/Deckers%20Outdoor%20Corp_%20Hoka%20shoe%20by-%20Stefan%20Pinter%20via%20Shutterstock.jpg)

Retail stocks linked to merchandise have been battered in the past year, and tariffs are the most obvious reason why. Tariff rates on countries where these companies source their products are in the low to mid-double digits. Moreover, the de minimis rule, which allowed products worth below $800 to enter the U.S. duty-free, has been eliminated.

It doesn't take much guesswork to see why these stocks have slumped. Retail businesses rely on volume to generate profits through thin margins. Once tariffs eat away at those margins, the shock is too great for these businesses to survive... or you'd think so.

There are two retail companies that could be bucking the trends and may rebound. Analysts say Deckers Outdoor (DECK) and Lululemon Athletica (LULU) are among the retail sector's elite performers when it comes to capital efficiency.

Both of them may have the pricing power to pull through the tariff impacts.

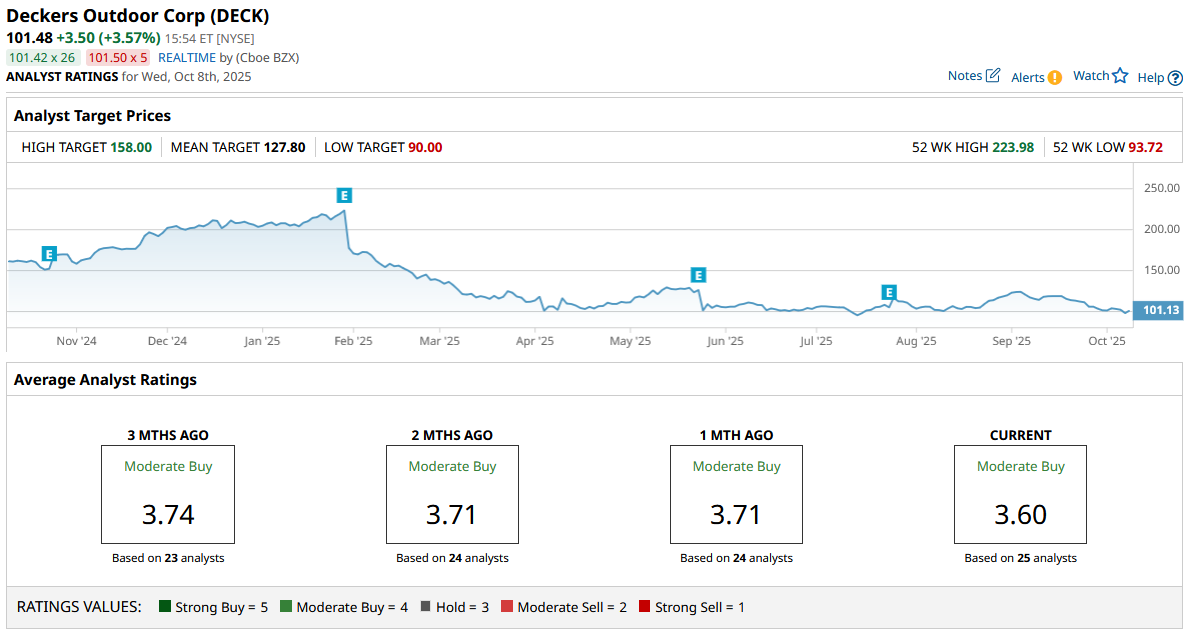

Deckers Outdoor (DECK)

Deckers has been using its premium brand positioning to fight back against tariffs. The plan is to partially offset tariff costs through price increases on fast-growing HOKA and UGG products. The company's CFO, Stephen Fasching, stated that “Assuming Vietnam increases from 10% to 20%, we would expect to face a total of $185 million of unmitigated impact to our cost of goods sold in fiscal year 2026.”

The second element involves cost-sharing partnerships with manufacturing facilities in Vietnam and China, where Deckers is collaborating with factories to split the tariff burden rather than absorbing the full impact alone.

