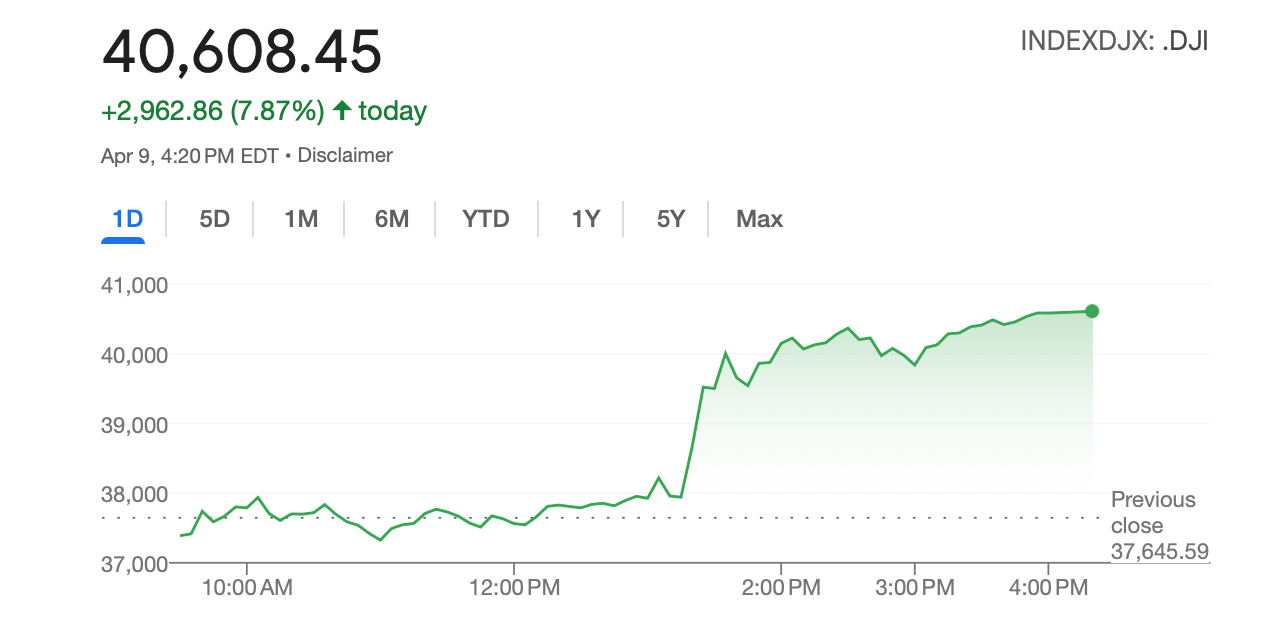

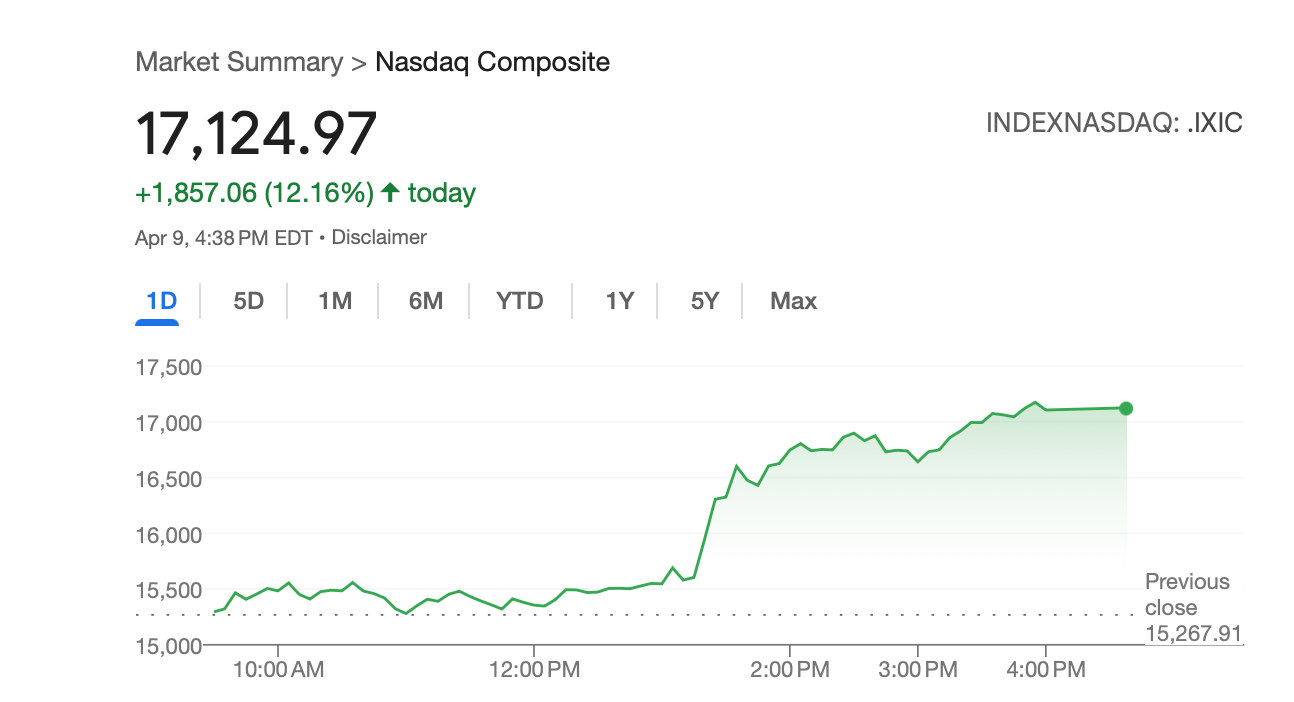

Stock markets surged after President Donald Trump announced a pause on most of his sweeping tariffs, with both the Dow Jones and the NASDAQ breaking records for the largest point gains in a single day.

The stock markets closed with massive gains after Trump announced the change in his tariff plan. At close, the Dow soared 2,962 points, while the NASDAQ surged 1,857 points, marking the largest single-day point gains for both indices. The S&P 500 also closed up 9.5 percent for one of its best days since 2008.

The president announced the decision in a Wednesday Truth Social post.

“Based on the fact that more than 75 Countries have called Representatives of the United States, including the Departments of Commerce, Treasury, and the USTR, to negotiate a solution to the subjects being discussed relative to Trade, Trade Barriers, Tariffs, Currency Manipulation, and Non Monetary Tariffs, and that these Countries have not, at my strong suggestion, retaliated in any way, shape, or form against the United States, I have authorized a 90 day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately,” he wrote.

Trump also raised China’s tariffs to 125 percent “effective immediately” due to the country’s “lack of respect” for the world’s markets.

One week ago, on what he dubbed “Liberation Day,” Trump unveiled his sweeping tariff plan, imposing an across-the-board tax on all imported goods purchased by Americans in order “to help rebuild our economy and to prevent cheating.”

Ignoring droves of experts who warned against levying these taxes, the president declared “Liberation Day” will “forever be remembered as the day American industry was reborn, the day America's destiny was reclaimed, and the day that we began to make America wealthy again.” Now, he paused most of those plans after the stock markets tumbled the last few days.

Discussing investors’ fears, Trump said at a Wednesday press conference: “I thought that people were jumping a little bit out of line. They were getting yippy, you know, they were getting a little bit yippy, a little bit afraid.”

Earlier this week, when pressed about whether he was considering pausing the tariffs before they took effect, the president said: “We’re not looking at that.”

Over the weekend, Commerce Secretary Howard Lutnick insisted to CBS’ Face the Nation: “There is no postponing. They are definitely going to stay in place for days and weeks.”

Democrat and California Sen. Adam Schiff questioned the mixed signals over the past few weeks. “Trump is creating giant market fluctuations with his on-again, off-again tariffs. These constant gyrations in policy provide dangerous opportunities for insider trading,” he wrote on X on Wednesday. “Who in the administration knew about Trump's latest tariff flip flop ahead of time? Did anyone buy or sell stocks, and profit at the public’s expense? I'm writing to the White House — the public has a right to know.”

Some analysts warned the celebration around Wednesday’s rallies could be short-lived.

“This allows for at least a near-term rally, but I would not assume that the bottom has been put in place,” Sam Stovall, chief investment strategist at CFRA Research, told CNBC. “Fool me once shame on you; fool me five times, shame on me.”

Bolvin Wealth Management Group’s president Gina Bolvin told Reuters: "This pause may provide companies with a clearer backdrop for their guidance, offering some relief to a market hungry for direction."However, uncertainty looms over what happens after the 90-day period, leaving investors to grapple with potential volatility ahead."

The markets’ swift change in direction comes after last week ended in a stock market bloodbath. On Friday, the Dow Jones closed down 2,231 points, marking the worst week for the stock market since 2020, and only the fourth time in history that the Dow lost 2,000 points in a single day.

“The bull market is dead, and it was destroyed by ideologues and self-inflicted wounds,” Emily Bowersock Hill, CEO and founding partner at Bowersock Capital Partners, told CNBC on Friday.

One day earlier, the NASDAQ broke a record, dropping 1,050 points for its largest one-day drop in the market’s 50-year history. Still, the president remained confident, predicting outside the White House last Thursday: “The markets are going to boom.”

Trade war latest: Trump pauses reciprocal tariffs but hikes duties on China to 125%

Laura Loomer is pitching her new opposition research firm to White House officials

Trump’s tariff pause won’t help these small businesses that are already hurting

Mike Johnson calls budget vote despite Republican fury over Medicaid cuts and deficit

The billionaire friends of Trump who spoke out against his tariff plan

Trump’s chaotic U-turn sees 90-day pause on tariffs – except for China