/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

Tesla (TSLA) stock is charging higher, rising over 29% in just a month. The rally comes at a time when the electric vehicle giant is under increasing scrutiny due to lower deliveries, mounting pressure from rising competition, and a shrinking share of the U.S. market. Despite these concerns, a string of positive developments has reignited investor enthusiasm and pushed Tesla stock higher.

Musk’s Billion-Dollar Signal

Much of the renewed confidence in Tesla stock can be traced back to CEO Elon Musk himself. His decision to purchase $1 billion worth of Tesla shares earlier this month wasn’t just another insider trade. This significant purchase sent a strong bullish signal to the market, especially at a time when many have started to question Tesla’s ability to maintain its growth trajectory and its high valuation.

Musk’s move suggested that he sees the stock as undervalued and is willing to stake his own fortune on the company’s future.

Another key development has been Musk’s new compensation proposal. The package is tied directly to Tesla’s ability to achieve outsized growth milestones, meaning that Musk is rewarded if the company delivers long-term value for shareholders. It effectively aligns his financial incentives with ambitious stock performance goals, providing him with yet another reason to push the company toward higher levels of innovation, scale, and profitability.

Tesla’s New Growth Initiatives

Meanwhile, Tesla is also making notable progress in areas that could drive future growth beyond its core EV business. In June, the company officially launched its robotaxi service and is already working to expand its presence. The Arizona Department of Transportation recently gave Tesla the green light to roll out a semiautonomous ride-hailing service. The move marks small steps toward what could become a multibillion-dollar opportunity in autonomous transportation.

Overall, Tesla stock has gained over 75% in a year. This surge reflects that investors are viewing Tesla not simply as an EV maker, but as a leader in artificial intelligence (AI), autonomous mobility, and robotics.

Tesla’s ability to generate demand remains strong, thanks to its continuous focus on enhancing vehicle performance and rolling out advanced features powered by AI. Offerings such as Full Self-Driving (FSD) highlight the company’s edge in innovation. These technologies enhance the driving experience and provide a solid foundation for the widespread adoption of advanced autonomous systems, a development that could significantly expand Tesla’s addressable market.

Looking ahead, the recent launch of Tesla’s Robotaxi service could prove transformative. By focusing on recurring service revenue, Tesla would be positioned to capture a much larger share of value in the mobility ecosystem. At the same time, the company is leveraging its AI expertise in self-driving to push into robotics. The Optimus humanoid robot project, still in development, represents a bold bet on the future of automation and labor efficiency. Elon Musk has even suggested that production could reach 100,000 units per month after five years. If successful, Optimus could unlock entirely new opportunities in automation and labor efficiency, making robotics a potential long-term value driver.

Still, much of this promise remains aspirational. The financial contribution of these ambitious projects is yet to be felt, and the company faces near-term challenges. Rising costs tied to tariffs, the removal of federal EV tax credits, and intensifying competition from both traditional automakers and new entrants are weighing on the industry.

Tesla Stock: The Valuation Dilemma

Tesla’s valuation is another concern. Tesla currently trades at 355 times its forward earnings, reflecting an enormous premium relative to peers. Even with analysts projecting strong 66.7% EPS growth for 2026, the valuation shows just how much optimism is already built into the price.

Conclusion

Tesla’s recent rally reflects renewed investor confidence, as the market views the company not just as an automaker, but as a business shaping the future of mobility, automation, and AI.

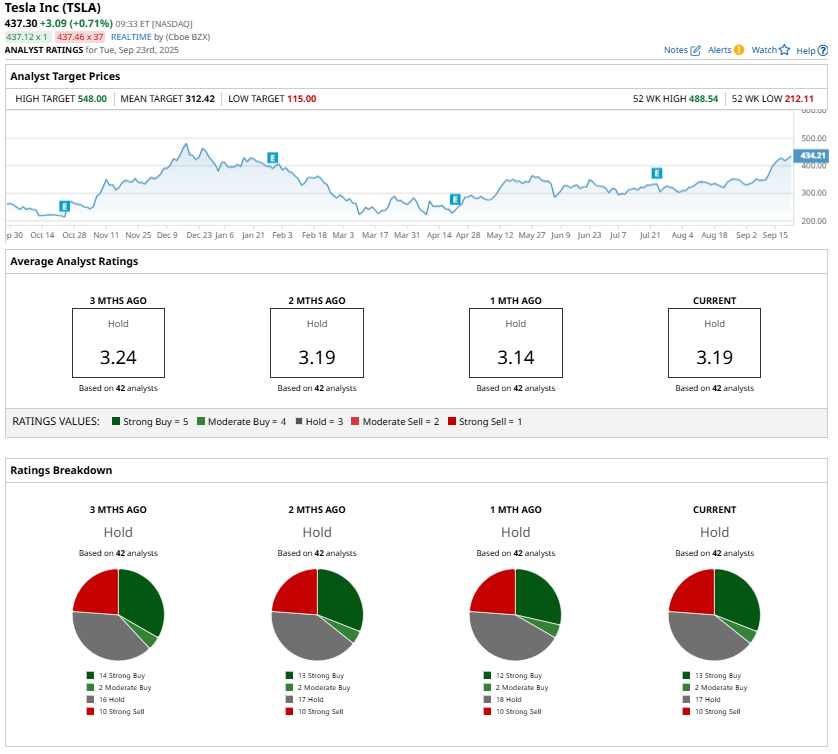

That said, Tesla’s current valuation incorporates a significant amount of future growth, leaving the stock vulnerable if growth disappoints or timelines slip. Thus, Wall Street remains sidelined, maintaining a “Hold” consensus rating on TSLA stock.

In short, Tesla’s high valuation and near-term challenges suggest caution is warranted. For those who are risk-averse or focused on short-term gains, cashing out could be prudent.

For long-term investors willing to tolerate volatility, Tesla remains a high-risk, high-reward investment proposition. The company’s ambitious initiatives in autonomous driving, robotics, and AI could redefine its market potential.