/Tesla%20charging%20station%20black%20background%20by%20Blomst%20via%20Pixabay.jpg)

What once sounded like science fiction is quietly rolling onto American streets. Robotaxis—self-driving cars you summon on demand—are no longer just an idea scribbled on Silicon Valley whiteboards. Built to be cost-effective, efficient, and cleaner than traditional cabs, these vehicles promise a future where getting around town means no driver, no hassle.

And Tesla (TSLA) is racing hard toward that future, even as a growing pack of rivals tries to stake their claim. Elon Musk’s company jumped into this race a few months ago, launching its robotaxi program in Austin, then expanding into California and securing approvals in Nevada. Now Arizona has given the green light, allowing Teslas that steer themselves to hit Phoenix roads. But Arizona regulators cleared its service with safety drivers still in place.

The move puts Tesla shoulder-to-shoulder with other players already running empty vehicles in the region. Backed by its Full Self-Driving (FSD) tech and a brand cultlike in its following, Tesla’s expansion feels like the next big chapter.

But with rivals already entrenched, regulators watching closely, and safety still under the microscope after recent mishaps, should investors lean in on TSLA or wait it out?

About Tesla Stock

Tesla, a Texas powerhouse valued at over $1.4 trillion by market capitalization, has evolved from an ambitious EV startup into a global innovator. Guided by Elon Musk, it blends EVs, battery storage, solar energy, and robotics into one ecosystem. The company shapes mobility, powers cities sustainably, and constantly pushes boundaries, keeping the world fixated on its next move.

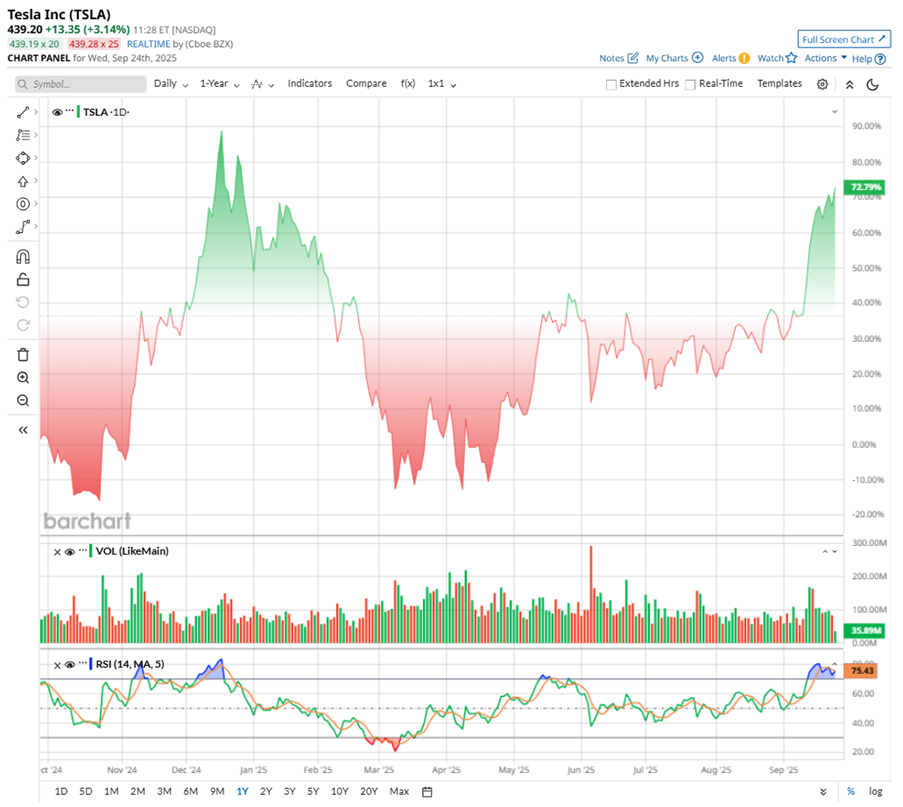

Tesla’s 2025 journey has been volatile. The year opened with the electric vehicle (EV) pioneer stumbling hard—shares cratered after a brutal first quarter, worsened by Trump’s April tariff punch. Add in slowing deliveries, rising Chinese competition, and Musk’s political escapades, and Tesla was staring at its ugliest stretch since 2022. Investors were rattled, and TSLA stock bottomed out in the spring, marking a low of $214.25 in April.

But fast-forward to September, and Tesla has flipped the script. Over the month, the stock has roared back more than 28%, erasing its year-to-date (YTD) losses. The spark was a blockbuster insider move, with Musk himself buying 2.568 million shares worth roughly $1 billion, his first purchase in five years. That, paired with renewed optimism about Tesla’s long-term growth amid the Robotaxi launch in Arizona, catapulted the stock to $444.98 on Sept. 22, a massive 104% rebound off April’s lows. Shares now sit nearly 72% higher over the past 52 weeks, with momentum that few saw coming.

As I’ve already mentioned in my last piece, TSLA’s chart flashed caution, and technical signals hinted at a breather. The 14-day RSI sits above 75, flashing overbought territory. Plus, what really caught my eye is how Tesla broke above the $430 resistance level, a key barrier that had been capping momentum. After briefly slipping to $425, it powered right back to nearly $440 in today’s trading session, proving buyers are still in control.

The next resistance is sitting near $448. If Tesla clears that level, it could open the door to more upside, but if it stalls there, a pullback wouldn’t surprise me.

Tesla’s Q2 Earnings Miss

On July 23, Tesla released its Q2 2025 earnings report, and honestly, it did not exactly thrill Wall Street. After the bell, the company showed a revenue beat but missed on profits. Revenue hit $22.5 billion, which was down 12% year-over-year (YoY), while EPS slipped 23% annually to $0.27.

Deliveries came in at 384,122, off more than 13%, highlighting the drag from an aging lineup and relentless pressure from Chinese competitors. Automotive revenues slid 16%, and those once-reliable regulatory credit sales nearly got cut in half.

Still, there were some bright spots. Gross margins clocked in at 17.2%, better than expected even after a $300 million tariff bite, thanks to stronger efficiency from the refreshed Model Y. Tesla’s cash pile showcases resilience, sitting at $36.8 billion. But the flip side was free cash flow, which shrank to only $146 million, a steep fall from $1.3 billion last year, showing how capital-heavy the business has become.

Elon Musk kept up his trademark mix of realism and moonshot vision on the earnings call. He warned about tough macro headwinds and even walked back Tesla’s 2025 delivery guidance. Yet he doubled down on autonomy and robotics, predicting unsupervised FSD this year and mass production of Optimus robots within five.

Wall Street’s watchful eyes are bracing for a bumpy ride with Tesla. Analysts expect the EV giant’s bottom line to take a sharp hit in 2025, with EPS falling 41% YoY to just $1.20. But the forecasts hint at a swift turnaround in the next fiscal year, potentially catapulting EPS back up to $2 in 2026, signaling a bright rebound on the horizon.

The Road Ahead for Tesla Robotaxis

Tesla’s robotaxis are envisioned as fully autonomous vehicles designed to operate without a human driver, powered by the company’s advanced FSD technology. Built on artificial intelligence (AI), machine learning, and billions of miles of real-world data, these vehicles are designed to navigate dense urban environments safely.

Tesla’s robotaxis aim to revolutionize urban mobility—cheaper, faster, and greener than traditional ride-hailing. CEO Musk envisions millions serving half the U.S. by 2025, cutting emissions, easing congestion, and reshaping transit. Autonomous fleets could slash fares, boost availability, and rival taxis and apps, powering Tesla’s next growth engine while staying true to its sustainable energy mission.

Yet, the road ahead is not without hurdles. Regulatory approvals remain critical, with rules varying across states and countries. Safety concerns and consumer skepticism also loom large.

The competitive landscape is also fierce. Alphabet’s (GOOG) (GOOGL) Waymo leads the field, operating fully driverless services across several U.S. cities and delivering hundreds of thousands of paid rides weekly. Amazon’s (AMZN) Zoox, though newer, brings a fresh design and the financial muscle of its parent company to back its rollout in Las Vegas and beyond. Both players have carved out early leads, and their progress keeps the pressure on Tesla to accelerate.

