Snap Inc. (NYSE:SNAP) shares tumbled over 14% in after-hours trading after the company reported second-quarter results on Tuesday and CEO Evan Spiegel addressed a slowdown in U.S. user engagement and a shift in how people interact on Snapchat.

Snapchat Usage Habits Are Changing, Says CEO

On the earnings call, Spiegel acknowledged that user behavior in the U.S. is changing. While time spent on content continues to grow, traditional story posting is declining.

One of the biggest shifts has been from posting stories for friends to sharing content from Spotlight or Stories to start conversations, Spiegel said, adding that the platform has seen content sharing emerge as a key catalyst for engagement.

Snap's North America Monthly Active Users held steady at 159 million year-over-year, but the company reported a slight dip in daily active users. Spiegel said Snap is focused on increasing engagement through new products launching later this year.

See Also: July’s 20 Most-Searched Tickers On Benzinga Pro — Where Do Opendoor, Nvidia, Apple Stock Rank?

Direct Revenue Soars, Snapchat+ Hits $700 Million Run Rate

Despite user stagnation in its largest market, Snap continues to see strength in its subscription and direct revenue streams. Snapchat+, the company's paid tier, has reached a $700 million annual run rate, growing 64% year-over-year.

Snap posted second-quarter revenue of $1.345 billion, marking a 9% year-over-year increase and slightly surpassing the Street's consensus estimate of $1.344 billion.

The company closed the quarter with 932 million monthly active users, reflecting a 7% year-over-year growth. Daily active users reached 469 million, up 9% from the same period last year.

Stock Reaction And Outlook

Snap shares sank 14.12% in after-hours trading to $8.01, according to data from Benzinga Pro. This reflects investors' concern over flat user metrics despite healthy revenue trends in other areas.

Snap holds a consensus price target of $11.47, based on ratings from 33 analysts. The three latest analyst updates came from Bernstein, Morgan Stanley and UBS, setting an average price target of $9.50, suggesting an implied upside of 18.60% from Snap's current levels.

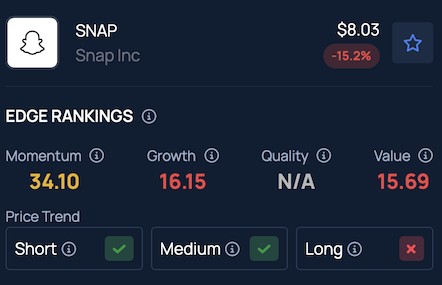

According to Benzinga's Edge Stock Rankings, SNAP shows strong upward momentum in the short and medium term, but a downward trend over the long term. More detailed performance metrics are available here.

Read Next:

Photo Courtesy: dennizn on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.