/Cybersecurity%20by%20AIBooth%20via%20Shutterstock.jpg)

Almost a year to the day after a global Windows outage that rocked companies from Delta Air Lines (DAL) to local hospitals, Microsoft (MSFT) once again jumped into the headlines for an enterprise-level security breach. Attacks beginning on July 18 exploited a critical zero-day vulnerability across dozens of systems hosted on SharePoint servers worldwide, affecting organizations that included U.S. government agencies - and once again, underlining the importance of reliable cybersecurity across organizations of all sizes and sectors.

Against this backdrop, here's a top cybersecurity stock for investors to consider now.

About CyberArk Stock

Established in 1999, CyberArk Software (CYBR) is a company that helps organizations stay safe by controlling who can access critical information and systems. CyberArk is recognized for its tools that safeguard sensitive accounts against both internal and external threats. Their main services include managing special accounts with high-level access, monitoring what those users do, and making sure companies follow security rules. Israel-based CyberArk’s products are used by banks, hospitals, and governments to guard passwords, oversee users with extra privileges, and automate identity management in both traditional and cloud-based systems.

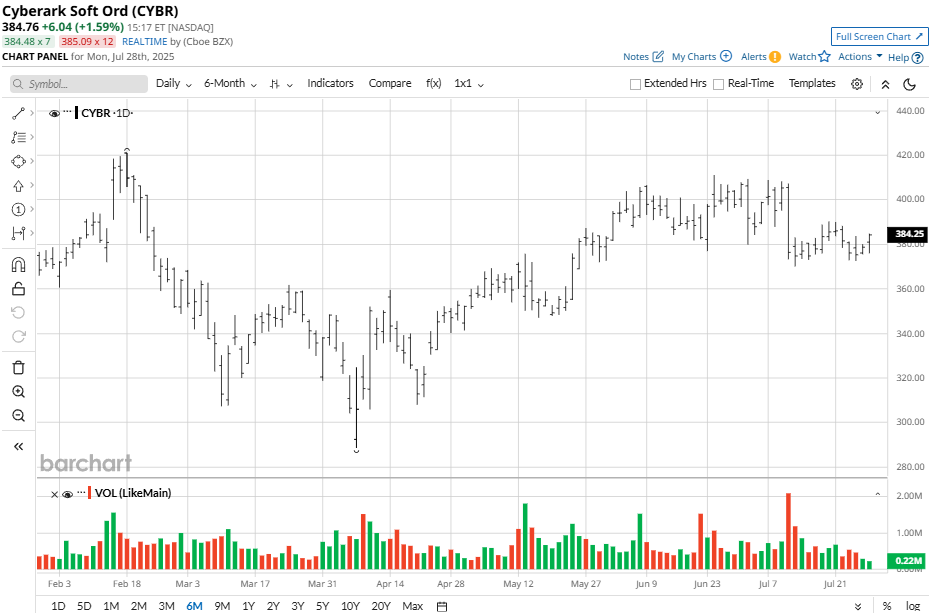

CyberArk Software’s stock has gained about 15% year-to-date and around 49% over the past 52 weeks, and is currently down about 9% from its 52-week high, set in February. Compared to the benchmark S&P 500 Index ($SPX), CyberArk has significantly outperformed the broader market over the past year.

CyberArk Exceeds Expectations

CyberArk Software delivered an impressive first quarter for 2025, posting revenue of $317.6 million, up 43% from the prior year and exceeding analyst expectations of $305.7 million. The company reported adjusted earnings per share (EPS) of $0.98, surpassing the consensus estimate of $0.79 per share. This strong performance reflects robust customer demand for its identity security offerings and ongoing adoption of its subscription platform.

Annual recurring revenue (ARR), a key metric for CYBR, jumped 50% year-over-year to reach $1.215 billion. Subscriptions rose by 65% to $1.028 billion, and are now 85% of total ARR. Free cash flow reached $96 million (30% margin), a sharp rise from $68.6 million a year ago. Non-GAAP operating margin improved to 18% from around 15%.

