/Meta%20by%20creativeneko%20via%20Shutterstock.jpg)

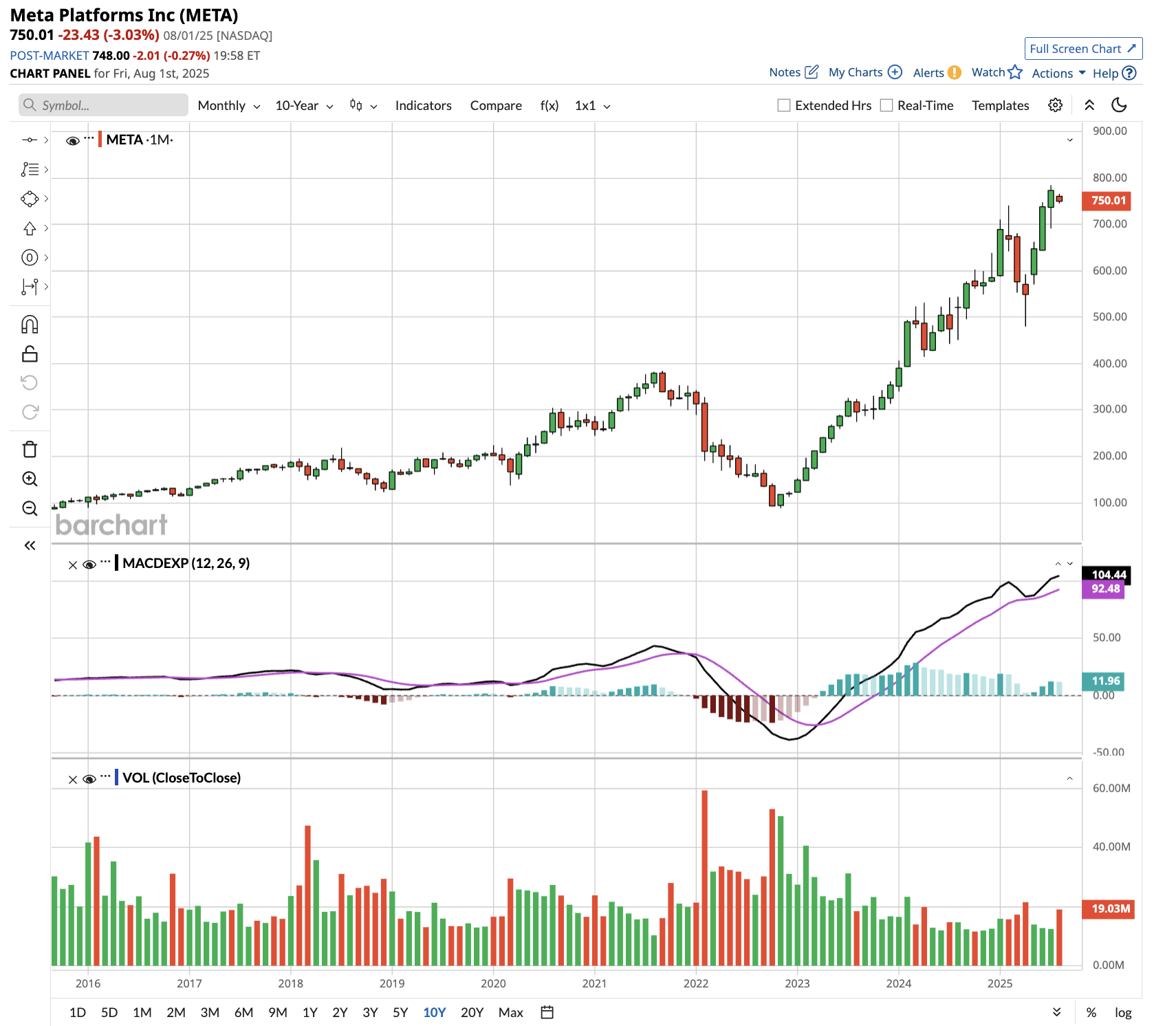

Last week, Meta Platforms (META) delivered stellar second-quarter results that sent META stock soaring 11.3% on Thursday, driven by CEO Mark Zuckerberg's ambitious vision of "personal superintelligence" and AI-powered advertising dominance.

In Q2 of 2025, Meta increased revenue by 22% to $47.52 billion, beating estimates of $44.80 billion. It reported an adjusted earnings per share of $7.14, compared to estimates of $5.92.

Zuckerberg credited artificial intelligence (AI) technology for unlocking "greater efficiency and gains across our ad system," with advertising revenue reaching $46.56 billion. Meta’s $15.1 billion investment in Scale AI signals a commitment to its superintelligence ambitions, with Zuckerberg stating that developing AI surpassing human intelligence "is now in sight."

Meta raised its capital expenditure guidance for 2025 to $66-72 billion, reflecting aggressive AI infrastructure expansion. The social media giant expects 2026 expense growth to exceed 2025 levels, driven by AI hiring and development costs. Management is also exploring partnerships with financial firms to co-develop data centers, suggesting even larger investments ahead.

Is Meta Platforms Stock a Good Buy Right Now?

Meta Platforms' latest earnings demonstrate how AI is revolutionizing user engagement across its entire ecosystem, while positioning it for long-term growth. Meta's AI-powered recommendation systems delivered engagement improvements across all platforms. Instagram video time surged over 20% year-over-year globally, while Facebook experienced similar gains, particularly in the U.S. market.

These improvements stem from advanced ranking system optimizations that identify relevant content for users, with AI systems now considering longer engagement histories to provide superior content selection.

Meta’s cross-platform approach is yielding compound benefits, with large language models (LLMs) driving meaningful engagement gains on Threads and helping reduce bug reports by 30% across Facebook Feed and notifications. Meta AI has achieved impressive scale with over 1 billion monthly active users, primarily driven by WhatsApp integration for tasks, including information gathering and image generation.

