The robots aren’t arriving — they’ve already started their shifts.

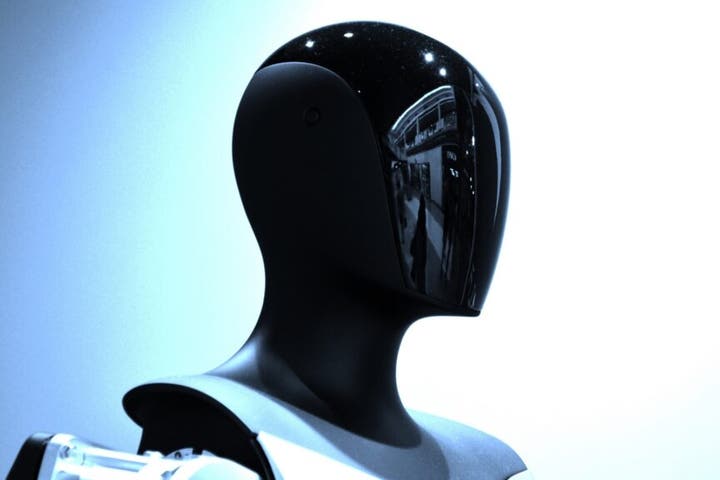

Tesla Inc.’s (NASDAQ:TSLA) Optimus is sorting 4680 battery cells in Fremont. Xiaomi’s CyberOne and Hyundai-owned Boston Dynamics’ Atlas are patrolling factory floors in China and South Korea. And as humanoids transition from science fiction to supply chains, investors are posing an extremely 2025 question: how do we get exposure?

Last week, Benzinga highlighted two first-of-their-kind ETFs, Roundhill’s Humanoid Robotics ETF (BATS:HUMN) and KraneShares’ Global Humanoid and Embodied Intelligence Index ETF (NASDAQ:KOID), both giving investors a front-row seat to what Morgan Stanley estimates could be a $5 trillion humanoid robotics market by 2050.

But headlines only paint part of the picture. To get the inside track, we sat down with Dave Mazza, CEO of Roundhill Investments, who thinks that this isn’t some moonshot decades down the road, it’s a real, investible theme already bringing in revenue and returns.

Mazza identifies the market’s turning point as an uncommon intersection of three trends: Record labor shortages, crashing AI prices and Robots-as-a-Service (RaaS) pricing.

This three-pronged dynamic, Mazza contends, has moved humanoid robotics from futurism to fiscal reality.

“Three curves just converged: record labor shortages (over 450,000 U.S. warehouse roles are unfilled), AI inference costs down roughly 85% since 2023 and robots‑as‑a‑service pricing hovering around $30 per hour, which is competitive with overtime pay. When capability meets corporate math, that's when a theme turns investable,” he said.

Addressing the question of whether humanoid robots are still too pricey or impractical for scaled deployment, Mazza explained, “Early robots already compete with night‑shift labor, and each hardware generation cuts costs — mirroring cost curves in solar panels and EV batteries — so scale will make today's sticker shock fade.”

Why HUMN Isn’t Just Another Index ETF

Roundhill’s HUMN ETF is not only one of the first U.S.-listed ETFs focused on humanoid robotics, it’s also actively managed, a decision Mazza maintains was non-negotiable.

“Frontier tech moves too fast for static indexes, when start‑ups list and incumbents spin out robotics units overnight. HUMN's portfolio is reviewed at least monthly, and we can trade more frequently when opportunities emerge,” said Mazza.

Contrast that with KOID, which adheres to an index approach: equal weighting holdings across the robotics supply chain. Although KOID offers widespread diversification, it doesn’t have the agility that HUMN is counting on to generate alpha.

And there’s history: Roundhill’s Generative AI & Technology ETF (NYSE:CHAT), which is also actively managed, has beaten indexes and peers since its launch in May 2023.

The Tesla Question

No humanoid discussion would be complete without Tesla. Elon Musk’s humanoid robot Optimus is already driving within Tesla factories, and the firm has pledged significant updates soon.

With Tesla being HUMN’s single-largest holding (now capped at approximately 13%), some investors may fear over-exposure to the volatile personality of Musk. But this is precisely why the fund is actively managed, according to Mazza.

“Tesla brings unique leverage: an in‑house AI stack, gigafactory‑scale manufacturing, and a captive reference customer. We cap its weight so a single tweet can't steer the entire fund,” Mazza noted.

Less hype than blueprints, perhaps, Tesla is planting the seeds of full-stack humanoid deployment — just like its vertical integration strategy for EVs.

“If Optimus keeps learning on Tesla lines, the company controls both the robot and its first large customer, echoing its EV vertical‑integration playbook, so we believe Tesla has an inside track,” Mazza says.

The Road Ahead

Though Morgan Stanley landed on 2050, Mazza puts that timeline into even greater relief.

"Adoption looks linear through the late‑2020s, then inflects in the mid‑2030s as fleets scale, exhibiting classic S‑curve dynamics."

That doesn't mean investors have to wait decades to see returns.

"Investors should treat HUMN as a long-term satellite holding with the potential for strong returns over shorter time periods," says Mazza.

Global Reach, Grounded Exposure

Most of the most sophisticated humanoid mockups — CyberOne, Atlas, Walker S from UBTech — aren’t publicly traded. So how does HUMN give exposure?

By being their owners, says Mazza.

Boston Dynamics’ Atlas resides under Hyundai, a holding company of HUMN.

Xiaomi, frequently undercovered in U.S. media, is listed and part of HUMN’s portfolio.

HUMN takes a value-chain approach. “HUMN is deliberately global: U.S. silicon (Nvidia), Chinese humanoid builders (UBTech, XPeng), and Japanese precision‑gear makers (Harmonic Drive) create exposure across the entire value chain,” Mazza reasoned.

Last Thought: HUMN Now, Bot Empire Soon?

As individual investors, institutional allocators, and ETF issuers begin to wrap their minds around robots with brains and biceps, Roundhill’s HUMN ETF provides an early — maybe first-mover — edge.

And with labor gaps widening, AI hardware advancing and enterprise appetite growing, the bet on humanoids might just be the most human thing Wall Street has done in years.

"Large‑language models gave computers a brain," Mazza says. "humanoids add arms and legs, letting AI tighten bolts and physically interact instead of just answering prompts." Now it can go to work.

Read Next:

Photo: Optimus via Shutterstock