Shares of ad-tech leader Trade Desk Inc (NASDAQ:TTD) are trading lower Wednesday after Morgan Stanley downgraded the stock to ‘Equal-Weight’ from ‘Overweight’ and cut its price target to $50 from $80. Here’s what investors need to know.

What To Know: The downgrade exacerbates recent bearish sentiment that has plagued the stock, which saw significant declines in August. Analysts have cited mounting competitive pressures from tech giants like Amazon and reports that partner Walmart may be distancing itself from The Trade Desk’s platform.

Recent market anxiety has largely overshadowed the company’s fundamentals. The Trade Desk last month posted second-quarter revenue of $694 million, beating analyst expectations and representing an increase year-over-year.

The company also maintained a customer retention rate of over 95% and issued a strong third-quarter revenue forecast of at least $717 million. Despite its solid operational performance, the stock remains under pressure as investors weigh competitive risks.

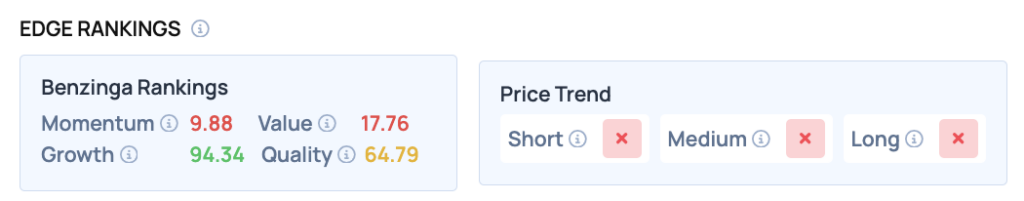

Benzinga Edge Rankings: Reflecting the company’s strong underlying business, Benzinga Edge rankings show an exceptional Growth score of 94.34.

Price Action: According to data from Benzinga Pro, TTD shares are trading lower by 9.22% to $47.57 Wednesday. The stock has a 52-week high of $141.53 and a 52-week low of $42.96.

Read Also: Taiwan Semiconductor Extends Growth Streak With Strong August Sales

How To Buy TTD Stock

By now you're likely curious about how to participate in the market for Trade Desk – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock