Wedbush analyst Dan Ives has reiterated his bullish stance on Tesla Inc. (NASDAQ:TSLA), positioning it as one of the premier investments in the field of physical AI.

What Happened: Ives, known for his insights into the technology sector, forecasts a staggering $2 trillion valuation for Tesla, without factoring in the future earnings from its humanoid robot, Optimus.

"The two best physical AI plays in the market are Nvidia Corp. (NASDAQ:NVDA) and Tesla," Ives stated during the interview with Herbert Ong. "I don't believe any of that valuation is factored into the story today."

His comments underscore a belief that the market has yet to fully appreciate the transformative potential of Tesla's AI initiatives. Ives' optimism extends beyond Tesla's current offerings, reaching into its future projects.

"We're not even factoring Optimus into the $2 trillion," he elaborated, referring to Tesla's humanoid robot designed for a variety of tasks.

"Because my view is that as they start to scale it and it starts to get deployed, it could be EVEN BIGGER than autonomy."

Ives' forecast of a $2 trillion valuation for Tesla is part of a broader narrative about the future of AI.

"There's so many growth levers with this story that investors are now appreciating," he said, pointing to the evolving landscape of AI applications. His comments reflect a belief that Tesla's integration of AI across its product ecosystem could redefine its market position.

See Also: Bill Gates Is Betting Two-Thirds Of His Foundation’s Portfolio In These 3 Stocks

Why It Matters: The interview comes at a time when Tesla is navigating both opportunities and challenges in the AI space.

Recent developments, such as NVIDIA's launch of the Cosmos platform at CES 2025, have intensified the competition in physical AI.

However, Ives remains confident in Tesla's position, citing its real-world data collection approach as a key differentiator. "Tesla's focus on real-world data, as opposed to synthetic data, gives them a unique edge," he noted.

Price Action: Tesla shares were 4.44% lower in premarket on Tuesday, and the stock ended 1.84% lower at $317.66 apiece on Monday. It has declined by 16.25% on a year-to-date basis and is up 51.37% over the past year.

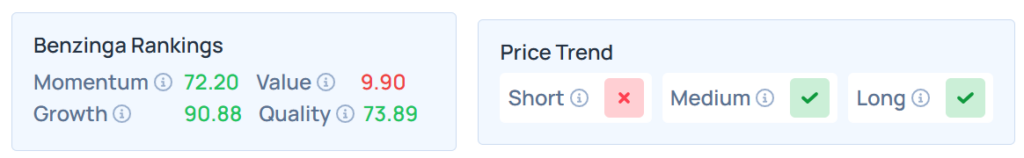

Benzinga Edge Stock Rankings shows that Tesla had a stronger price trend over the medium and long term but a weaker trend over the short term. Its momentum ranking was solid; however, its value ranking was poor at the 9.90th percentile. The details of other metrics are available here.

After hitting fresh records on Friday and Monday, on Tuesday, the SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were lower in premarket. The SPY was down 0.18% at $616.74, while the QQQ declined 0.22% to $550.41, according to Benzinga Pro data.

Read Next:

Photo: Around the World Photos/Shutterstock