/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)

Artificial intelligence (AI) remains one of the most sought-after investment themes, and Palantir (PLTR) has undoubtedly been one of the biggest winners of this trend. And now the company is once again in the spotlight as it edges closer to securing a major international contract. According to The Times of London, the U.K. Ministry of Defence is preparing to sign a roughly $1 billion (£750 million) deal with Palantir during President Donald Trump’s trip to the country.

The agreement, which also involves the Royal Navy, will see Palantir deploy its advanced AI systems to analyze data across the U.K. military. The technology is designed to pinpoint recruitment gaps, evaluate deployment suitability, and manage parts and maintenance schedules for military assets, a move that underscores the growing importance of AI in national defense.

As part of the arrangement, Palantir has also pledged to invest up to $2 billion in the U.K. over the next five years, further cementing its role in the country’s AI and defense landscape. So, with a deal of this scale on the horizon, here’s a fresh look at PLTR stock now.

About PLTR Stock

Founded in 2003, Denver-based Palantir has evolved into a global tech powerhouse, trusted by governments, militaries, and enterprises alike for its advanced intelligence and operational planning tools. At the heart of its success is the Artificial Intelligence Platform (AIP), a next-generation system that integrates generative AI into business workflows, enabling organizations to supercharge decision-making and boost efficiency.

With strong traction in both the public and private sectors, the company is building momentum, and the growing demand for AI leaves ample room for even greater gains ahead. Currently valued at a market capitalization of about $399.3 billion, shares of this AI darling have gained massive investors’ attention over the past year, with the stock soaring a stunning 388.4%, dwarfing the S&P 500 Index’s ($SPX) 18.2% gain.

And that remarkable rally has carried into 2025 as well, with Palantir shares up 122.6% year-to-date (YTD), once again leaving the broader market’s 12.2% return in the dust. After hitting a fresh high of $190 just last month, the stock now trades about 11.4% below its peak. Given such a massive rally, valuation concerns are naturally a big talking point for a high-flyer like Palantir.

The stock is currently priced at an eye-watering 391.4 times forward earnings and 140.9 times sales, multiples that don’t just eclipse sector medians but also far exceed its own five-year averages of 134.8x and 31.1x, respectively. These lofty valuations highlight just how much optimism is already baked into the stock, leaving little room for error as investors bet on Palantir’s AI-driven growth story.

A Look Inside Palantir’s Q2 Earnings

The AI software provider revealed its fiscal 2025 second-quarter earnings report in early August, which blew past both Wall Street’s top and bottom-line expectations. For the first time in its history, the company crossed the $1 billion revenue mark in a single quarter, marking a 48% year-over-year (YoY) growth, a pace that has accelerated consistently over recent quarters, signaling surging demand for its AI-driven solutions.

The reported revenue comfortably exceeded analysts’ forecast of $939.5 million. Earnings were equally impressive, with EPS of $0.13 soaring 43.8% YoY, beating estimates by a remarkable 62.5% margin. Digging further, growth was led by the U.S. market, where revenue jumped 68% YoY to $733 million. The U.S. commercial segment stood out with 93% annual growth to $306 million, while government revenue rose 53% to $426 million.

Palantir’s gains were aided by efficiency initiatives under President Trump’s government, including contract restructuring, which created additional opportunities. The company also saw strong traction in high-value deals, closing 66 contracts worth $5 million or more and 42 contracts worth at least $10 million, which pushed the total contract value up 140% from last year to a record $2.27 billion. On the balance sheet, Palantir holds $6 billion in cash, cash equivalents, and short-term U.S. Treasury securities, providing solid financial flexibility.

Looking ahead, Palantir’s management expects Q3 revenue to come in between $1.083 billion and $1.087 billion, signaling continued strong momentum. Plus, building on Q2 performance, the company has raised its full-year 2025 revenue outlook to a range of $4.142 billion to $4.150 billion, reflecting confidence in its ability to leverage AI-driven solutions.

What Do Analysts Expect for PLTR Stock?

