The Terra (CRYPTO: LUNA) community has unanimously decided to burn 1.38 billion UST stablecoins from its pool, reducing the supply by roughly 11% of its total supply of 11.28bn tokens.

Over 99% of the voters supported the proposal, while 0.60% abstained from voting. 9,896 of the voters voted against the proposal.

UST circulation to reduce by 8.05%

According to the proposal, currently, 1,017,233,195 UST remains in the community pool. The current (CRYPTO: UST) circulating supply is 12,623,445,466 and as a result, burning the remainder of the Community Pool’s UST will reduce the circulation of UST by roughly 8.05%.

“Eliminating a significant chunk of the excess UST supply at once will alleviate much of the peg pressure on UST. This is advantageous relative to the slow burn rate and type of downstream effects that inflated on-chain swap spreads induce on the Terra economy over an extended period,” according to the proposal.

It further states that the burn will help “reduce the outstanding bad debt of the Terra economy” and also play a significant role in restoring the UST dollar peg by eliminating a big chunk of excess supply.

Subsequently, minting capacity will increase from $293 million to $1200m. The result will help expedite the outflows of UST from the system, reducing swap spreads and pressure on the UST peg but coming at the cost of the LUNA price.

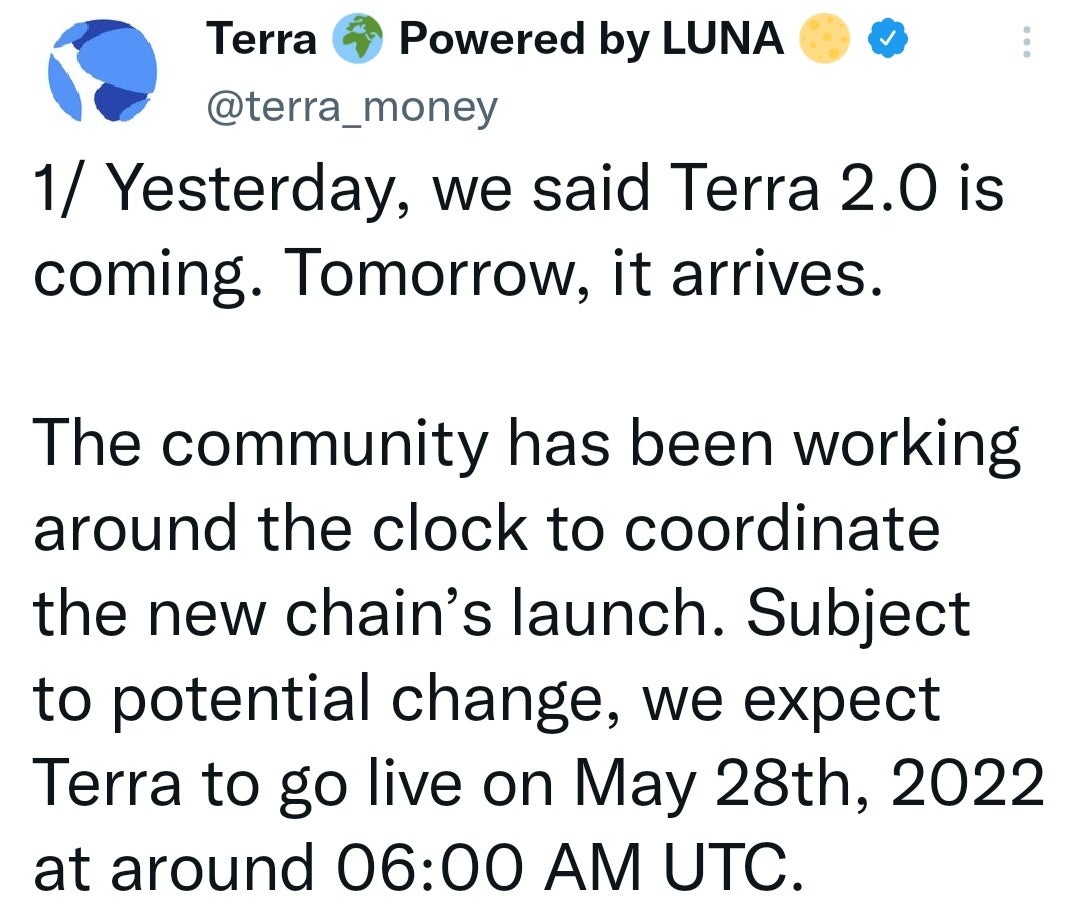

'Terra 2.0' to launch on Saturday

Meanwhile, Terra’s new blockchain ‘Terra 2.0’ will be launched on Saturday followed by an airdrop of LUNA tokens, according to the developers.

“The community has been working around the clock to coordinate the new chain’s launch,” Terra developers said in a tweet on Friday morning. “Subject to potential change, we expect Terra to go live on May 28th, 2022 at around 06:00 AM UTC,” the developers stated.

A snapshot of the new blockchain had taken place earlier this week after the conclusion of a vote among network validators with a 65% approval rate.

Terra’s stablecoin UST had earlier this month lost its peg to the US dollar and never recovered. Unlike other stablecoins like USDT and USDC, UST was not backed by any assets.