The United States is experiencing its most dramatic tariff overhaul in decades, reshaping the business environment for every major industrial player. In 2025, the effective tariff rate on imports surged to a range of 10%-30% (for China), the highest seen since 1933.

This sweeping change applies across multiple sectors: products from over sixty countries now face rates as high as 25%, with steel, aluminum, machinery, and transportation equipment especially affected. These tariffs, intended to protect domestic industries, are instead squeezing profit margins, raising input costs, and forcing many companies to reconsider supply chains and capital investments.

Now, Caterpillar (CAT), a blue-chip dividend stock, is bearing the brunt of these new trade barriers. They announced it may face $1.8 billion in tariff-induced costs this year, an eye-watering figure that has shaken investor confidence. With its stock price sliding down 3.17% in the past month and profit margins under pressure, the company’s storied reputation for resilience and reliable dividends is being put to the test as tariff realities cut deeper than anticipated. Will this blue-chip giant emerge stronger, or is the selloff just the beginning? Let’s dive in.

A Fresh Look at CAT’s Numbers

Caterpillar stands as a top global supplier of construction, mining, and energy machinery, anchored by a market capitalization of $194.9 billion, and remains a central figure in heavy industry.

Shareholders benefit from an annual dividend rate of $5.74, with a yield of 1.38%, and the forward outlook signals continued commitment to capital return, climbing to $6.04 at 1.44%, providing comfort even as the earnings landscape shifts.

CAT’s share price, $422.29, reflects a 16% gain year to date and a 26% rise across the past 52 weeks, highlighting durable appeal, especially as investors weigh the tariffs' impact.

Valuations hold a premium, with a price-to-earnings (P/E) ratio at 21.73x compared to the sector’s 21.28x median and a forward multiple at 23.22x against the sector’s 20.75x median, positioning Caterpillar as a standard-bearer.

The latest earnings report, dated Aug. 5, 2025, illustrates the direct financial toll of tariffs and evolving market demand. Total second-quarter sales and revenues reached $16.6 billion, narrowly below last year's level, a modest slip engineered by unfavorable price realization that shaved off $414 million. Meanwhile, higher sales volume brought a $237 million boost as Caterpillar’s equipment held customer appeal.

Profit per share ended at $4.62, with adjusted profit per share at $4.72, both missing expectations and trailing the prior year’s stronger results. The numbers reflect how tariffs and manufacturing costs are directly squeezing profitability, with operating profit margin at 17.3% and adjusted margin at 17.6%, both notably reduced from 20.9% and 22.4%, respectively, last year.

Despite these external strains, Caterpillar’s enterprise operating cash flow was a robust $3.1 billion, and the company closed the quarter with $5.4 billion in cash, underscoring disciplined financial management and strong liquidity even in challenging circumstances. Strategic capital returns continued, with $800 million deployed for buybacks and $700 million allocated to dividends, sending a clear signal of resolve to shareholders. The numbers, viewed collectively, reveal a company balancing the demands of tariffs and production costs.

Catalysts Fueling CAT’s Growth

Caterpillar’s recent moves show the company isn’t sitting helplessly while tariffs squeeze profits. Instead, it’s busy forging alliances that could fuel an entirely new phase of growth. The strategic partnership with Hunt Energy Company, announced in August 2025, is a prime example.

With nearly 190 years of combined industry experience between Caterpillar and Hunt, the alliance sets out to bring up to 1 gigawatt of power generation capacity to data centers across North America, with the first project launching in Texas.

Caterpillar will supply natural gas and diesel generation equipment, integrate gas turbines, switchgear, controls, and sophisticated aftertreatment systems. The company’s engineering and design services will make sure every power solution matches the demanding reliability requirements of the data center sector. Hunt Energy adds its expertise in infrastructure development and battery energy storage, with over 310 megawatts deployed across Texas, ensuring data centers stay powered even when grid access is spotty or interrupted.

The future isn’t just about Texas. Earlier in August, Caterpillar announced a collaboration with Joule Capital Partners and Wheeler Machinery Co. for a groundbreaking data center campus in central Utah. This initiative is set to deliver 4 gigawatts of total energy capacity, mixing traditional prime power with integrated combined cooling, heat, and power technology.

The flagship campus will span 4,000 acres, utilize Caterpillar’s latest G3520K generator sets, and include 1.1 gigawatt-hours of grid-forming battery storage. The project brings battery innovation to the forefront, combining power reliability with sustainability goals, all critical in a world where downtime can cost data operators millions.

Analysts’ Views on CAT’s Future

Analysts are paying close attention to Caterpillar, with the next earnings release set for Oct. 29, 2025. For the current quarter ending in September, the average earnings estimate stands at $4.56. Looking ahead, the consensus is $17.92 for fiscal year 2025 and $21.14 for fiscal year 2026.

