SoFi (SOFI) stock has never been for the faint-hearted, given its volatility and periods of deep drawdowns that can test the patience of even the most hardened investors. The stock has a beta of 1.92x, which implies that it is nearly twice as volatile as the broader markets.

SoFi, which went public in 2021 by merging with one of Chamath Palihapitiya’s special purpose acquisition companies (SPACs), reached its all-time low of $4.24 in December 2022. As investors would recall, that year, U.S. stock markets, particularly growth and tech stocks, plunged. Loss-making names, which SoFi was back then, bore much of the brunt as investors shunned such companies amid tightening capital market conditions following the Federal Reserve’s rate-hiking spree.

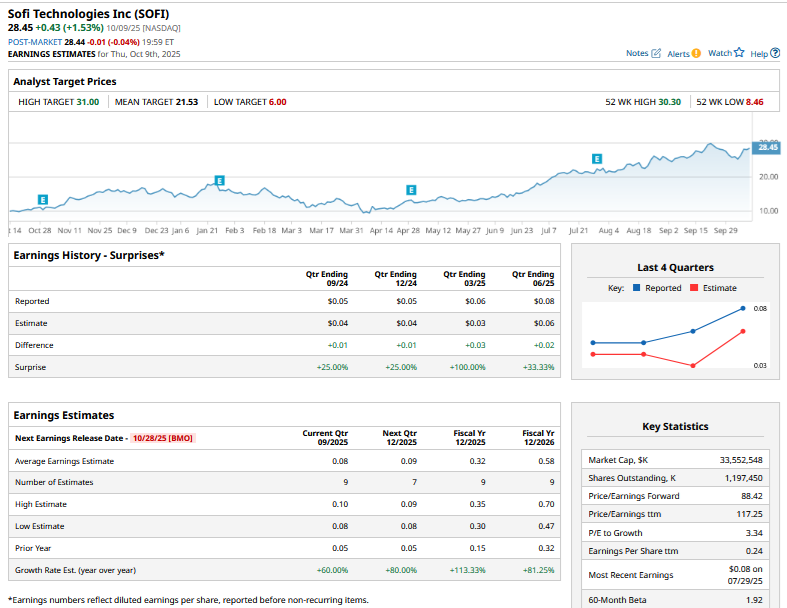

SoFi Stock Has Been Quite Volatile

The rally in SoFi stock has been as spectacular as the crash, and it rose 116% in 2023 and another 55% last year. 2025 is turning out to be another stellar year for the fintech company, and it is up nearly 80% for the year.

However, it hasn’t been a one-directional move, and SoFi has been particularly volatile this year. The stock bottomed at $8.60 in April amid the tariff chaos and has since risen by over 220%. While short-term trading has never been my forte, I believe SoFi stock provides a lot of opportunities for short-term trades given its volatile nature.

SoFi Is a Fundamentally Strong Stock

To begin with, while I have traded SoFi several times and used the rallies to exit while capitalizing on dips to add more shares, I am a long-term bull on the stock, and for good reason.

One of the key reasons I invested in SoFi in the first place was its widening ecosystem with a rising member count that rose 34% YoY to 11.7 million in Q2 2025. The member count has swelled over 10x in five years and represents a cross-selling opportunity for SoFi, especially as it keeps on adding new products to the platform.

The company has managed to grow its top line at a stellar pace while not losing sight of profitability. For instance, it reported revenues of $1.01 billion in 2021, which it expects to rise to $3.375 billion this year, an impressive CAGR of over 35%.

The growth in profitability metrics has been even greater, and last year it posted adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) of $666 million, which is over 20x of what it did in 2021. The company’s 2025 guidance calls for adjusted EBITDA to rise to $960 million. Moreover, while the “adjusted” numbers can mask a lot of things, SoFi has turned profitable on a GAAP basis as well.

Another impressive thing about SoFi has been meeting, or rather exceeding, guidance. While a lot of startups faltered on execution after promising astronomical numbers in their SPAC merger presentations, SoFi has fared much better.

SoFi has met or exceeded its guidance in recent quarters, and I have no reason to believe that it won’t be able to deliver on 2026 earnings per share guidance of between $0.55 and $0.80, as well as growing earnings between 20%-25% beyond 2026.

How to Trade SoFi Stock

The last time I covered SoFi, it was trading around $30, which I believe is a level that’s hard to justify even with the company’s sound fundamentals and strong growth. I believe that level will be the roof for SoFi stock at least until its Q3 earnings, which are set for Oct. 28.

At the same time, there is strong buying support for the stock as it approaches the $25 price level. Currently, SoFi is more towards what I see as the upper end of its trading band, so I would not add to my positions and wait for a better price.

That said, sentiment could change following the company’s Q3 confessional. I am constructive on the upcoming report and will especially be watching the commentary on the recently relaunched crypto trading business. Digital assets have seen buying interest, and crypto trading could potentially become the next growth driver for SoFi.