Taco Bell is rethinking how it uses artificial intelligence at drive-throughs after a spate of viral ordering flubs, even as the company says the technology has successfully handled millions of orders.

Viral Ordering Flubs Trigger Rethink Of Voice AI Orders

The chain rolled out a voice AI system to more than 500 U.S. drive-throughs beginning in 2023 to cut errors and speed service. But customer videos showing the bot looping prompts or accepting prank orders, like a request for 18,000 water cups, have triggered a reassessment, executives said.

"I think like everybody, sometimes it lets me down, but sometimes it really surprises me," Taco Bell Chief Digital and Technology Officer Dane Mathews told The Wall Street Journal in an interview last week. "We're learning a lot, I'm going to be honest with you," and "We'll help coach teams on when to use voice AI and when it's better to monitor or step in," he added.

Taco Bell’s Hybrid Human-In-The-Loop Approach

Mathews said Taco Bell will tailor usage by restaurant, keeping humans squarely "in the loop," especially at peak times, while it studies "more than two million" AI-handled orders to refine where the tool helps and where it hinders.

That mirrors a broader industry course correction. McDonald's Corp. (NYSE:MCD) ended a high-profile voice-ordering pilot with IBM last year before shifting to a new Google Cloud effort and Wendy’s Co. (NASDAQ:WEN) plans to expand its Google-built "FreshAI" to hundreds more locations after tests in company stores.

Yum! Brands Is Doubling Down On AI As Consumers Demand Accuracy

Taco Bell's parent, Yum! Brands Inc. (NYSE:YUM) has signaled it will keep investing in automation and data tools, announcing an AI collaboration with Nvidia earlier this year, even as front-line deployments get fine-tuned.

Competitors see upside if the kinks get worked out. Wendy's says its bot can autonomously take most orders and shave drive-through times, an efficiency pitch that resonates with franchisees juggling labor costs and busy lanes. But the recent backlash shows consumers expect these systems to match, or beat human accuracy, not add friction.

Price Action: YUM shares traded higher by 1.03% to $146.97 on Friday at market close.

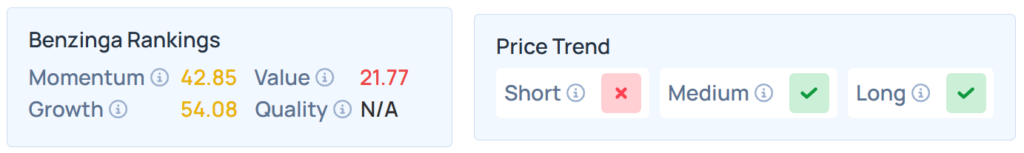

Benzinga Edge Stock Rankings indicate Yum! Brands’ stock offers poor value, with an unfavorable price trend in the short term. Check here to see how YUM positions itself against its peers.

Read Next:

Photo courtesy: Shutterstock