/An%20image%20of%20the%20Snowflake%20logo%20on%20a%20corporate%20office_%20Image%20by%20Grand%20Warszawski%20via%20Shutterstock_.jpg)

Snowflake (SNOW) shares inched higher on Thursday after the cloud company revealed a strategic partnership with Denver-headquartered Palantir (PLTR).

Snowflake is integrating its data cloud with Palantir’s Foundry and Artificial Intelligence Platform (AIP), enabling zero-copy data sharing and streamlined AI deployment for enterprise clients.

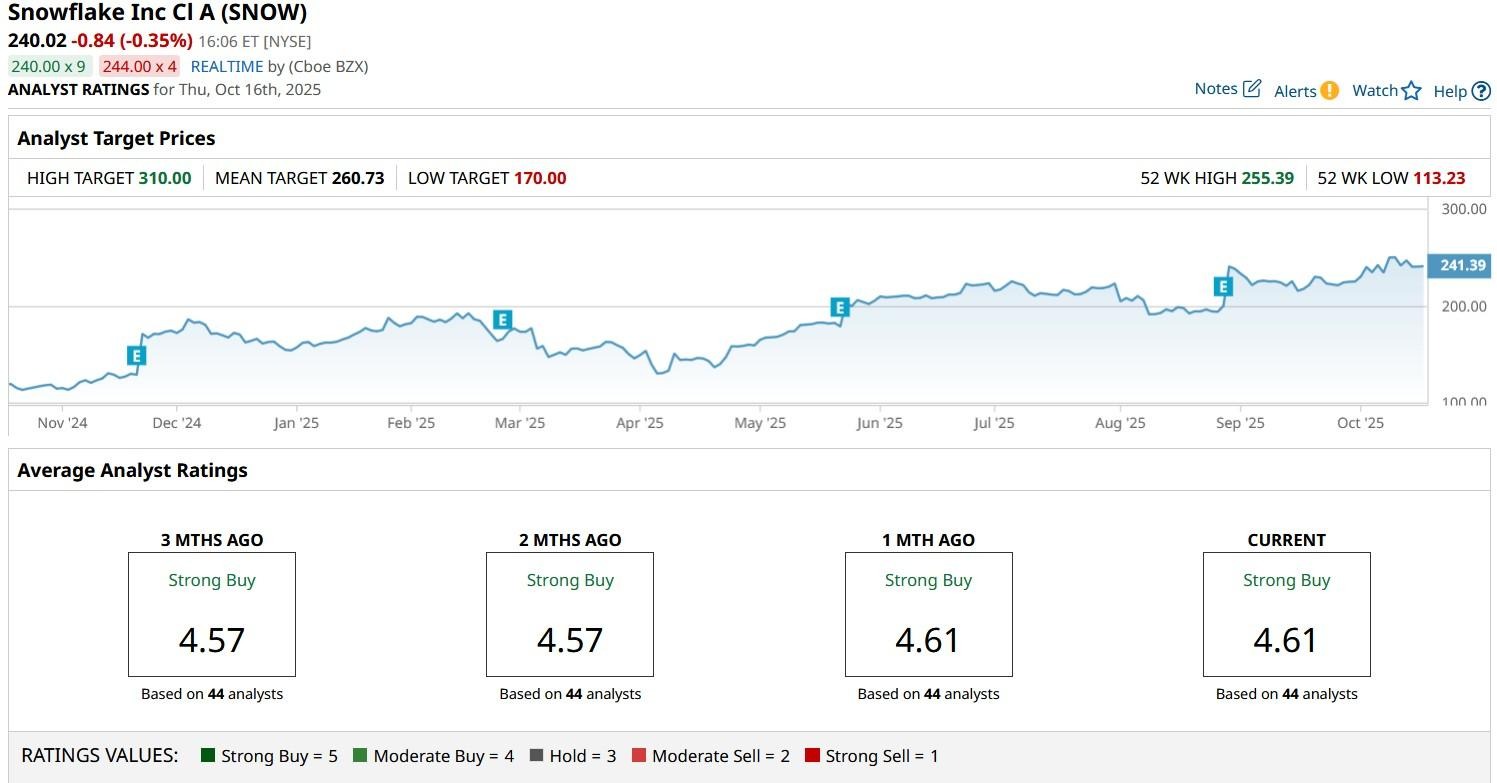

At the time of writing, SNOW stock is up roughly 100% versus its year-to-date low in early April.

Significance of Palantir Deal for Snowflake Stock

Teaming up with Palantir positions Snowflake as a more versatile AI infrastructure provider.

By enabling seamless interoperability between SNOW’s Iceberg Tables and PLTR’s platforms, the deal positions customers to build and deploy artificial intelligence models faster without having to duplicate data.

This improves Snowflake’s overall value proposition in enterprise AI where speed, governance, and scalability are critical. Early adopters like Eaton (ETN) are already leveraging the combined stack to improve operational efficiency and customer insights

The partnership also strengthens SNOW’s competitive moat against cloud-native rivals like AWS and Databricks, while expanding its reach into defense, manufacturing, and industrial verticals, all of which could unlock further upside in Snowflake shares over time.

How High Can SNOW Shares Fly?

The Palantir deal reinforces the bullish view on Snowflake stock that UBS analysts shared with clients in their research note last week.

The investment firm believes SNOW’s leadership in data management will push its share price up further to $310 over the next 12 months, indicating potential upside of another 29% from here.

Other reasons cited for the positive view on the cloud stock include strong customer engagement and resilient demand despite pricing concerns.

The analysts also acknowledged AI as a growing demand catalyst, even if its direct revenue impact remains hard to quantify. SNOW shares are worth owning as the company is one of two dominant players alongside Databricks.

Wall Street Remains Bullish on Snowflake

Other Wall Street firms also agree with UBS’ positive view on Snowflake shares due to the firm’s strong fundamentals, including gross margin hovering near 75% and positive free cash flow, which is rare for a growth tech name.

The consensus rating on SNOW stock currently sits at “Strong Buy” with the mean target of about $261 indicating potential upside of another 9% from here.