/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)

Microsoft (MSFT) recently wrapped up its fiscal 2025, which showed resilience, scale, and operational discipline. Revenue, margins, and bookings all rose, indicating Microsoft's ability to translate artificial intelligence (AI) hype into tangible, long-term earnings power.

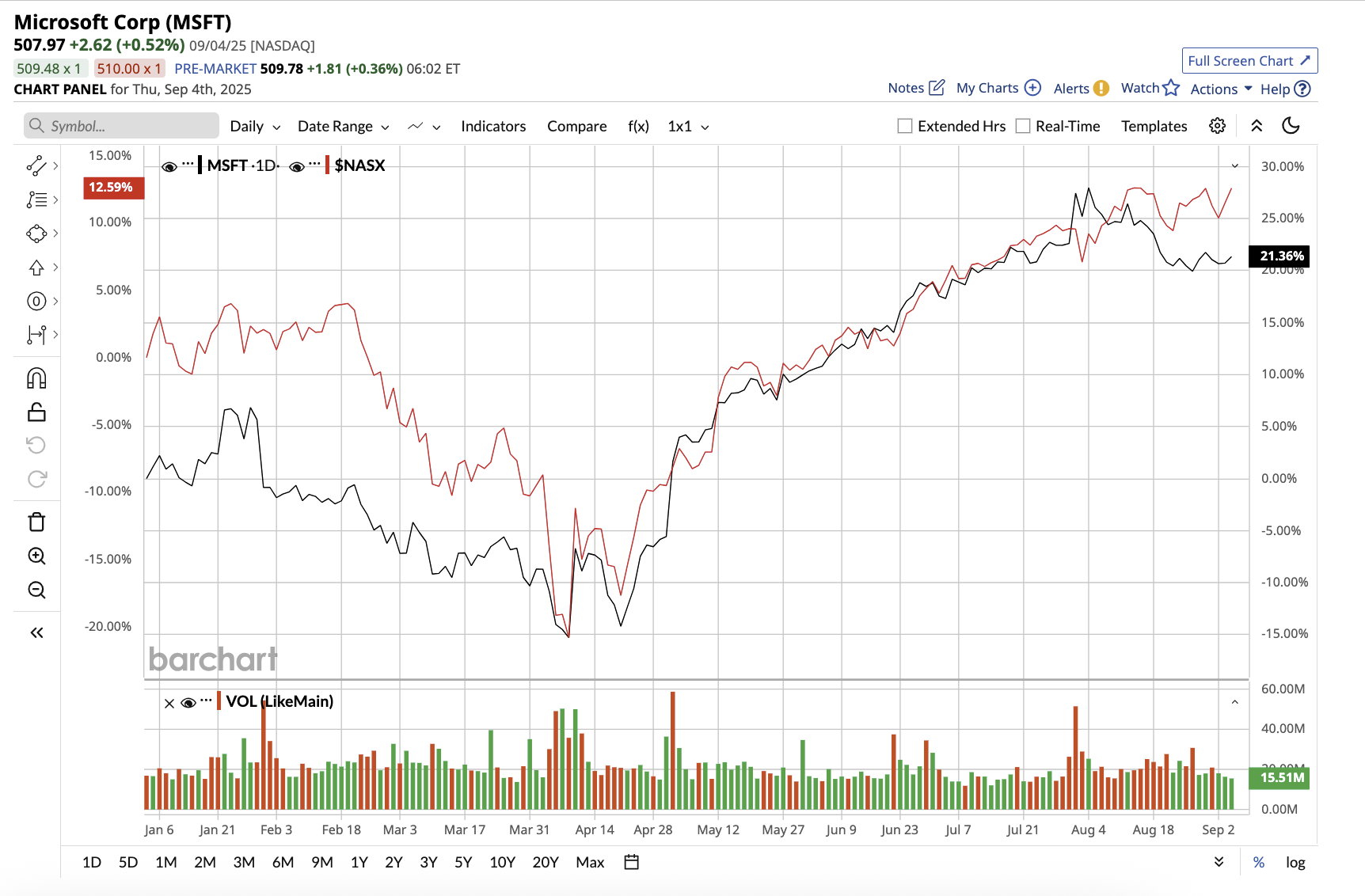

Now, the big question is whether Microsoft can maintain this rate of growth. MSFT stock is up 18% year-to-date (YTD), outperforming the tech-heavy Nasdaq Composite's ($NASX) gain of 13%. Let's take a closer look.

