/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

Tesla (TSLA) announced its third-quarter financials last night. While the electric vehicle giant delivered better-than-expected sales, its bottom line came below the Street’s expectations. The quarterly report was hardly disappointing, with Tesla achieving record highs in both vehicle deliveries and free cash flow.

Despite record deliveries and strong free cash flow, TSLA stock is trading lower in the morning session. The muted market response suggests that investors were hoping for even stronger performance. Adding to the uncertainty, Tesla’s management offered no short-term outlook or 2026 delivery targets. This lack of visibility, coupled with broader headwinds such as fluctuating demand, evolving trade dynamics, and shifting tariff policies, has left investors unsure about what’s next.

So, is Tesla stock a buy at this point?

Record Deliveries, Strong Free Cash Flow, but a Profit Miss

Tesla’s third quarter was, by most operational measures, impressive. The EV maker delivered record vehicle volumes globally, with growth across every major region. Its automotive revenue rose 6% year-over-year and 29% sequentially, powered by strong demand for the Model Y. The company’s energy segment also performed well, marking its highest-ever quarterly energy storage deployments. Thanks to the higher deliveries and deployments, Tesla’s total revenue and free cash flow reached new highs.

Despite the top-line strength, Tesla’s adjusted earnings fell 31% from the prior year. This decline stemmed mainly from a drop in regulatory credit revenue and higher costs per vehicle. Those costs were driven by a combination of lower fixed-cost absorption, higher tariffs, and a less favorable sales mix. In short, while Tesla sold more cars, profitability per unit has come under pressure.

A notable factor behind Q3’s record deliveries was the expiration of the U.S. federal EV tax credit of $7,500 in September. Many customers likely rushed to buy before the credit expired, inflating quarterly volumes. That could make Q4 comparisons more difficult, especially as consumers adjust to the post-incentive landscape.

Product Expansion and Energy Innovations

Tesla launched several new automotive and energy products during the quarter. On the vehicle side, Tesla introduced the Model YL and Model Y Performance, while expanding its affordable vehicle lineup with the Model 3 and Model Y Standard. These lower-priced offerings are designed to widen Tesla’s addressable market, particularly in price-sensitive regions.

In the energy division, the company unveiled the Megablock, a next-generation industrial storage solution. By integrating hardware, software, and grid connectivity into one package, Tesla aims to accelerate large-scale renewable energy deployment.

Meanwhile, a new leasing program for Tesla’s solar and Powerwall products in the U.S. offers customers predictable energy costs, lower payments compared to loans, and flexible buyout options. These features could drive incremental residential demand.

The Road Ahead: Challenges and Catalysts

Despite solid Q3 deliveries and deployments, the near-term outlook for Tesla remains mixed. On one hand, the company’s leadership maintains an upbeat tone on its progress in autonomous driving, artificial intelligence (AI), and robotics, areas that could redefine Tesla’s long-term identity. On the other hand, immediate headwinds such as tariffs, a less favorable cost structure, and intensifying competition could continue to be a short-term drag.

Tesla’s new growth initiatives, including its robotaxi service and humanoid robot project, represent high-risk, high-reward bets on the future. The company launched its robotaxi service in June, beginning operations in Austin and across much of the San Francisco Bay Area. Early adoption looks promising, with rapid expansion in service coverage. If Tesla can successfully scale this model, it could transform its revenue mix from one-time vehicle sales to recurring service-based income.

In parallel, Tesla’s AI-powered self-driving technology continues to evolve. Although the company claims progress toward full self-driving (FSD) without human supervision, only about 12% of Tesla owners currently pay for the FSD package. Regulatory approvals in markets like China and Europe remain pending, which could limit near-term monetization opportunities.

Then there’s Optimus, Tesla’s humanoid robot project. Elon Musk envisions producing as many as 100,000 units per month within five years. If realized, this could open a new frontier in automation and labor efficiency. However, like many of Musk’s visionary promises, it will have no immediate financial contribution.

Is Tesla Stock a Buy?

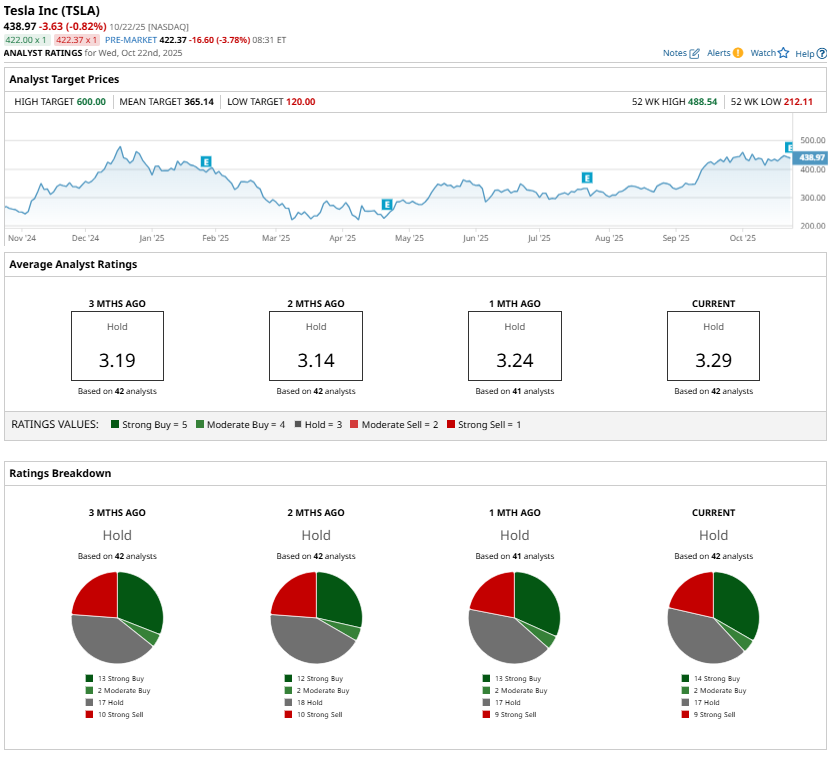

Even as Tesla pioneers its groundbreaking ventures, its valuation remains a concern. The stock currently trades at roughly 381 times forward earnings, an astronomical multiple compared to peers. Analysts do expect its earnings to rebound sharply in 2026, but much of that optimism already appears priced in. For investors buying now, the risk is that even strong execution may not justify today’s lofty valuation multiples.

Tesla’s high valuation reflects not just its current business but also the expectation that it will dominate future technologies, including EVs, energy storage, AI, robotaxis, and robotics. Thus, analysts are sidelined on TSLA stock and maintain a “Hold” consensus rating.