Deckers also has the best return on invested capital (ROIC) "across the universe of retail stocks," according to Citi Research. It posted a 53% ROIC in 2024.

The company has over $1.72 billion of cash on hand with just $312 million of debt. Despite the tariffs, the strong footing has allowed it to stay profitable. Management is now making moves to absorb the shock and return to its original trajectory. The mean price target of $127.80 implies a 26% upside potential.

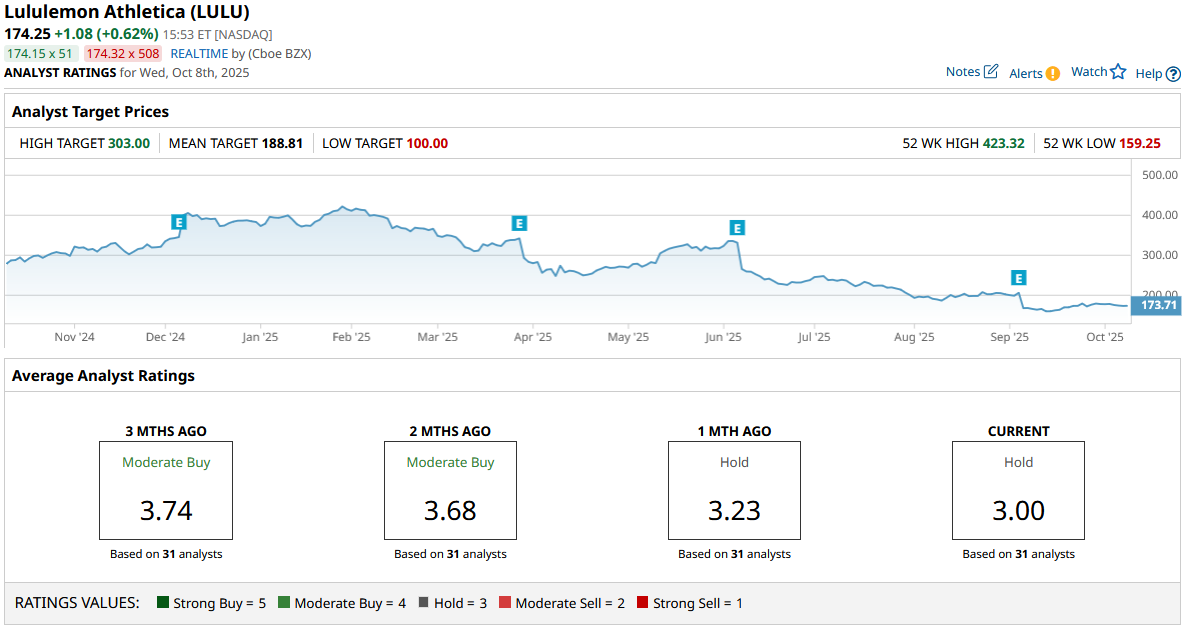

Lululemon (LULU)

Lululemon is another efficient business trying to fight back against the sector-wide decline. Its ROIC is at 45%, though Citi rated it “Neutral,” and LULU stock has a consensus “Hold” from the 31 analysts covering it.

Citi's primary concern this summer was that Lululemon's "lackluster product group has made it vulnerable to tough competition and promotional pressures" going forward.

And unlike Deckers, which can aggressively raise prices on HOKA and UGG without demand destruction, Lululemon faces constraints on using pricing as a tariff mitigation tool.

This limitation exists because Lululemon already has premium pricing.

Those cons aside, the positives are starting to come into the spotlight. The first one is, of course, the value. LULU stock is down over 66% from its peak while growing revenue and keeping profits as is. Q2 2025 trailing EBITDA stayed flat at $2.98 billion. Operating cash flow has declined significantly but remains near mid-2023 levels, whereas the stock has halved relative to that period.

Interest rate cuts may finally lead to a re-rating in the coming months, so LULU is an interesting stock to keep in your notes for a potential triple-digit rebound.