Azure: The Engine of Growth

Jumping into Microsoft's financial results, total revenue for fiscal 2025 increased 15% year-over-year (YOY), reaching $281.7 billion. Commercial bookings reached $100 billion for the first time, up 30%. Meanwhile, remaining performance obligations (RPO) — which reflect future growth — rose 35% to $368 billion. The company expects a third of this RPO to translate to revenue within the next 12 months.

During the earnings call, CEO Satya Nadella proudly stated that cloud and AI are growth drivers for the company. Azure generated $75 billion in annual revenue, up 34% YOY. Notably, Microsoft Cloud surpassed $168 billion in annual revenue, a 23% YOY increase, as the company continues to ride an AI wave that is reshaping every layer of its business. Microsoft has emerged as the market leader in AI infrastructure, now boasting over 400 data centers across 70 regions.

In terms of segment performance, Productivity and Business Processes revenue increased 14%, driven by Microsoft 365 commercial and consumer cloud. Intelligent Cloud revenue increased by 25% due to growth in Azure and cloud services. In gaming, Microsoft is now the leading publisher on both Xbox and PlayStation, resulting in a 10% increase in gaming revenue. Finally, More Personal computing revenue increased by 9% to $13.5 billion.

Management noted that capital expenditures totaled $24.2 billion, with a large portion going to GPU and CPU servers to meet insatiable AI demand. Despite these significant investments, free cash flow totaled $25.6 billion for fiscal 2025. Microsoft also proved its commitment to shareholders by paying $37 billion in dividends and buybacks in fiscal 2025.

The Long Game: Can Microsoft Keep Up?

Microsoft sees AI as a generational platform shift rather than a single product cycle. From cloud infrastructure and data systems to apps and security, AI is reshaping every aspect of Microsoft's business. Management expects fiscal 2026 to be another year of double-digit revenue and operating income growth, with record bookings, a $368 billion backlog, and AI adoption still in its early stages. Analysts who cover Microsoft predict earnings to increase 12% to $15.34 per share in fiscal 2026, followed by another 17% rise to $17.93 in fiscal 2027.However, challenges remain. The company faces stiff competition in the AI space, and rivals aren’t standing still. Tech titans such as Amazon (AMZN), Alphabet (GOOGL), and Meta Platforms (META) are also making significant investments to strengthen their long-term position in AI. However, Microsoft's scale, legacy products, cross-stack integration, and early enterprise traction indicate that it may have created a defensible moat.

Microsoft is currently winning in the AI era, and this trend could continue for another decade. As Nadella stated, “I have never been more confident in our opportunity to drive long-term growth and define what the future looks like.” Looking ahead, Microsoft is already gearing up for the next wave: quantum computing. The company recently announced the world's first operational deployment of a Level 2 quantum computer with Atom Computing, indicating a decade-long bet on what could be the next great computing frontier.

