Tesla (TSLA) released its Q2 2025 earnings yesterday, July 23, after the markets closed. The stock is trading lower today as CEO Elon Musk’s bullish chatter failed to overshadow the earnings miss. Here are the key takeaways from the report and whether Tesla stock looks like a buy after its initial post-earnings fall.

Tesla Missed Q2 Estimates

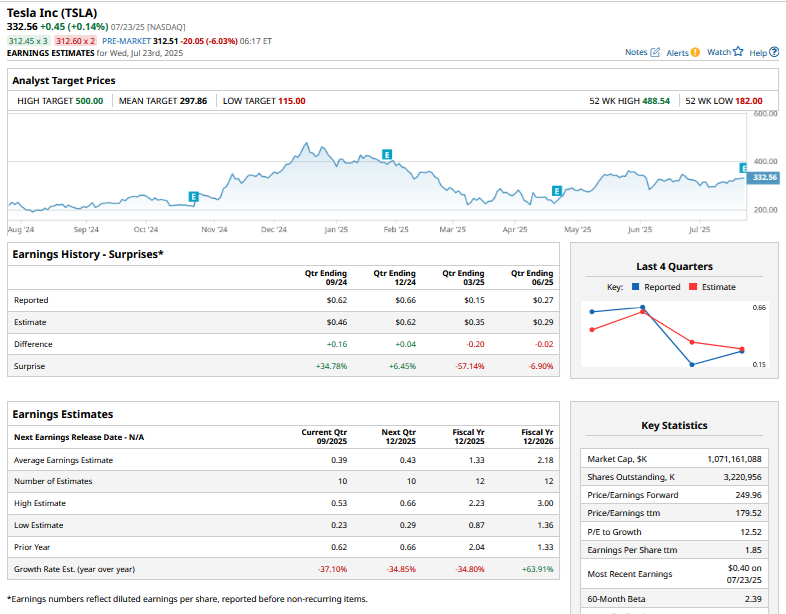

Tesla reported revenues of $22.5 billion in the quarter, which fell short of the $22.74 billion that analysts were expecting. Its earnings per share came in at $0.27, which was also below the $0.29 that analysts were expecting.

Other Key Takeaways from Tesla’s Q2 Earnings

While Tesla missed estimates in Q1 as well, the stock rose following the report, as CEO Elon Musk announced that he would step back from his role with President Donald Trump’s administration. There was no such bullish pivot this time around, and TSLA stock is down sharply today. Here are some of the other key takeaways from Tesla’s Q2 report

- Affordable Model: Tesla announced that it commenced production of its affordable model in June, but has delayed the ramp-up as it prioritizes deliveries of other models before the electric vehicle (EV) tax credits expire.

- Tesla Believes Macro Factors Are Impacting Its Sales: Musk said that the “biggest obstacle” for Tesla is not the desire to buy its cars, but that many “don't have enough money in their bank account to buy it.” The company, meanwhile, virtually withdrew its 2025 guidance, saying it is “difficult to measure the impacts of shifting global trade and fiscal policies on the automotive and energy supply chains.” While last year Musk touted up to a 30% YoY increase in 2025 deliveries, the company has since been toning down the optimism gradually. It is now widely expected to report a second consecutive year of degrowth.

- Margin Boost: The revamped Model Y has been accretive to Tesla’s margins. The company’s gross margin came in at 17.2% in Q2, which was ahead of the 16.5% that analysts were modeling. The margin increased despite a $300 million sequential impact from the tariffs, of which two-thirds was in the automotive business and the remaining in the energy business.

- Trump’s Energy Policies Are Hitting Tesla: Sales of regulatory credits dropped to $439 million in Q2 as compared to $890 million in the corresponding quarter last year. If not for these credits, Tesla would have burned cash in Q2. The sales of these credits are set to fall further as the One Big Beautiful Bill Act does away with penalties on automakers not meeting the emission standards. During the earnings call, Tesla warned that the removal of the EV tax credit is another headwind for its business. Musk also warned of a few “rough quarters” even as he stressed that it is only a possibility and not something certain.

- Musk Wants Higher Voting Rights: The question over Musk wanting more voting rights at Tesla also popped up during the earnings call, unsurprisingly from Morgan Stanley analyst Adam Jonas, a long-time TSLA bull. Musk responded in the affirmative, saying, “I hope that it’s addressed at the upcoming shareholders’ meeting.”

