RAM, Jeep parent company Stellantis NV‘s (NYSE:STLA) CEO Antonio Filosa says the automaker supports President Donald Trump's tariff strategy at the company's Q2 earnings call.

Check out the current price of STLA stock here.

What Happened: "Since day 1, we understand and we support the general strategy of President Trump’s administration, to boost job creation and U.S. production," Filosa said at the earnings call with investors on Tuesday.

The comments follow Stellantis’ release of its H1 2025 financial results recently, which saw the company’s revenue go down by 13% and an updated tariff impact of $1.7 billion in the second half of the year.

Filosa added that the company was also in talks with authorities in the U.S., Mexico, as well as Canada regarding the tariff situation. Filosa also outlined that Stellantis aims to highlight the high U.S. content in its vehicles.

"We would like to request to properly recognize the high U.S. content in some vehicles," he said, adding that the U.S. auto industry sees over 16 million units sold annually, half of which are produced locally, while 4 million arrive from the U.S.’s neighbors.

"4 million are built in Mexican and Canadian plants, but they use a lot of components coming from U.S. suppliers. So also those units carry a lot of U.S. content," Filosa said, while the remaining vehicles are imported from Europe and Asia with “virtually zero U.S. content.”

The CEO also said that the company "salutes" the range of options introduced by the U.S. government on tariffs for Mexico and Canada, including the expanded U.S. content in the vehicles.

Why It Matters: The automaker also recently outlined that it was expecting a loss of over $2.7 billion in H1 2025 amid uncertainty in the auto industry due to the tariffs imposed by the Trump administration.

Stellantis' European sales also fell by over 12.3% in June when compared to the same period last year, resulting in a 7% fall in the company's stock.

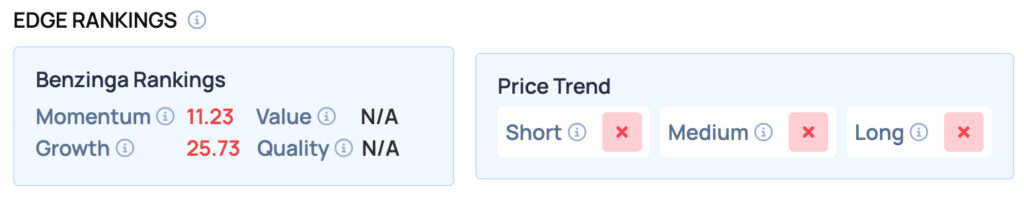

Stellantis offers poor Momentum and Quality and offers satisfactory Growth, but scores well on the Value metric. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga's Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: rikstock / Shutterstock.com