Targa Resources Corp. (TRGP), based in Houston, Texas, is a major force in the midstream energy sector, handling key processes such as collecting, treating, transporting, storing, and exporting both natural gas and natural gas liquids.

Through a network of strategically positioned facilities, Targa connects domestic and international markets, focusing on safety and efficiency while operating mainly in the Gulf Coast and other high-production regions across North America. The company currently has a market capitalization of $32.5 billion.

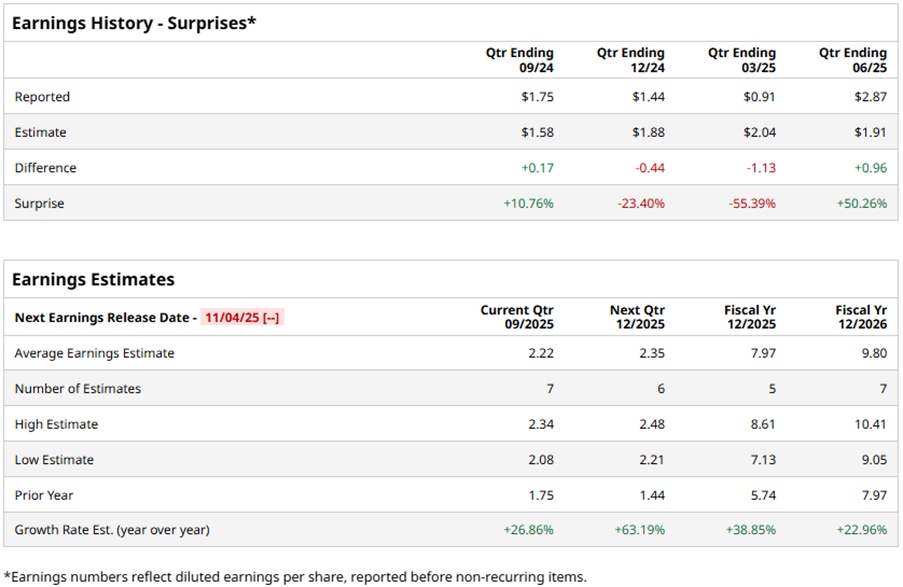

Targa Resources is set to report its third-quarter results soon. Ahead of the results, Wall Street analysts project the company’s bottom line to expand. For the third quarter about to be reported, its profit is expected to grow 26.9% year-over-year (YOY) to $2.22 per diluted share. Additionally, for the current fiscal year, analysts project its profit to increase by 38.9% from the prior year to $7.97 per diluted share and rise by another 23% annually to $9.80 in fiscal 2026.

Targa Resources has a mixed record of surpassing consensus bottom-line estimates. The company’s reported EPS beat estimates in two of the trailing four quarters, while missing them in two.

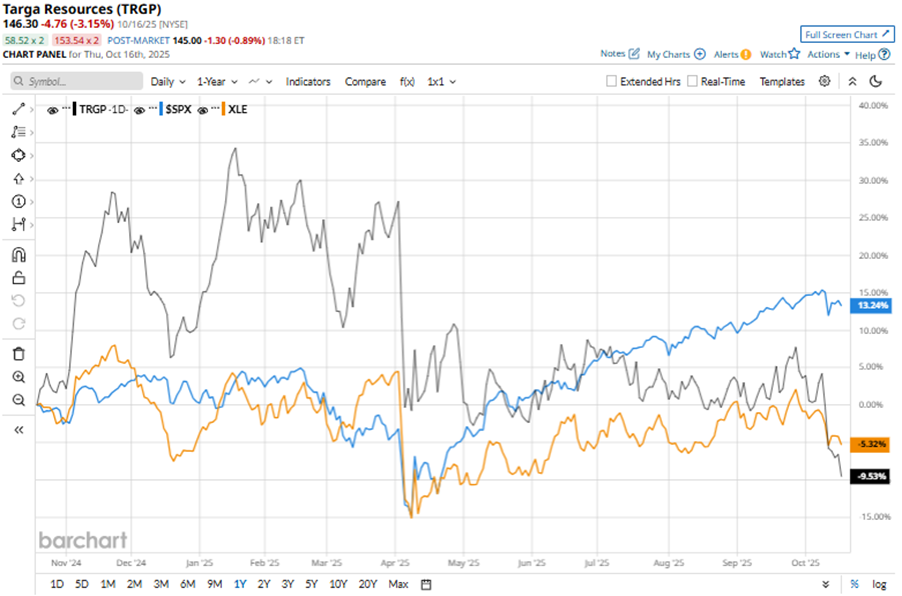

Over the past 52 weeks, the stock declined by 10%, while it dropped 18% on a year-to-date (YTD) basis. This has widely underperformed the broader market. The S&P 500 index ($SPX) climbed 13.5% and 12.7% over the same periods, respectively. While the broader energy sector is not holding up well, its decline pales in comparison to TRGP’s drop. Over the past 52 weeks, the Energy Select Sector SPDR Fund (XLE) fell 5.5%, while the ETF is down marginally this year.

Targa Resources’ shares have come under pressure over the past year amid shifting commodity prices and broader economic conditions, which have affected midstream companies. Plus, doubts about how fast Permian oil output will grow have been putting pressure on the stock lately.

But Targa Resources is investing $3.30 billion in the Permian Basin, including the 500-mile Speedway NGL Pipeline to transport liquids to Mont Belvieu and multiple new gas processing plants, such as the Yeti plant. The pipeline and plants are expected to be operational by 2027-2028, enhancing infrastructure and meeting customer needs in this vital energy region.

Wall Street analysts have been bullish about TRGP’s prospects. Among the 22 analysts covering the stock, the consensus rating is a “Strong Buy.” 18 analysts advise a “Strong Buy,” one has a “Moderate Buy,” and the remaining are playing it safe with a “Hold.”

The mean price target of $203.41 indicates a 39% upside from current levels, while the Street-high price target of $240 implies the stock could rise as much as 64%.