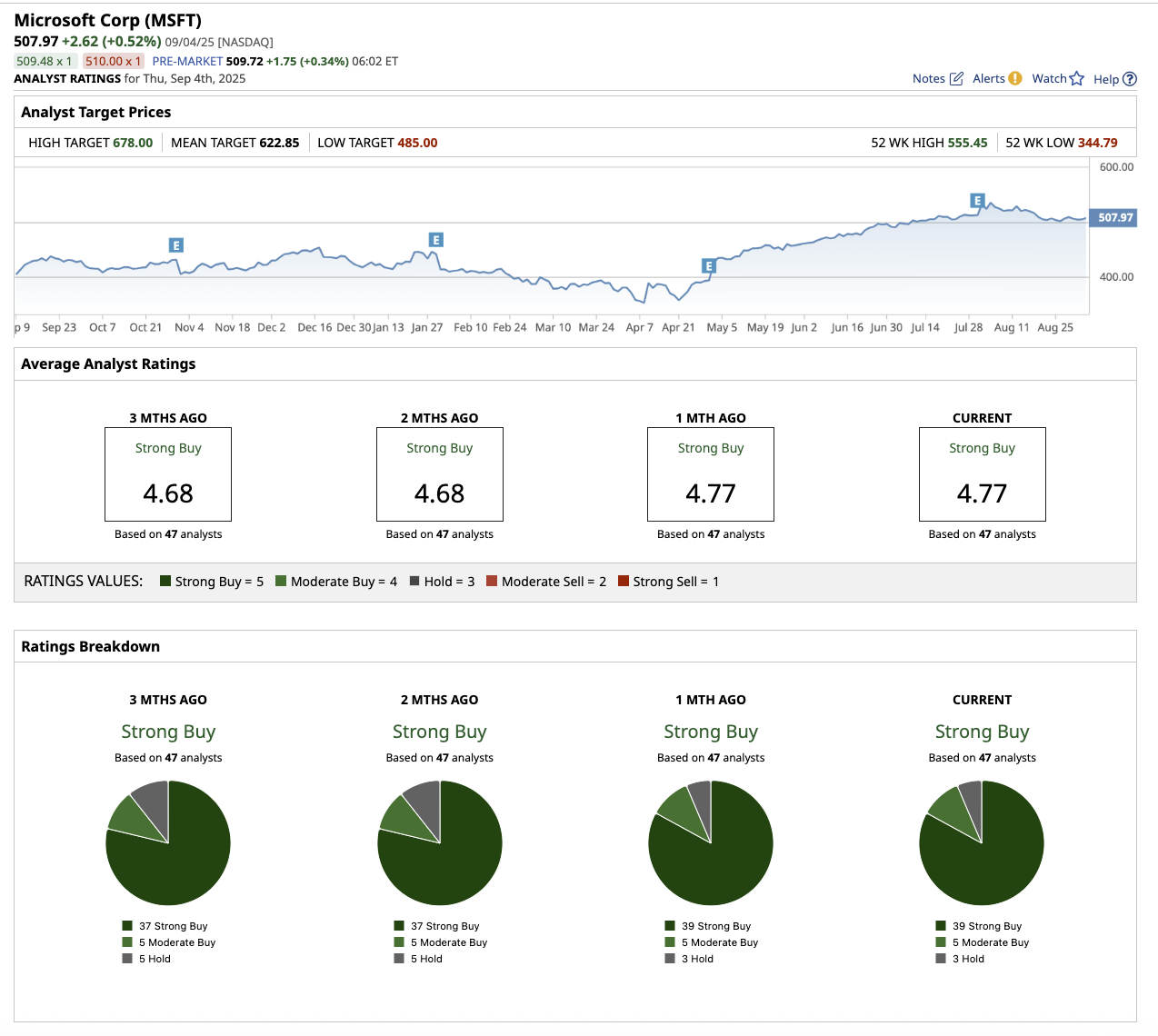

What Does Wall Street Say About Microsoft Stock?

Overall, Wall Street assigns Microsoft stock a consensus “Strong Buy” rating. Of the 47 analysts covering MSFT stock, 39 have a “Strong Buy” recommendation, five suggest a “Moderate Buy,” and three rate it a “Hold.” The average price target of $622.85 implies the stock has 25% potential upside from current levels. The Street-high price target of $678 suggests the stock could rally as much as 36% over the next 12 months.