Meta is expanding AI integration across emerging product categories. Ray-Ban Meta glasses sales accelerated in Q2, with demand outstripping supply for popular models despite production increases. The launch of Oakley Meta HSTN glasses targets sports enthusiasts with enhanced battery life and camera resolution, demonstrating Meta's commitment to AI-powered wearable computing.

Management emphasized glasses as the optimal form factor for integrating superintelligence into daily life, enabling multimodal AI interactions through visual, audio, and conversational interfaces. Zuckerberg predicted that users without AI-enabled glasses will face significant cognitive disadvantages in future competitive environments.

Meta is cautiously expanding advertising surfaces while maintaining user experience quality. It introduced ads within Threads Feed and WhatsApp's Updates tab, though management expects a gradual rollout and lower initial pricing compared to core platforms. Business messaging revenue grew over 40% year-over-year in the U.S., driven by website-to-message advertising adoption.

Meta’s Advantage+ AI-powered advertising suite continues gaining traction, with nearly 2 million advertisers using video generation features. These tools particularly benefit smaller advertisers with limited creative resources, while agencies help larger brands apply AI strategically.

The Investment Case for META Stock

Strong advertising revenue growth, proven AI monetization, and massive market opportunity in superintelligence development position Meta stock favorably. An ability to translate AI investments into immediate revenue gains demonstrates execution capability.

However, Reality Labs continues to burn cash, with $4.53 billion in operating losses. Rising capital expenditures and expense growth could pressure margins if AI benefits don't scale proportionally. Meta's superintelligence bet appears to be paying dividends, but investors should weigh immediate gains against long-term investment risks.

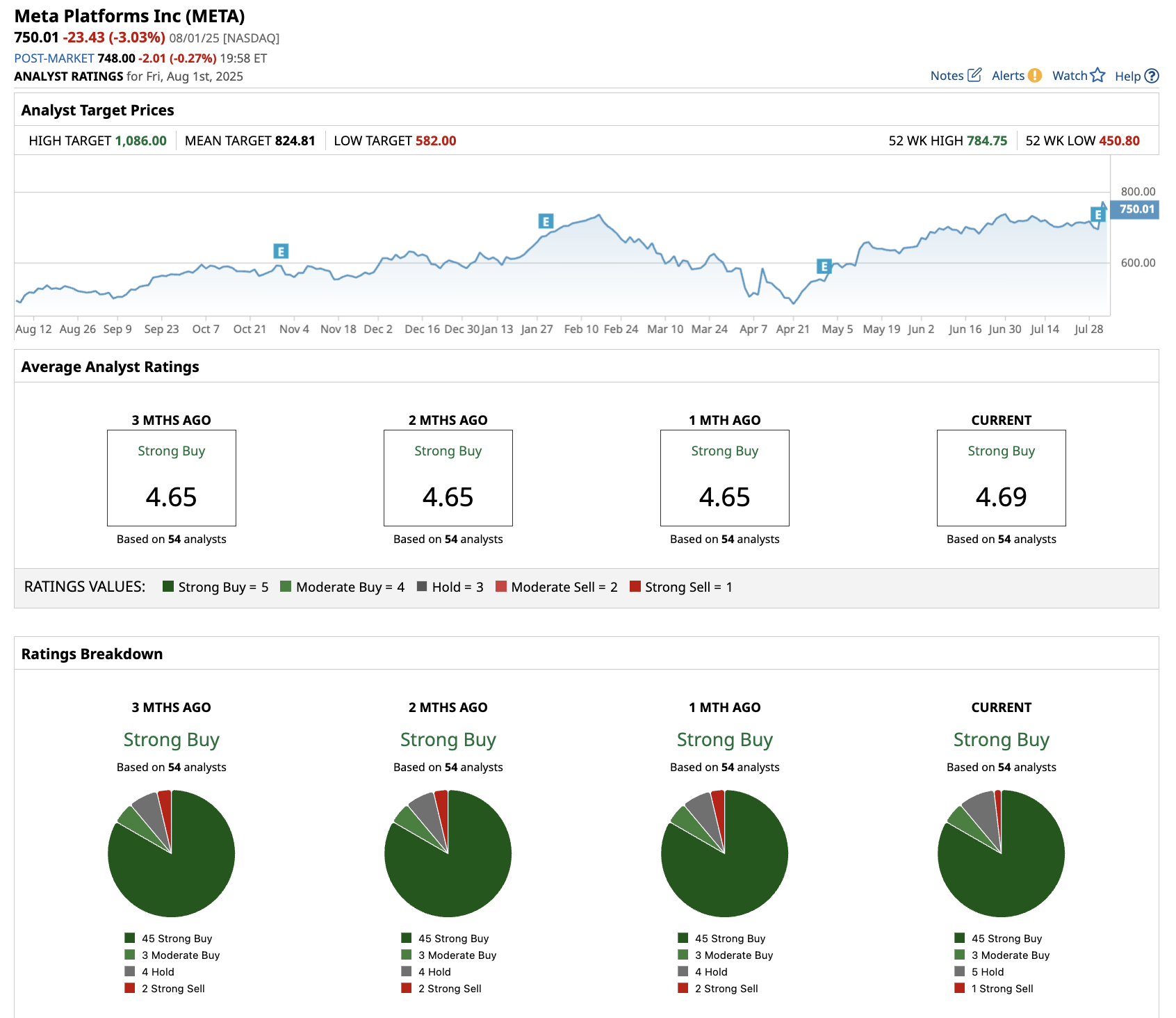

Out of the 54 analysts covering META stock, the overwhelming majority rate the stock a “Strong Buy,” and the average price target is $824, about 10% above current prices.