As of March 31, CyberArk had $776.1 million in cash and equivalents. Operating cash flow for the quarter was $98.5 million, up from $68.6 million in Q1 2024.

Management raised its full-year 2025 forecast, and now expects revenue of $1.313–$1.323 billion, with ARR projected at $1.410–$1.420 billion, implying more than 21% annual growth. The company also anticipates non-GAAP operating income of $221–$229 million and adjusted EPS of $3.73–$3.85 for the year, reflecting confidence in sustained demand for its cybersecurity solutions.

Why is CyberArk a Top Pick?

In the wake of the recent Microsoft SharePoint exploit that underscored growing threats to enterprise identity and access systems, analysts and industry experts highlight CyberArk as a key beneficiary of rising security incidents. That positive outlook is based on CYBR's strong financial performance, robust growth in recurring revenues, and continued innovation in identity security. As organizations seek resilient protection amid new exploit waves, CyberArk offers a proven, holistic defense for mission-critical infrastructure, making it attractive for both security and portfolio resilience.

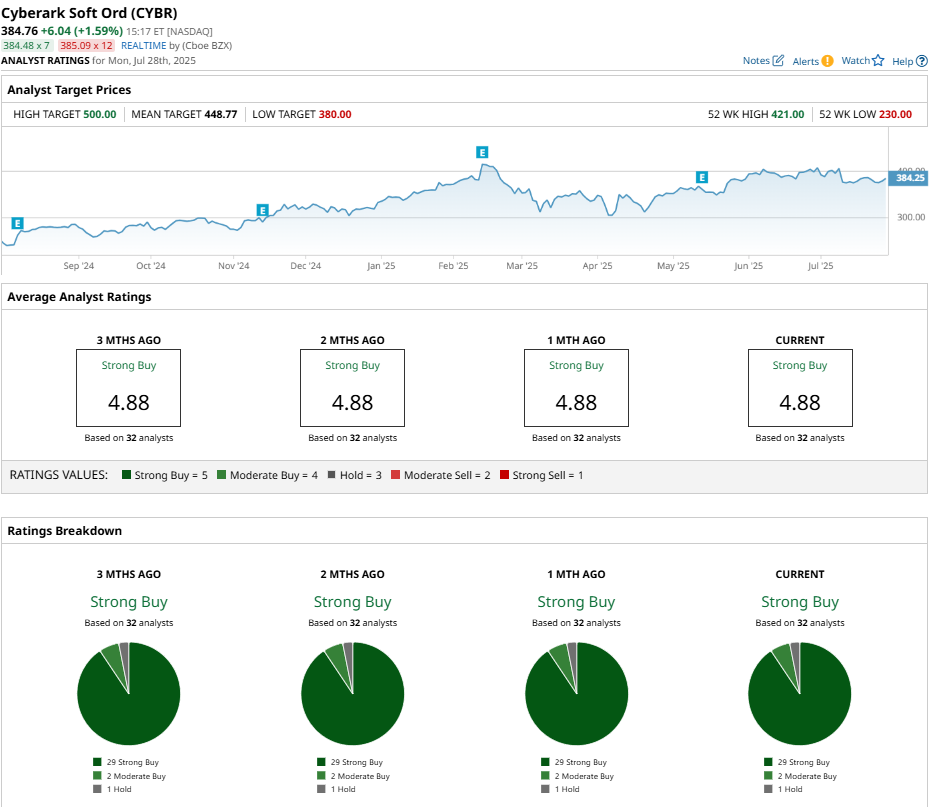

Based on consensus analyst opinions tracked by Barchart, CyberArk Software is the top-rated cybersecurity stock pick. With 32 analysts in coverage, the average opinion is a “Strong Buy” rating, with only 1 “Hold” and zero “Sell” ratings.

This bullish group carries a mean price target for CYBR stock of $448.77, reflecting an expected upside potential of 17.2% from Monday's closing price.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.