T-Mobile US Inc. (NASDAQ:TMUS) announced a stellar second quarter for 2025, with President and CEO Mike Sievert declaring it the “greatest Q2 for growth ever in T-Mobile US’s storied history.”

Check out the current price of TMUS stock here.

What Happened: The Un-carrier delivered record-setting postpaid net additions and significant financial gains, further cementing its position as a market leader.

When compared to AT&T Inc. (NYSE:T), T-Mobile continued to be the market share gainer in the telecom industry, adding more customers than AT&T for 23 quarters in a row.

The company also surpassed its goal of achieving 20% household market share in smaller and rural areas by 2025, demonstrating strong penetration beyond urban centers.

Adding to its robust financial outlook, T-Mobile anticipates a substantial $1.5 billion cash tax benefit in 2026 stemming from the recently enacted One Big Beautiful Bill, signed by President Donald Trump.

Executive Vice President and CFO Peter Osvaldik confirmed this benefit, stating it “will be deployed thoughtfully guided by our capital allocation philosophy.” This windfall provides incremental upside to the company’s previously laid out guidance.

Its Average Revenue Per Account (ARPA) growth exceeded 5%, the highest rate in eight years. This surge is partly due to customers increasingly opting for premium plans.

“Customers are loving our most premium tier within it more than ever. Selecting our new Experience Beyond plan at more than double the rate of Go5G Next just a year ago,” Sievert noted, highlighting a deliberate customer move towards higher-value offerings.

T-Mobile is also aggressively expanding its network, with plans to bring on nearly 4,000 greenfield sites this year and the UScellular acquisition set to close on Aug. 1st, expanding site coverage by one third and increasing capacity by 50% or more.

Why It Matters: T-Mobile reported better-than-expected revenue at $21.13 billion, beating the Street’s estimate of $20.98 billion and earnings of $2.84 per share, which beat the analyst consensus estimate of $2.68.

It now sees fiscal 2025 postpaid net customer additions between 6.1 million and 6.4 million, an increase from prior guidance of 5.5 million to 6 million. It also sees 2.95 million to 3.1 million postpaid phone net customer additions and approximately 100,000 fiber net customer additions.

Price Action: TMUS shares rose 0.29% on Wednesday and 5.16% in after-hours. The stock was up 6.56% year-to-date and 32.25% higher over the past year.

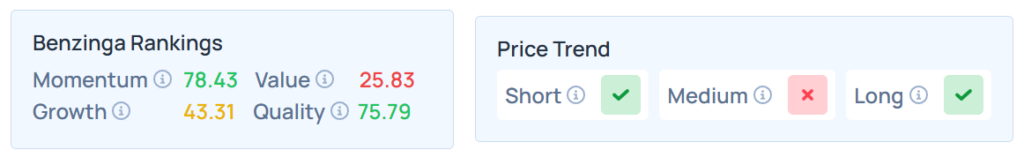

Benzinga Edge Stock Rankings show that TMUS had a stronger price trend over the short and long terms but a weaker trend over the medium term. Its momentum ranking was strong, but its value ranking was poor at the 25.83th percentile. The details of other metrics are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, ended higher on Wednesday. The SPY was up 0.85% at $634.21, while the QQQ advanced 0.46% to $563.81, according to Benzinga Pro data.

On Thursday, the futures of the Dow Jones, S&P 500, and Nasdaq 100 indices were trading mixed.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock