You can't get rich simply by copying billionaires' moves, but there's still something irresistible about following their top stock picks.

The billionaires we're about to talk about have larger-than-life reputations when it comes to investing other rich people's money. Meanwhile, their resources for research, as well as their intimate connections to insiders and others, can give them unique insight into their stock picks.

Studying which stocks they're chasing with their capital can be an edifying exercise for retail investors. There's a reason the rich get richer, for one thing. But it's also helpful to see where billionaires sometimes make mistakes — at least in the short term.

No matter how successful they've been in the past, all investors are fallible. Those who've amassed multibillion-dollar personal fortunes have merely made more money being right than they've lost when getting it wrong.

Need proof? As Chairman and CEO Warren Buffett wrote in Berkshire Hathaway's 2022 annual report (PDF): "In 58 years of Berkshire management, most of my capital-allocation decisions have been no better than so-so. Our satisfactory results have been the product of about a dozen truly good decisions."

Berkshire's "satisfactory results" happen to be a stock that has generated compound annual growth of almost 20% since 1965. The S&P 500 delivered compound annual growth of not quite 10% over the same span.

Without further ado, here are five notable top stock picks from the billionaire class.

In each case, the billionaire below initiated a substantial position or added to an existing one in the third quarter. If you're wondering why megacap tech and communication services stocks have been rallying so hard, well, buying pressure on the part of billionaires is at least part of the equation.

Stake values and portfolio weights are as of September 30, 2025. Data courtesy of S&P Global Market Intelligence, YCharts, WhaleWisdom, Forbes and regulatory filings made with the Securities and Exchange Commission, unless otherwise noted. Stocks are listed by weight in the selected billionaire investor's equity portfolio, from smallest to largest.

- Billionaire investor: Steve Cohen (Point72)

- Stake value: $602 million

- Percent of portfolio: 0.7%

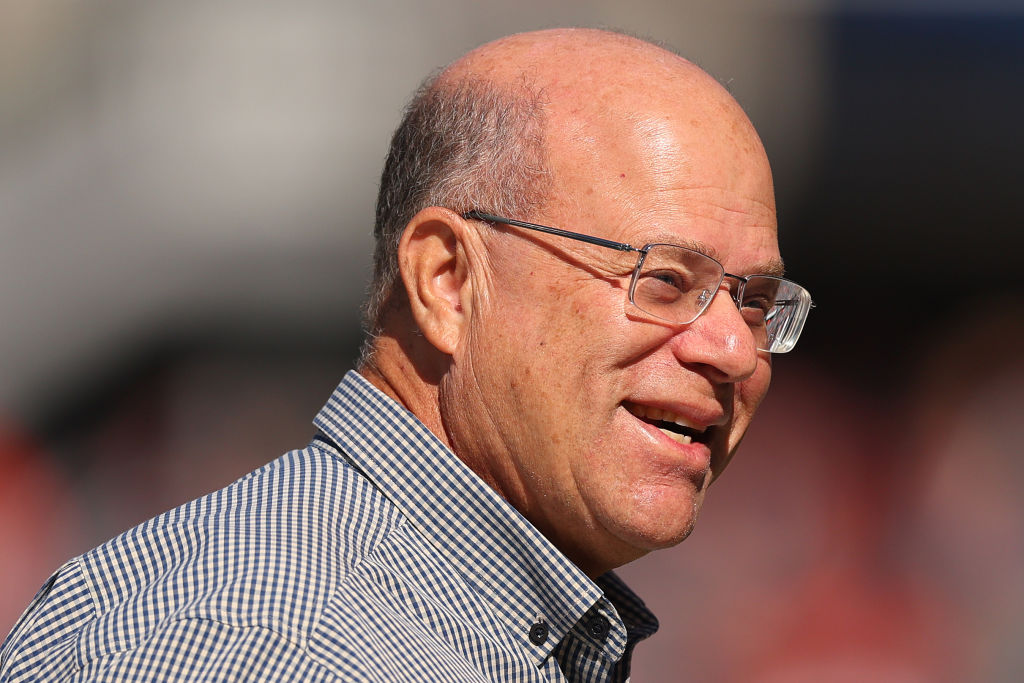

Steve Cohen is probably best known for using his estimated net worth of $21 billion to buy the New York Mets. But he's also known for adding to positions when stocks he already likes a lot are on sale.

