With a market cap of $145.9 billion, Stryker Corporation (SYK) is a global leader in medical technology. The company operates through its Orthopaedics and MedSurg & Neurotechnology segments, offering innovative products ranging from joint replacement implants to advanced surgical, neurovascular, and patient care solutions across more than 75 countries.

Shares of the Portage, Michigan-based company have underperformed the broader market over the past 52 weeks. SYK stock has increased 13.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14.5%. Moreover, shares of the company have risen 7.3% on a YTD basis, compared to SPX's 9.2% return.

Looking closer, Stryker stock has outpaced the Health Care Select Sector SPDR Fund's (XLV) 11.2% decrease over the past 52 weeks.

Despite Stryker beating expectations with Q2 2025 adjusted EPS of $3.13 and revenue of $6.02 billion on Jul. 31, shares fell 3.8% the next day as investors focused on weaker-than-expected Orthopedics sales of $2.3 billion, weighed down by a 97.2% decline in spinal implants.

For the fiscal year ending in December 2025, analysts expect SYK’s adjusted EPS to grow 10.8% year-over-year to $13.50. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

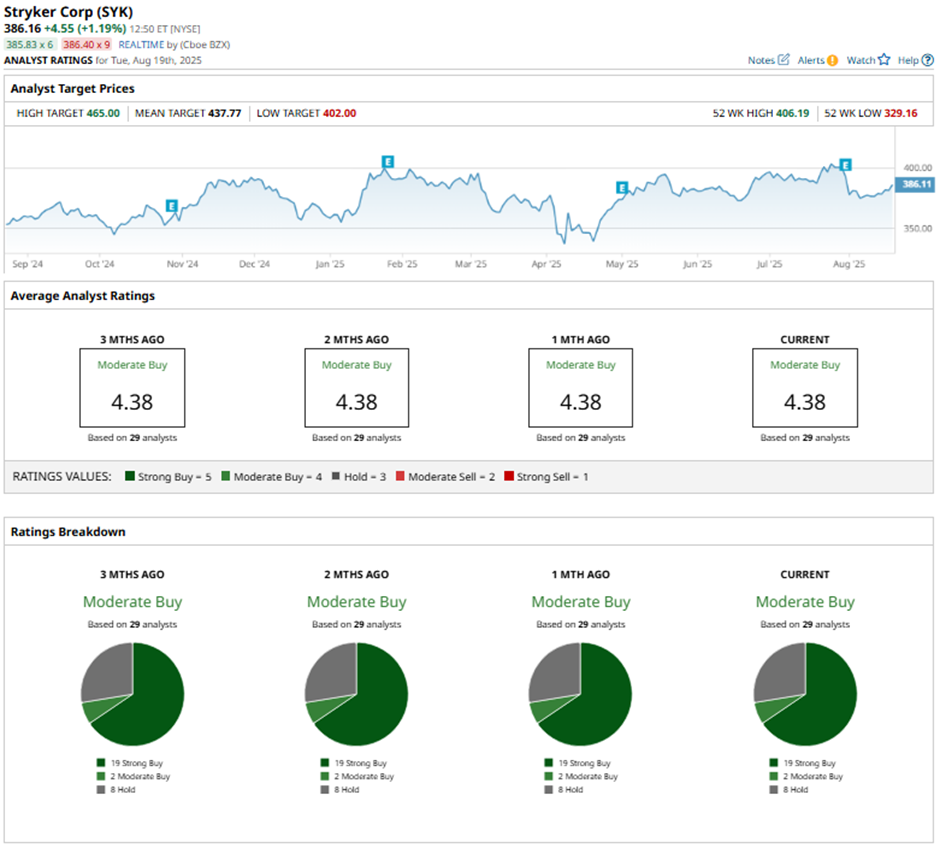

Among the 29 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 19 “Strong Buy” ratings, two “Moderate Buys,” and eight “Holds.”

On Aug. 1, UBS raised its price target on Stryker to $438 while maintaining a “Neutral” rating.

As of writing, the stock is trading below the mean price target of $437.77. The Street-high price target of $465 implies a modest potential upside of 20.4% from the current price levels.