/A%20corporate%20sign%20for%20SoundHound%20by%20Tada%20Images%20via%20Shutterstock.jpg)

SoundHound (SOUN) stock rallied over 10% on Tuesday after the voice artificial intelligence (AI) company teamed up with one of the world’s largest seafood restaurant chains, Red Lobster.

This partnership will introduce automated phone ordering across all Red Lobster location, reducing the overall workload for restaurant staff and improving customer experience.

Following today’s surge, SoundHound stock is up some 180% versus its year-to-date low in April.

Significance of Red Lobster Deal for SoundHound Stock

Investors are cheering the Red Lobster announcement this morning primarily because it validates SOUN’s enterprise strategy.

It serves as a strong proof-of-concept for SoundHound’s voice AI technology, demonstrating its scalability and effectiveness in a real-world commercial setting.

According to the company’s press release, its solution “is trained on Red Lobster’s full menu” and is built to ensure every incoming call is handled even during peak hours.

The Red Lobster deal validates SoundHound’s business model and could help attract other large restaurant chains seeking to automate their operations.

In short, this partnership improves SoundHound’s visibility, setting the stage for broader adoption and long-term upside in SOUN stock.

The Case for Looking Beyond Valuation in SOUN Shares

Teaming up with Red Lobster further dilutes the valuation overhang on SoundHound shares.

At 78x sales, they’re super expensive to own at current levels, but a whopping 217% year-over-year increase in revenue in the latest reported quarter still warrants owning them for the long term.

Plus, the Santa Clara-headquartered firm currently has nearly $250 million in cash and no debt on its balance sheet, indicating ample firepower to aggressively expand across industries.

With renowned names like Chipotle (CMG) and Papa Johns (PZZA) as customers and over 280 patents in total, SOUN shares sure have a defensible edge within the conversational artificial intelligence market.

This makes them worth the premium for long-term investors.

How Wall Street Recommends Playing SoundHound in 2025

Wall Street analysts, however, continue to focus on the stretched multiple on SoundHound stock.

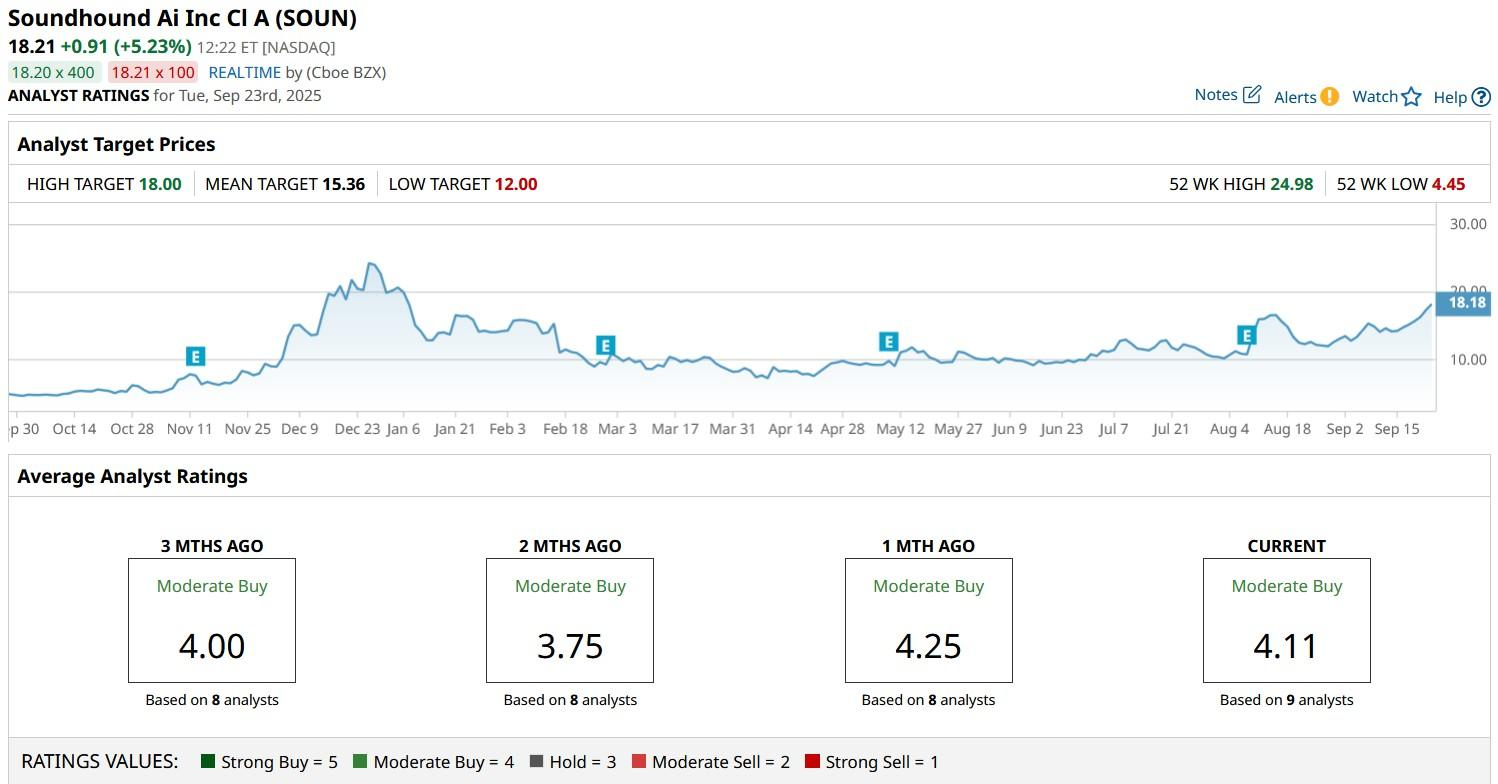

According to Barchart, the consensus rating on SOUN shares remains at “Moderate Buy” but the mean target of about $15.36 suggests potential downside of nearly 20% from here.