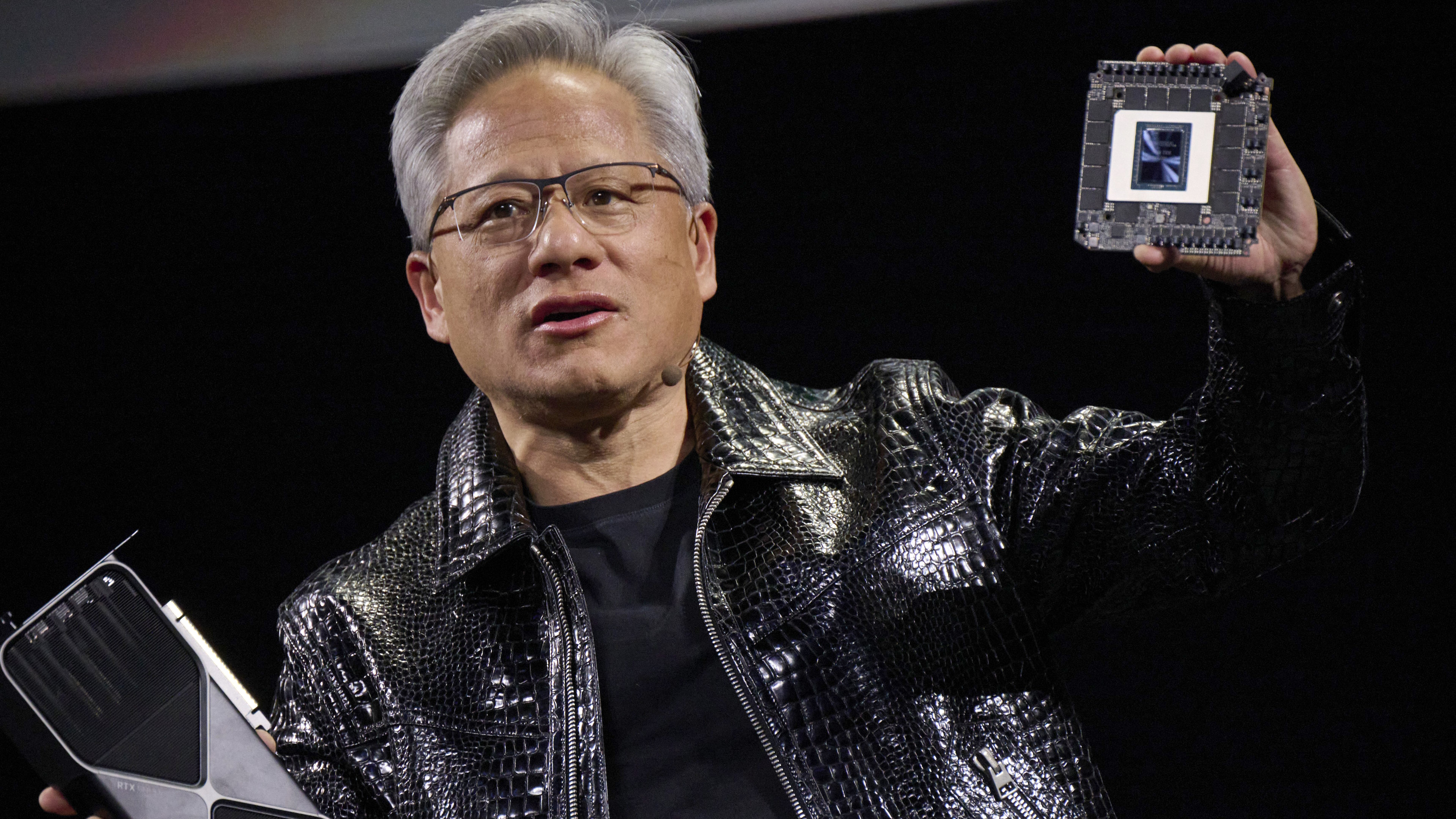

The dust is beginning to settle on yesterday's Nvidia and Intel announcement, in which the two companies declared a collaboration to make new chips for both the data center and consumer markets. In a press conference yesterday evening, Nvidia CEO Jensen Huang firmly stated that the Trump administration "had no involvement in this partnership at all", but there's evidence to suggest this may not be entirely the case.

The announcement also broke the news of a $5 billion investment by Nvidia into Intel's common stock, at a purchase price of $23.28 per share. According to sources speaking to The New York Times, the Trump administration approached Nvidia in January and asked it to invest in the chipmaker. The US government has since made an $8.9 billion investment in Intel itself, which is now estimated to be worth $13 billion as a result of Intel's share price rising by near 23% off the back of yesterday's news.

Writing on Substack, US semiconductor industry analyst Alex_Intel notes that Intel's chief financial officer stated that the company wasn't seeking any more stake sales at a recent Goldman Sachs conference. This could potentially be an indication that Intel paused its recent capital raising efforts before the announcement, instead waiting for its share price to rise so it could once again seek investment at a higher valuation.

Alex_Intel also notes that, in their view, Huang's answer as to why the company has made a significant investment in Intel at this point seems suspicious. At the press conference, when asked why he felt it was appropriate to make an equity investment in Intel alongside the product collaboration, Huang said:

"Because we thought it was going to be such an incredible investment. This is a big partnership, and we think it's going to be fantastic for Intel. It's going to be fantastic for us. And we're building revolutionary products [that are] going to address some $50 billion annual market. And so, how could we, on the one hand, be excited about the products and how revolutionary they are, and on the other hand, not be excited about the opportunities ahead?

