Jeep, Chrysler owner Stellantis NV (NYSE:STLA) shared the financial results for the first half of 2025 as President Donald Trump's tariffs impacted the automaker's sales.

Check out the current price of STLA stock here.

What Happened: The company posted a revenue of €74.3 billion ($85.7 billion), down 13% YoY since H1 2024, Stellantis said in a press release published on Tuesday.

The company also updated its tariff impact to €1.5 billion ($1.73 billion) and posted a net loss of €2.3 billion ($2.66 billion). "The Company remains highly engaged with relevant policymakers, while continuing long-term scenario planning," Stellantis said.

In North America, net revenue was down 23%, which, the company says, happened due to production gaps caused by the Trump administration's tariffs on the auto industry. Sales were down in Europe as well for Stellantis, but the company experienced growth in South America.

"2025 is turning out to be a tough year, but also one of gradual improvement. Signs of progress are evident when comparing H1 2025 to H2 2024, in the form of improved volumes, Net revenues, and AOI, despite intensifying external headwinds," CEO Antonio Filosa said in the press release.

The company plans to launch over 10 new models in 2025 across multiple brands in the second half of the year. Stellantis also saw a 5% increase in shipments and posted total liquidity of €47.2 billion ($54.5 billion)

Why It Matters: The news comes as Stellantis has had a troubled 2025, with the company earlier saying that it expected a $2.7 billion loss in H1 2025 amid uncertainty in the auto industry due to the tariffs.

Stellantis to move some production of pickup trucks away from Mexico and into Michigan as the automaker explored ways to offset the impact caused by Trump's tariffs.

Shares of the company also fell by over 7% recently as European sales declined 12.3% YoY in June. Stellantis also scrapped the planned development of Hydrogen fuel cell technology due to a lack of incentives and no mid-term growth.

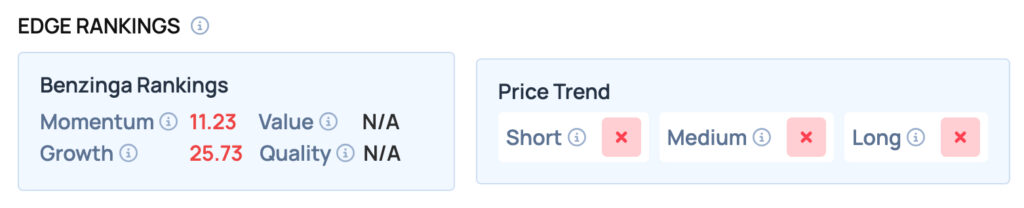

Stellantis offers poor Momentum and Quality and offers satisfactory Growth, but scores well on the Value metric. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: rikstock / Shutterstock.com