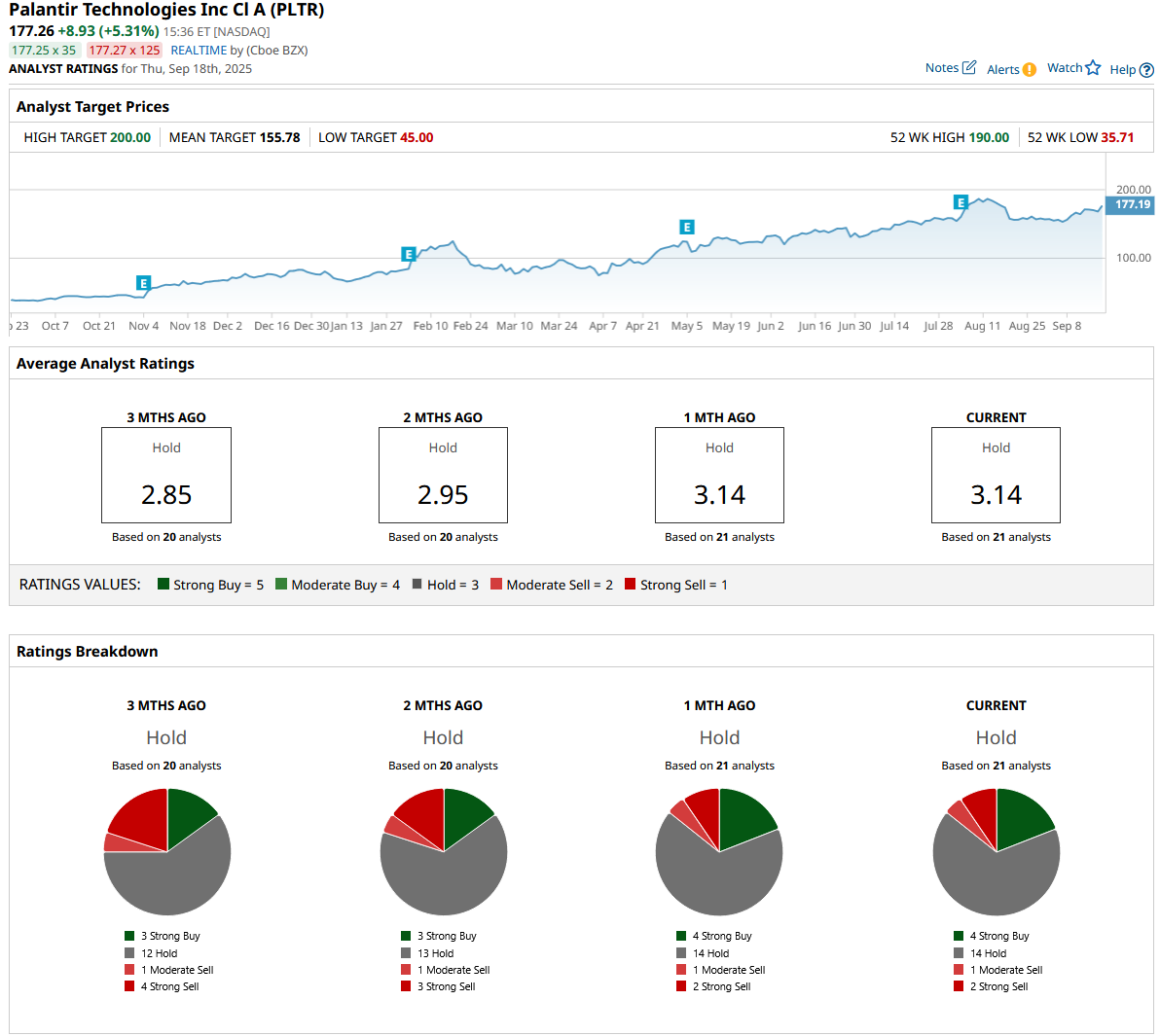

Palantir has plenty of fans among investors, but on Wall Street, the mood is more cautious, with analysts sticking to a consensus “Hold” rating overall. Among 21 analysts covering the stock, only four call it a “Strong Buy”; the majority, 14 analysts, have issued a “Hold,” one advocates “Moderate Sell,” and the remaining two give a “Strong Sell.”

Despite Palantir’s meteoric rise, which has pushed shares well past the average analyst price target of $155.78, the stock still shows potential for further gains. On the bullish end, Wall Street’s top target of $200 suggests that the stock can still climb about 13% from current levels.