/Super%20Micro%20Computer%20Inc%20HQ%20photo-by%20Tada%20Images%20via%20Shutterstock.jpg)

Supermicro (SMCI), or Super Micro Computer, irked investors after it lowered its revenue outlook for the first quarter of fiscal 2026. The company, which provides high-performance servers and storage systems for artificial intelligence (AI) workloads, said that design win upgrades caused some expected revenue for the quarter to shift into the next one. As a result, management now expects Q1 revenue to reach about $5 billion, well below its earlier forecast of $6 to $7 billion.

The revised outlook points to a notable slowdown in growth for a company that has been benefiting from solid demand for its AI-optimized servers. In its most recent quarter, Supermicro reported $5.8 billion in revenue, up 7.4% year-over-year. However, that figure highlights a continued deceleration in the sales growth rate compared with earlier quarters. For instance, SMCI’s top line grew 19.5% in Q3, 54.9% in Q2, and 180.1% in Q1 of fiscal 2025.

With the new $5 billion forecast for Q1 fiscal 2026, Supermicro is now guiding for a year-over-year decline in sales as it generated $5.94 billion in the same quarter last year.

This pullback in sales could also squeeze the company’s profitability in the short term. Analysts now expect Supermicro’s earnings per share (EPS) to drop nearly 46.3% year-over-year to $0.36 in the first quarter, reflecting margin pressure amid slower revenue growth.

Supermicro’s Long-Term Story Still Intact

Despite the weak near-term forecast, there are still reasons for optimism. The company continues to see robust demand for its next-generation Blackwell Ultra systems, which integrate Nvidia’s (NVDA) latest architecture with Supermicro’s own cooling and design technologies. The company announced in September that it had begun volume shipments of its Blackwell Ultra systems, featuring both advanced air and direct liquid cooling (DLC) systems, designed to double compute network bandwidth and efficiency in large-scale AI training environments.

Encouragingly, Supermicro also announced design wins exceeding $12 billion, with many orders scheduled for delivery in the second quarter of fiscal 2026. Management emphasized that customer engagement for its new AI solutions is at record levels, with several large clients preparing for multi-quarter, high-volume deployments.

While the near-term guidance cut has pressured the stock, Supermicro’s long-term outlook remains compelling. The company reiterated its full-year fiscal 2026 revenue outlook of at least $33 billion, signaling confidence that delayed sales will ultimately flow through in later quarters.

Further, its customer base is also expanding. Notably, the number of large-scale rack clients has doubled from two in fiscal 2024 to four in fiscal 2025, with more expected in the year ahead. This momentum signals both growing demand and a strengthening sales pipeline.

Moreover, to address margin concerns, Supermicro is prioritizing higher-margin revenue streams across the enterprise, IoT, and telecom markets. The company has invested in developing tailored server and storage systems optimized for hybrid cloud, AI, and edge computing applications.

What’s Next for SMCI Stock?

Looking ahead, demand for AI-optimized servers and storage systems remains robust. To keep pace, Supermicro is expanding both its product lineup and manufacturing capacity, with particular emphasis on its Datacenter Building Block Solutions (DCBBS). These modular offerings streamline data center construction and are expected to see strong uptake. At the same time, the company is doubling down on cooling technologies. This dual focus positions Supermicro as a leading provider of high-performance computing solutions.

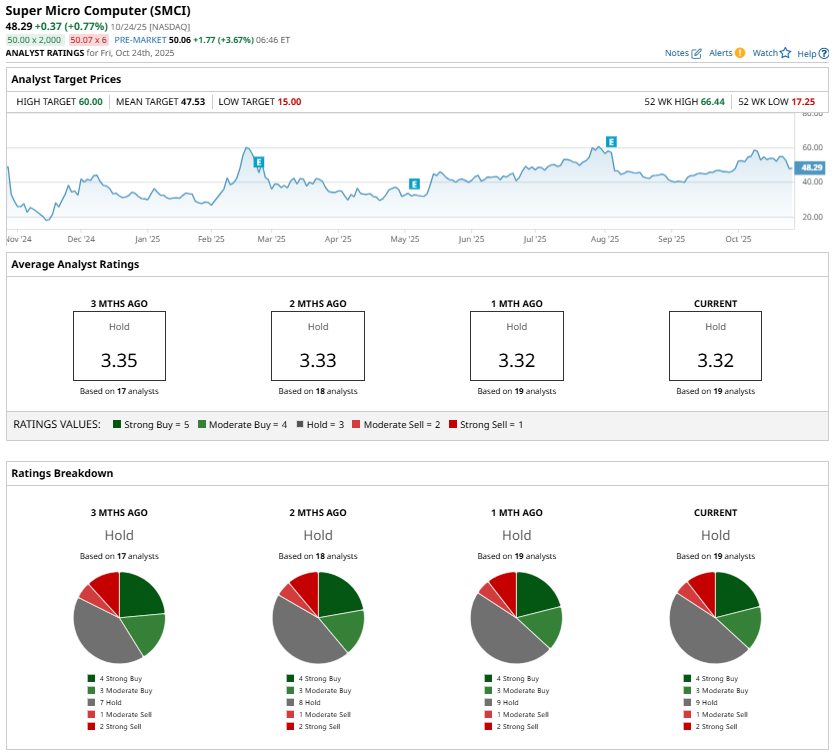

That said, competition in the AI hardware space is fierce, and near-term margin pressure remains a concern. Wall Street, for now, is taking a cautious stance and maintains a “Hold” consensus rating on SMCI stock.

However, for investors with a long-term outlook, the pullback in SMCI stock could be a buying opportunity. Supermicro’s product innovation, strong demand for AI-optimized servers, expanding customer base, and large deals position it well to deliver strong growth and drive its share price higher.