/State%20Street%20Corp_%20logo%20on%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $31.5 billion, State Street Corporation (STT) is a leading financial holding company serving institutional investors worldwide. Through its subsidiaries, it provides investment servicing, investment management, trading, data, and analytics solutions to mutual funds, retirement plans, insurance companies, investment managers, foundations, and endowments.

The Boston, Massachusetts-based company's shares have outperformed the broader market over the past 52 weeks. STT stock has surged 37.2% over this time frame, while the broader S&P 500 Index ($SPX) has increased 14.9%. In addition, shares of the company are up 13.3% on a YTD basis, compared to SPX’s 9.6% gain.

Looking closer, shares of State Street have also outpaced the Financial Select Sector SPDR Fund’s (XLF) 19.6% return over the past 52 weeks.

Despite beating estimates with Q2 2025 adjusted EPS of $2.53 and revenue of $3.45 billion versus $3.38 billion expected, STT shares fell 7.3% on Jul. 15. Adjusted expenses rose 6.3% year-over-year, provisions for credit losses tripled to $30 million, and net interest income declined due to lower rates and an unfavorable deposit mix, leading to a 17-basis-point drop in net interest margin.

For the fiscal year ending in December 2025, analysts expect STT’s adjusted EPS to grow 13.6% year-over-year to $9.85. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

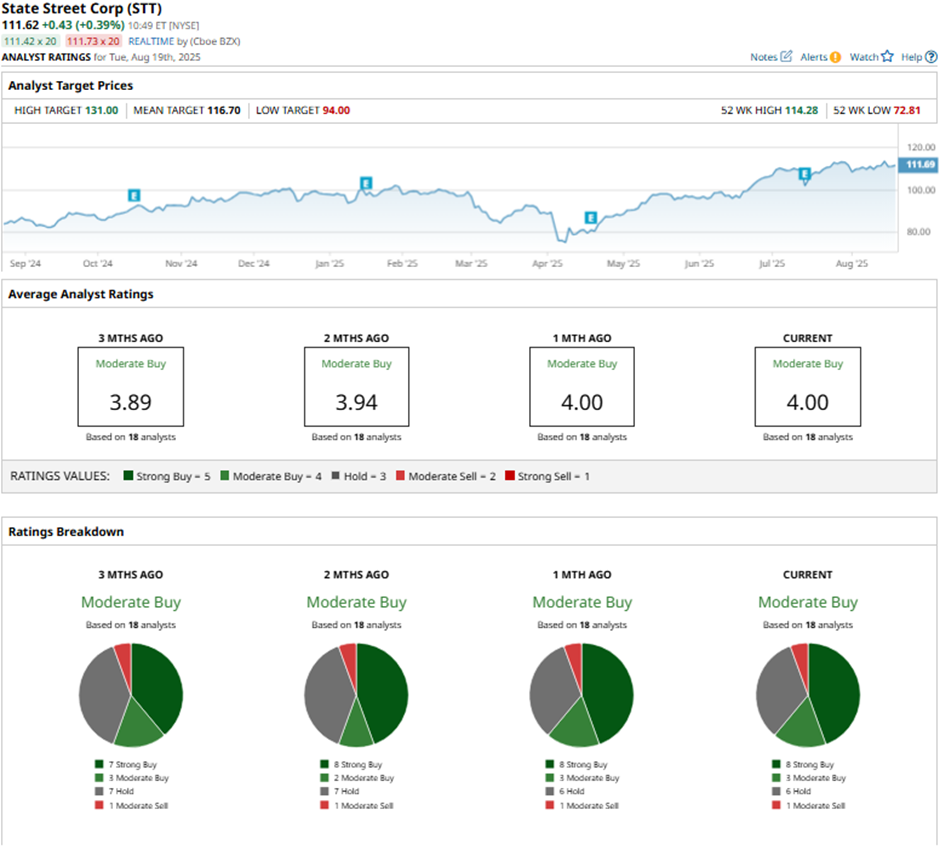

Among the 18 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, three “Moderate Buys,” six “Holds,” and one “Moderate Sell.”

On Aug. 14, Truist raised its price target on State Street to $125 with a “Buy” rating.

As of writing, the stock is trading below the mean price target of $116.70. The Street-high price target of $131 implies a potential upside of 17.4% from the current price levels.