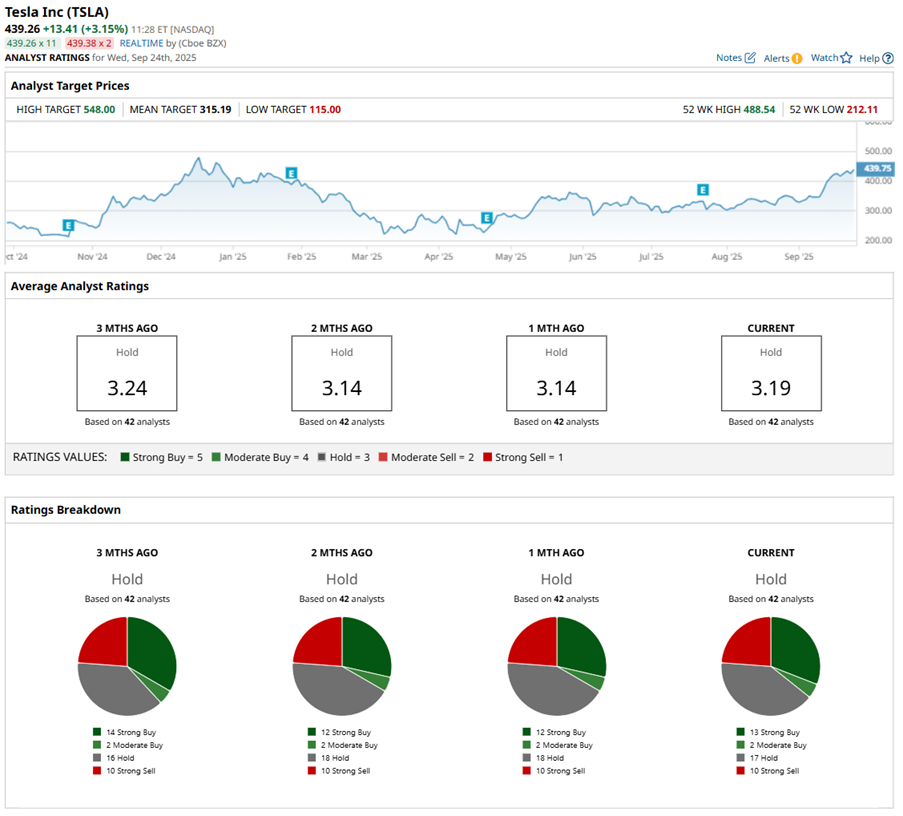

What Do Analysts Expect for TSLA Stock?

Recently, Mizuho Securities boosted TSLA’s price target to $450 from $375, citing resilient EV demand, easing tariff concerns, and rising production volumes. Analysts expect 1.91 million deliveries in 2026, fueled by the upcoming low-cost Model 2 and potential Robotaxi launches. Retaining an “Outperform” rating, Mizuho sees Tesla holding U.S. EV leadership, with Musk’s massive pay package and stock purchase aligning incentives for ambitious projects like autonomy and humanoid robots.

Piper Sandler turned more bullish on TSLA over the weekend, lifting its price target to $500 from $400. Analyst Alex Potter, fresh off a China visit, called Tesla the firm’s “top idea” in autonomous vehicles and robotics, defending its lofty valuation as a reflection of AI’s potential to disrupt massive markets.

The bull run talk was even more prominent on Friday when Tesla got a fresh jolt of optimism from Baird, with analyst Ben Kallo upgrading the stock to “Outperform” and jacking the price target up to $548 from $320. Kallo’s pitch was that Tesla isn’t being treated like just another car company anymore but valued as a physical AI powerhouse. Sure, recent EV sales have looked soft, but Wall Street’s gaze has shifted to what Musk is really selling—a future built on robotics, autonomous mobility, and AI.

Baird anticipates that by 2035, Tesla could sell 20 million cars, rack up 10 million active FSD subscriptions, put one million robotaxis on the road, and sell a million Optimus robots at $20,000 each, at 50% gross margins. That kind of scale, the analyst says, could push Tesla’s market cap past $5.5 trillion, with the stock at around $1,412. And if Musk somehow doubles those milestones, you are looking at a $12 trillion valuation and shares trading north of $3,000. Kallo stressed that is not the base case, but it does paint a wild picture of just how big Tesla could get if its AI bets pay off.

Despite TSLA's recent positive developments, Wall Street can’t seem to agree on Tesla. The stock carries a “Hold” rating overall, reflecting a split camp of believers and skeptics. Out of 42 analysts offering recommendations on TSLA, 13 advise a “Strong Buy,” two call it a “Moderate Buy,” 17 prefer to sit on the fence with “Hold,” while 10 are outright bearish with “Strong Sell.”

While the EV stock is already trading above its average price target of $315.19, Baird’s street-high target of $548 suggests there is still nearly 29% upside if its bullish vision plays out.

Final Thoughts on Tesla

Tesla’s Robotaxi approval in Arizona adds a thrilling new chapter—a mix of excitement and caution. TSLA stock is surging, but safety concerns and rivals like Waymo, Zoox, and General Motors’ (GM) Cruise keep investors on edge.

If Musk nails execution, expands FSD adoption, and builds public trust, the upside could be massive. Slip-ups, however, could hand the spotlight to competitors. TSLA today feels like holding on tight to a speed train—thrilling, unpredictable, and definitely not for the faint-hearted.