"And so we're delighted to be a shareholder, and we're delighted to have invested in Intel, and the return on that investment is going to be fantastic, both, of course, in our own business, but also in our equity share of Intel."

Alex_Intel points out that Nvidia works very closely with TSMC, as the Taiwanese semiconductor giant manufactures the vast majority of its chips, along with other industry giants like SK Hynix and Tower (who Intel nearly acquired a few years back), without taking similar stakes. The analyst speculates that Nvidia instead took a stake in Intel "because the Trump administration wanted it, and Jensen wants to sell [AI chips] to China."

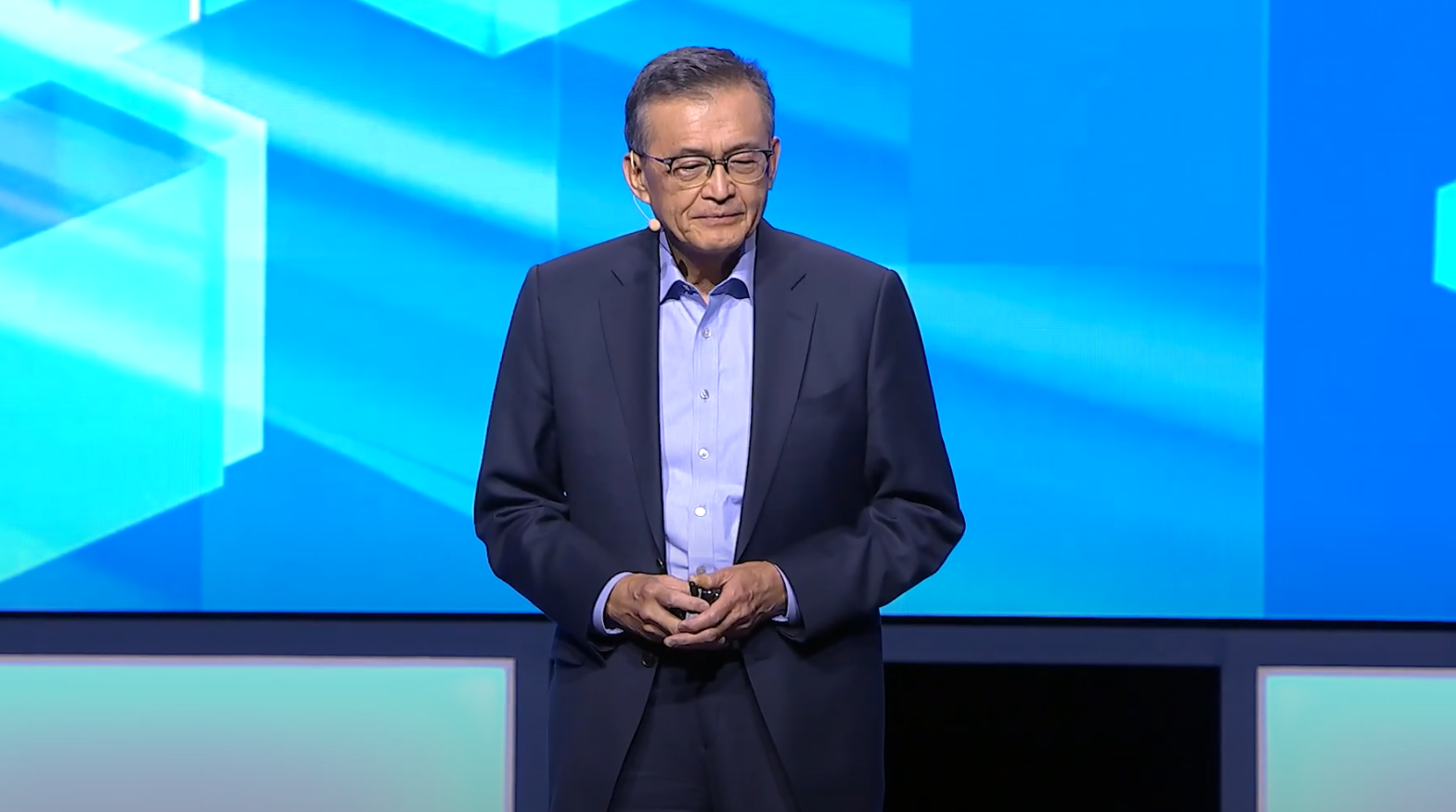

The details may be hazy, but let's also not forget President Trump's recent dealings with Intel's new CEO, Lip-Bu Tan. After initially calling for Tan's resignation, citing concerns over a potential conflict of interest related to his ties to Chinese businesses, Trump quickly changed his tune after a personal meeting with the new Intel chief a mere week later, calling his success and rise "an amazing story".

The meeting was also attended by the US secretary of commerce, Howard Lutnick, and the secretary of the treasury, Scott Bessent, and directly preceded the US government's purchase of an investment stake in the company.

The Trump administration has been pushing hard for chipmakers to build their products on US soil, and while both Huang and Tan refuse to be drawn into whether Nvidia would make use of Intel's foundry facilities in the near future, tying the two together financially would certainly work towards the Trump administration's goals to unify US tech production in the face of stiff international competition.

It's difficult to know for sure exactly what terms may have been agreed behind the scenes, if any at all. However, what seems clear is that there's likely more to this partnership than initially appears, and that it all seems to be working out rather nicely so far for Nvidia, Intel, and the US government in regards to the financial markets. How this plays out in future remains to be seen, but for now all the major players certainly seem to be financially benefiting so far.