Musk Repeats His Claim of Tesla Becoming the Most Valuable Company

Musk, meanwhile, repeated his often-made assertion that Tesla will eventually become the world’s most valuable company. He also made yet another “end of the year” prediction for the company’s autonomous driving feature and said that unsupervised full self-driving (FSD) will be available for personal use in some geographies in 2025. Musk is equally bullish on the Optimus humanoid and said that he would be “surprised” if Tesla is not making 100,000 of these a month in five years.

As I had anticipated my Tesla pre-earnings analysis, some of the burning issues did not come up for discussion during the earnings call, which more often than not is dominated by questions from Tesla shareholders and analysts bullish on the Elon Musk-run company. For instance, there was no mention of Musk’s political party, and management dodged the question of Tesla investing in Musk’s xAI.

Gerber Terms Tesla’s Q2 Earnings as “Garbage”

Ross Gerber of Gerber Kawasaki Wealth & Investment Management termed the earnings as “garbage.” While Musk blamed poor macros for the sales decline, Gerber believes it has to do with people not wanting to buy Tesla cars because of Musk’s politics.

The earnings had something for both bulls and bears, though. While Tesla fans have been fixated on the progress in autonomy and the expansion of the robotaxi service, bears see the earnings as yet another testament to the deteriorating fundamentals in the core automotive business.

Should You Buy the Dip in TSLA Stock Here?

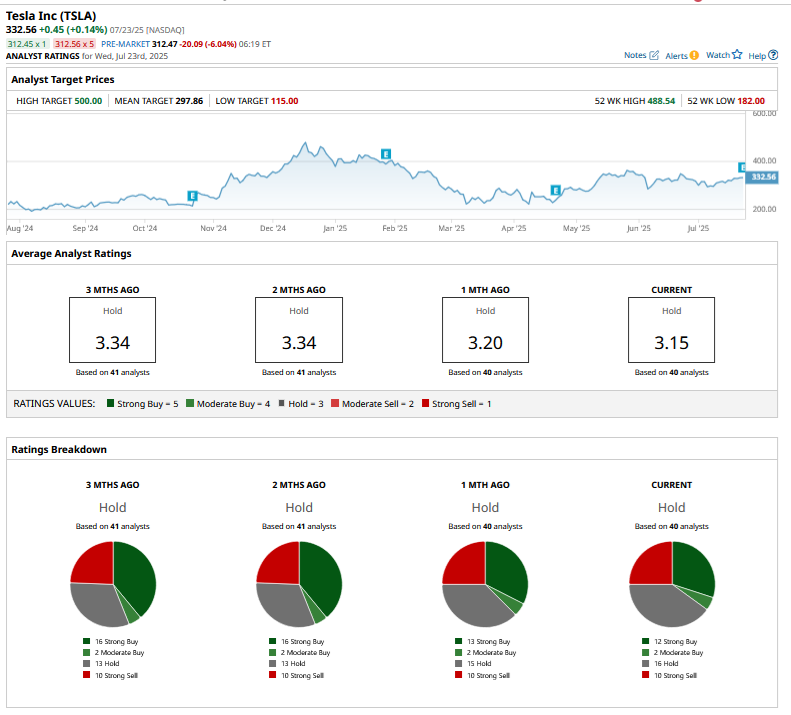

I don’t find today’s dip juicy enough to buy Tesla shares. The company is currently going through a transition period as it pivots to robotaxis and later, Optimus. However, its current business is undeniably going through a worsening slowdown, and the recent regulatory changes in the U.S. are set to make things even tougher. Given Tesla’s ongoing capex, it won’t be surprising to see the company access capital markets in the medium term. China remains yet another challenge as domestic EV companies are racing ahead with their lower-priced and exciting models.

I believe Tesla is currently at a juncture it faced previously before the Model 3 launch. Some skeptics did not give the Elon Musk-run company any chance in the automotive industry back then, while on the other hand, believers saw Tesla as a company that looked set to challenge the status quo.

To Musk and Tesla’s credit, the company proved critics wrong with the successful ramp-up of Model 3 and subsequently Model Y, which went on to become the best-selling vehicle across both EVs and internal combustion engine (ICE) cars.

That said, Tesla is a $1 trillion behemoth, which leaves little scope for error on execution. I would argue that Tesla hasn’t had any real success to talk about in years, and the Cybertruck has been nothing short of a failure, especially given the high expectations. With such rich valuations, I find it difficult to make a “buy” case for TSLA stock even after the post-earnings selloff.