Editor's Note: This article has been updated to include a statement from a Starbucks spokesperson.

When Brian Niccol took the reins at Starbucks Corp. (NASDAQ:SBUX) last September, he inherited several problems. Competition was growing, and consumers ditched pricey lattes for cheaper beverages.

By then, shares in the world’s largest coffee chain had lost a quarter of their value since his predecessor, Laxman Narasimhan, took the helm.

Niccol has since sought to rebuild the business through the “Back to Starbucks” initiative, which includes a series of major policy changes intended to improve the customer experience and return Starbucks to its glory as the “third place” customers spend time, other than at home and work. The company has already seen two rounds of sweeping layoffs and the closure of hundreds of stores as part of it.

Still, the stock tells a tougher story. Shares have lagged broader markets, slipping into a gradual decline that suggests investors still have doubts.

Protein Add-On, Green Apron Initiative Doing Well

In an interview on Wednesday with “Mad Money” host Jim Cramer, Niccol said the protein add-on options and the “Green Apron Service”, which is focused on enhancing customer service, were delivering strong results.

“We had a great start,” Niccol said, adding that the company was ahead of schedule on its turnaround plan.

Starbucks’ comeback campaign has encompassed everything from the dress code for baristas to streamlining the menu and overhauling the mobile ordering system, as competition grows. Its China business has been particularly hard hit, with domestic players like Luckin Coffee Inc. (OTC:LKNCY) taking off. Luckin opened its first store in the U.S. this year.

What Is Starbucks China Upto?

Starbucks China expects the value of the business to be about $10 billion, including the upfront investment by a potential partner, CNBC reported, adding that the company will retain a stake in the business and future royalty payments.

“We've had very strong interest from multiple, high-quality partners all of whom share our confidence in the long-term growth potential of Starbucks in China. Five bidders recently provided bids, and we are in the process of evaluating those. They all see significant value in the Starbucks brand, the business momentum, and our talented team,” a Starbucks spokesperson told Benzinga.

Carlyle and Boyu Capital have emerged as the leading contenders to acquire a majority stake in Starbucks’ China business, according to the Financial Times report on Thursday.

While China is still Starbucks' second-largest market behind the United States, growth has stalled. The company has over 7,500 stores in the country, according to its website, and annual sales from the region account for about $3 billion, or 8% of sales.

Shares Make A Bitter Brew

Since Niccol became CEO, shares have fallen about 9% to date. Investors appear to be waiting for proof that he can replicate his Chipotle (NYSE:CMG) playbook, where annual sales at the burrito chain surged and the stock tripled under his leadership.

For now, Niccol told Cramer: “The stock will take care of itself.”

The last three sessions have been in the green for Starbucks, on the back of a broader market rebound. Shares have fallen by over 10% so far this year.

The company is scheduled to report fiscal fourth-quarter earnings on Oct. 29, with analysts expecting earnings per share of 57 cents on revenue of $9.37 billion, according to Benzinga Pro data.

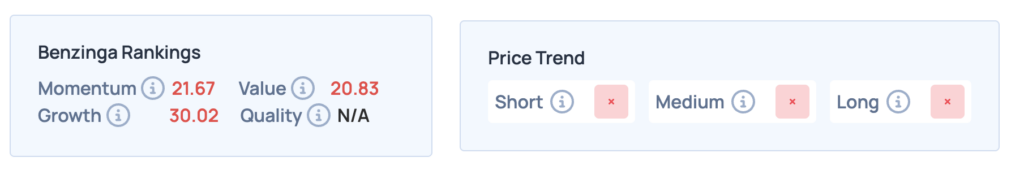

Benzinga’s Edge Rankings show poor scores in the stock’s Momentum, Value, and Growth, and the price trend is negative across short, medium, and long terms.

However, the consensus rating on the stock is “outperform”, with an average price target of $100.89, based on 29 analysts tracked by Benzinga.

Read Next:

Image via Shutterstock