SoFi Technologies Inc (NASDAQ:SOFI) shares are falling Tuesday, experiencing a pullback after a rally that pushed the stock to a new 52-week high on Monday. The stock is currently trading down as investors appear to be taking profits ahead of this week’s Federal Reserve meeting.

What To Know: On Monday, shares surged on investor optimism that policymakers could deliver a 25-basis-point interest rate cut. This speculation intensified after recent data showed jobless claims rising to their highest level since 2021, suggesting a cooling labor market that may prompt the Fed to ease monetary policy.

For SoFi, lower interest rates are seen as a significant tailwind, potentially spurring demand for its personal, student and home loans while also reducing the company’s cost of funds.

The fintech company’s stock has climbed some 10% over the past month and 90% on a year-to-date basis on the prospect of a more favorable lending environment. Tuesday’s downturn suggests some consolidation as Wall Street awaits the central bank’s official announcement on rates, which will set the near-term trajectory for financial stocks.

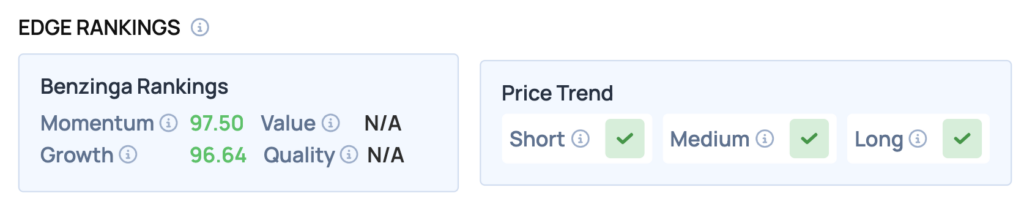

Benzinga Edge Rankings: Underscoring the stock’s powerful recent performance, SoFi carries an exceptional Momentum score of 97.50 from Benzinga Edge rankings.

Price Action: According to data from Benzinga Pro, SOFI shares are trading lower by 2.11% to $27.08 Tuesday. The stock has a 52-week high of $27.88 and a 52-week low of $7.57.

Read Also: Rocket Lab Stock Is Sliding Tuesday: Here’s Why

How To Buy SOFI Stock

By now you're likely curious about how to participate in the market for SoFi Technologies – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of SoFi Technologies, which is trading at $26.72 as of publishing time, $100 would buy you 3.74 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock