Bellevue, Washington-based T-Mobile US, Inc. (TMUS) is a wireless communications services company that provides voice, messaging, and data services across postpaid, prepaid, and wholesale channels. Valued at a market cap of $253.2 billion, the company is expected to announce its fiscal Q3 earnings for 2025 before the market opens on Thursday, Oct. 23.

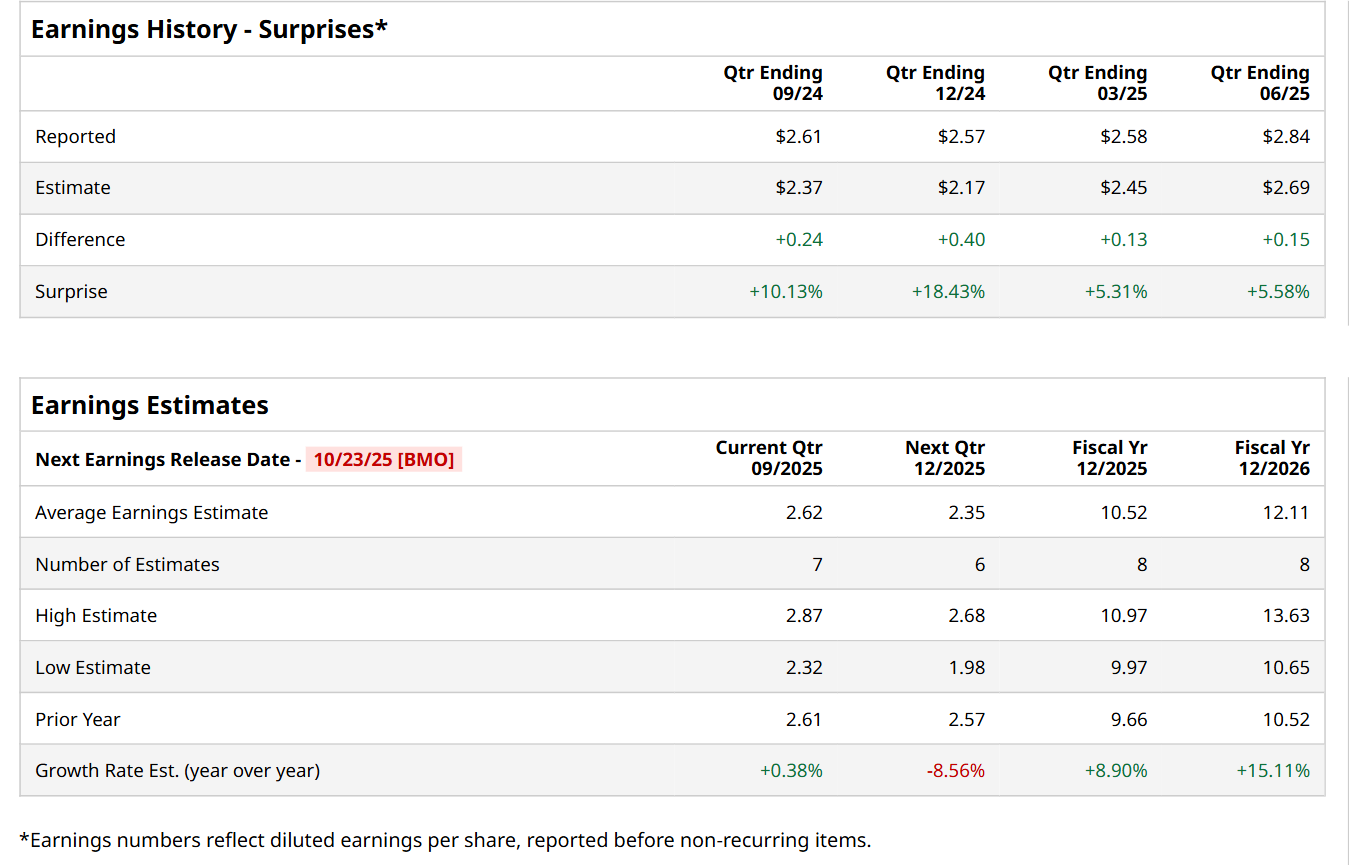

Before this event, analysts expect this telecom giant to report a profit of $2.62 per share, up marginally from $2.61 per share in the year-ago quarter. The company has a promising trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $2.84 per share in the previous quarter topped the consensus estimates by 5.6%.

For the current fiscal year, ending in December, analysts expect TMUS to report a profit of $10.52 per share, up 8.9% from $9.66 per share in fiscal 2024. Its EPS is expected to further grow 15.1% year-over-year to $12.11 in fiscal 2026.

TMUS has gained 8% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 17.2% return and the Communication Services Select Sector SPDR Fund’s (XLC) 28.2% rise over the same time frame.

TMUS reported better-than-expected Q2 results on Jul. 23, sending its shares up 5.8% in the following trading session. The company posted record Q2 postpaid phone net and gross customer additions. It also saw industry-leading growth in postpaid net account additions and 5G broadband subscribers. These strong subscriber gains fueled a 6.9% year-over-year increase in its total revenue to $21.1 billion, which came in slightly above consensus estimates. Moreover, on the earnings front, its core adjusted EBITDA improved 6.4% from the prior-year quarter to $8.5 billion, while its EPS advanced 14.1% annually to a Q2 record of $2.84, topping analyst estimates by 5.6%.

Noting this momentum, TMUS raised its fiscal 2025 guidance, now expecting 6.1 million to 6.4 million postpaid net customer additions and core adjusted EBITDA to be between $33.3 billion and $33.7 billion.

Wall Street analysts are moderately optimistic about TMUS’ stock, with a "Moderate Buy" rating overall. Among 29 analysts covering the stock, 16 recommend "Strong Buy," two indicate "Moderate Buy," 10 suggest "Hold,” and one advises a “Strong Sell” rating. The mean price target for TMUS is $275.24, indicating a 22.4% potential upside from the current levels.