Perhaps that's why his family office — Point72 Asset Management based in Stamford, Connecticut — upped its stake in Meta Platforms (META) when shares traded sideways in Q3.

Point72, with $221 billion in assets under management (AUM), bought another 611,420 shares in META – nearly a 300% increase – over the course of the third quarter, adding to a position the firm initiated in the second quarter of 2020.

With 819,325 shares worth $602 million as of the end of Q3, META stock leapfrogged into a top 10 holding. Previously, it was the fund's 59th-largest position.

Over the past three years, META generated an annualized return of more than 75%, easily outperforming the broader market's return of 20%.

- Billionaire investor: Daniel Sundheim (D1 Capital Partners)

- Stake value: $231 million

- Percent of portfolio: 2.7%

Daniel Sundheim's D1 Capital Partners made a name for itself during its seven years of existence. The New York hedge fund began trading with "only" $5 billion in capital. Today, D1 boasts nearly $28 billion in AUM.

Along the way, Sundheim built an estimated net worth of $2.6 billion, according to Forbes. In a nod to his precocious success, some wags called Sundheim the LeBron James of investing.

Shareholders surely hope Sundheim brings his scoring touch to D1's new position in Sea Limited (SE). The hedge fund initiated a stake in the Singapore-based online gaming, shopping and financial services company in Q3.

With 1.3 million shares worth $231 million as of September 30, SE is among Sundheim's top 20 holdings. Sadly, SE is off 27% over the past three months vs a 4% rise in the broader market.

- Billionaire investor: Stephen Mandel (Lone Pine Capital)

- Stake value: $511.2 million

- Percent of portfolio: 3.7%

It should come as no surprise that yet another billionaire investor initiated yet another big bet on a mega-cap tech stock in Q3. After languishing during the market's spring rout, shares in Broadcom (AVGO) are beating the broader market wide a margin in the second half of 2025.

Stephen Mandel picked up more than 1.5 million shares in the chipmaker in Q3. Mandel amassed an estimated net worth of $2.5 billion by knowing how to spot momentum, so count this as encouraging news for AVGO bulls.

Mandel's Lone Pine Capital hedge fund ($20.1 billion AUM) now owns a stake in AVGO worth more than half-a-billion dollars as of September. At 3.7% of the portfolio, Broadcom is the fund's 13th-largest holding.

Meanwhile, shares are up 18% over the past three months vs a 4% gain for the broader market.

- Billionaire investor: David Tepper (Appaloosa)

- Stake value: $354.5 million

- Percent of portfolio: 4.8%

Nvidia (NVDA) was well on its way to becoming the first company to top $5 trillion in market cap when David Tepper once again added to his hedge fund's position in the third quarter.

The owner of the NFL's Carolina Panthers accumulated an estimated net worth of $23.7 billion in part by knowing how to ride a hot hand. His Appaloosa hedge fund (AUM $17.8 billion) boosted its stake in the chipmaker in Q3 by nearly 9%, or 150,000 shares.

Appaloosa, which has owned NVDA since early 2023, now holds 1.9 million shares worth nearly $355 million as of the end of the third quarter. With a weight of 4.8%, Nvidia is Tepper's fourth-largest position, up from No. 7 in the previous quarter.

- Billionaire investor: Philippe Laffont (Coatue Management)

- Stake value: $2.4 billion

- Percent of portfolio: 5.9%

Philippe Laffont built an estimated net worth of $7.9 billion partly by knowing how to stick with winners. Such skills were on display when Laffont's Coatue Management hedge fund (AUM $69.5 billion) increased its stake in Microsoft (MSFT) by another 18% in Q3.

Coatue, which has owned MSFT since the third quarter of 2021, held 4.6 million shares worth $2.4 billion as of September 30, according to regulatory filings. With a portfolio weight of 5.9%, MSFT is the New York hedge fund's second-largest position.

If nothing else, Laffont finds himself in good company. Not only is Microsoft one of the most popular blue chip stocks among hedge funds, but it also gets the highest consensus recommendation of all 30 Dow Jones stocks.

It also doesn't hurt that MSFT has done extraordinary things for truly long-term shareholders. Anyone who put $1,000 into MSFT stock a couple of decades ago has clobbered the S&P 500 by a wide margin.