These numbers point to a tough road in the near term with a projected decline of about 11.8% for the current quarter and a deeper drop of 18.17% for full-year 2025, based on last year’s $21.90. However, the forecast brightens in 2026, when growth is pegged at a strong 17.97%, with earnings expected to rebound from the previous year’s low.

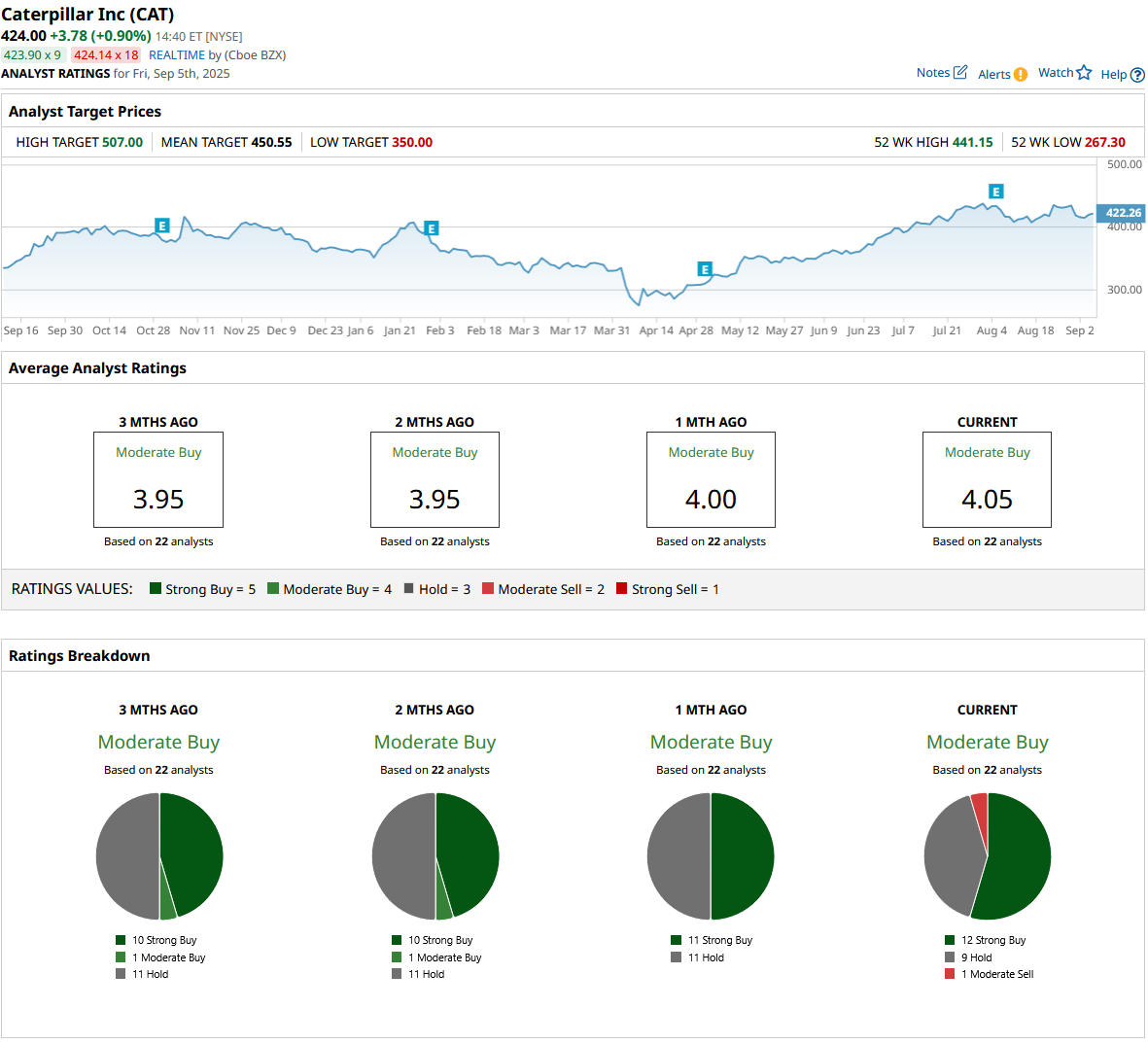

Despite short-term challenges linked to tariff expenses and muted margins, analysts seem optimistic overall. The 22 surveyed give CAT stock a consensus “Moderate Buy” rating, underscoring confidence in long-term fundamentals.

Conclusion

At the end of the day, Caterpillar is still shaping up as a solid play for those with patience. Tariffs are weighing on margins and guidance, but analysts see a path back to growth, and the dividend remains dependable. The average price target points to a 6% upside from here, suggesting the street expects a lift as conditions normalize. Most likely, shares will stick close to current levels in the short term, then pick up momentum as earnings rebound and new deals kick in. If steady income and long-term potential are the goal, buying this dip could pay off.