Dominoes are falling in crypto. First it was the collapse of algorithmic stablecoin TerraUSD, sowing turbulence in the broader market. Now its grown-up cousin Tether is wavering from the peg, fueling concern over its status as a place to hide during times of turbulence. While things appear to be settling down for the moment, nobody’s feeling safe.

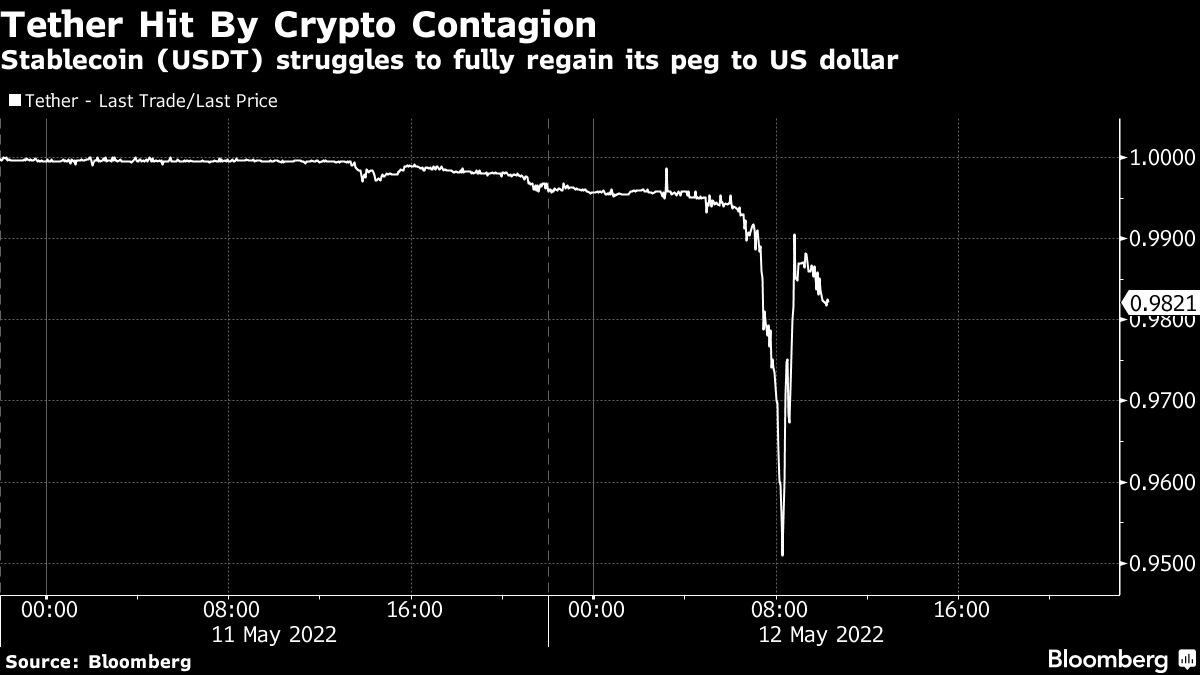

Tether briefly dropped to the lowest level since December 2020, falling to 94.55 cents from its intended 1-to-1 peg to the dollar on Thursday before recovering to just above 99 cents on reassurances from Paolo Ardoino, Tether’s chief technology officer, that investors shouldn’t have any problems redeeming its tokens at a one-to-one value to the dollar via its platform. Meanwhile, Bitcoin recovered from intraday losses of more than 10% early Thursday to edge higher in the US morning. The world’s largest cryptocurrency traded at about $29,000 as of noon in New York, up about 2% on the day.

With a market value of about $84 billion, Tether is an essential cog to the array of crypto trades being actioned across the market at any given time. Investors turn to stablecoins as a way of retaining value without leaving the digital asset ecosystem, acting as a safe haven from volatile coins or even simply as a means of digital payment. It is the most traded cryptocurrency by far, charting more than double the volume of second-place Bitcoin over the last 24 hours at $178 billion.

The dip came as a massive selloff in cryptocurrencies wiped more than $200 billion in value from the market in 24 hours, knocked by weakened sentiment after Terra’s algorithmic stablecoin UST -- also meant to be redeemable for $1 and a lynchpin of experimentation in decentralized finance -- fell as low as 20 cents.

‘Everything Broke’: Terra Goes From DeFi Darling to Death Spiral

Tether operates differently to TerraUSD, or UST, which was designed to use a complex mix of code, trader incentives and swaps with its sister token Luna to maintain its peg. Tether, on the other hand, says it backs its token with dollar-equivalent assets, though questions about the quality of its stockpile persist. Its decline highlights the overall risk-off mood that’s sweeping through crypto markets, analysts said.

“Tether’s de-pegging seems more driven by market sentiment rather than real concern over its reserves, which demonstrates how important centralized markets are for maintaining a stablecoin’s peg,” Clara Medalie, research director at Kaiko, said in an email.

The market frenzy also caused traders to flood certain digital markets that allow them to swap one stablecoin for another on Thursday morning, according to data from Dune Analytics. One such location is Curve’s 3pool, which houses a stockpile of three stablecoins, USDT, USDC and DAI. While the pool’s portion of USDT represented about 42.6% of the total on May 7, that figure skyrocketed to 92.6% as of mid-morning on Thursday.

“I think given the situation with UST and market volatility retail traders are motivated to exchange their stablecoins for actual dollars, and the imbalance in the Curve pool is a result of that fluctuating demand rather than a full-on bank run,” Andrew Thurman, who is in charge of content at blockchain data firm Nansen.

Opportunity Taking

In a statement following USDT’s return above 99 cents, Tether said it was processing more than $2 billion in transactions seeking to redeem USDT for fiat dollars. It repeated a figure mentioned by Ardoino in a tweet, which said that it had redeemed over $300 million in tokens in the last 24 hours.

As of Thursday afternoon in London, the broader stablecoin market had experienced bouts of volatility but largely avoided the same dramatic collapse as Terra’s UST. Other major tokens including Circle Internet Financial Ltd.’s USDC, Binance Holdings Ltd.’s Binance USD and Maker’s DAI were trading at their pegs, according to pricing data from CoinGecko.

“There may be some stablecoin contagion following UST, however Tether continues to honor 1:1 redeemable ratio on their platform,” Fadi Aboualfa, head of research at crypto custodian Copper, said in an email. “Anyone who was around 2017-2019 and saw massive drops in Tether, and it was really an opportunity to buy at a discount.”

“Quite a few people are lacking confidence in all stablecoins at the moment. I wouldn’t be surprised if a lot of USDT holders saw what happened to Terra and are now exchanging for cheap Bitcoin,” said Mati Greenspan, founder of crypto research outfit Quantum Economics.

More than $1.8 billion of Tether was removed from the market between Wednesday and Thursday, as Tether’s market value dropped to as low as $82.2 billion from $84.2 billion, according to data from CoinGecko.

©2022 Bloomberg L.P.