With multiple experts weighing in on the possibility of the U.S. economy falling into stagflation, it’s not a surprise that several popular securities have attracted elevated short interest — in some cases to an extreme magnitude. It just comes down to the math, particularly negative revisions in the labor market combined with stubbornly elevated inflation.

It’s at this point that speculative entities like social media platform Snap Inc (SNAP) appear to raise red flags. Right now, the short interest of SNAP stock stands at 13.13% of its float. While there’s no official threshold that determines excessive short interest, many traders use 10% as a meaningful milestone. Anything above this point could indicate a warning for potential downside action.

Adding to concerns is that SNAP stock doesn’t exactly have credibility based on other sentiment gauges. For example, the Barchart Technical Opinion indicator rates SNAP as a 64% Sell, noting that it has a weakening short-term outlook on maintaining the current direction.

Further, Wall Street analysts rate SNAP stock as a consensus Hold. Among 37 analysts, a whopping 29 experts (or 78.4%) have a neutral view on the underlying business. Reading between the lines, that’s basically a Sell — but with diplomatic language that keeps relationships intact.

In the open market, SNAP stock ended up losing 3.32% on Friday. Ordinarily, that may raise some eyebrows. However, last business week, SNAP gained almost 12%. In the past month, it’s up nearly 16%. Just as enticing is the action in the derivatives arena.

Heading into last weekend, total options volume for SNAP stock hit 294,264 contracts, representing a 54.44% lift over the trailing one-month average. Interestingly, call volume stood at 243,899 contracts, leaving put volume at 50,365 contracts. Moreover, options flow — which focuses exclusively on big block transactions — showed net trade sentiment at $366,900 above parity, thus favoring the bulls.

Sure enough, the biggest transactions by dollar volume were for debit-based calls expiring Oct. 17, suggesting optimism. Even better, the contrarian bulls may have a legitimate argument.

Advantaging Skepticism Against SNAP Stock

To be completely upfront, SNAP is only a few bucks removed from what arguably most experts would consider penny stock territory. As such, extreme caution should be applied here. Yes, there’s genuine opportunity but there’s also serious risk. However, given the contractual nature of short interest, SNAP stock deserves a closer look.

First, a true short position is a credit-based transaction. Essentially, the securities that were sold to initiate a short position must be returned to the lending creditor (broker). If all goes well for the short speculator, the sold securities will decline in value, allowing the bear to buy them back at a relative discount. After returning the borrowed shares, the rest of the funds is pocketed as profit.

It can be an incredibly shrewd way to make money — so long as the target security declines in value. If it rises, the short speculator would have to buy back the securities at a relative loss. Again, this is because the creditor must be made whole per the contractual agreement.

Prudent short traders will cut their losses early. Stubborn ones? They risk getting their portfolios blown up. Since exiting a short position involves buy-to-close transactions, so-called short squeezes could send stocks in the crosshairs skyrocketing.

I’m not saying that a short squeeze is a guaranteed outcome for SNAP stock. Still, the evidence is intriguing.

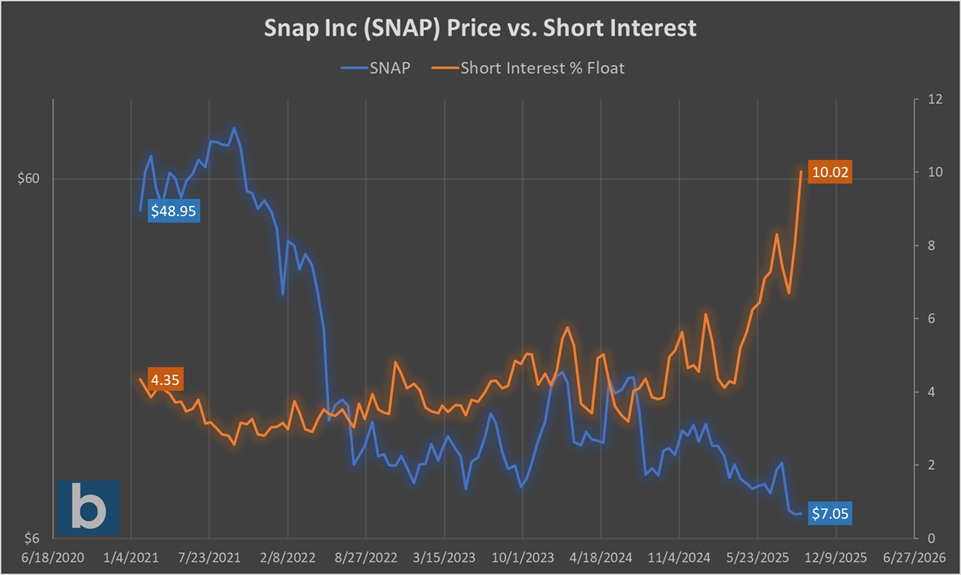

Between late January 2021 and early September 2025, the correlation coefficient between the SNAP stock price and its short interest was -43.53%. Basically, as the price fell, short interest moved higher. However, since June of last year, the correlation coefficient clocked in at -60.43%, with the magnitude of the inverse relationship strengthening in recent years.

Additionally, it appears that rising short interest is one of the leading drivers of the negativity witnessed in SNAP stock. In earlier years, the opposite seemed true — short interest would only rise materially when there were was a sizable drop in equity value.

The thing is, with short interest far more elevated than it was previously, a sustained rise in SNAP stock could lead to upside panic among the bears. That’s why the social media app is worth keeping on the radar.

A Staggered Approach to Speculation

Because short squeezes are difficult to predict, an exclusive strategy focused on expiration-specific options might not be advantageous. Thus, to establish some stake in the game, it wouldn’t be a bad idea — from a speculative standpoint — to buy SNAP stock in the open market.

If you do want to consider an options strategy, a naked debit wager — specifically the $9 call expiring April 17, 2026 — could be enticing. From a psychological perspective, the $10 target is likely a given. However, the speculation is that a potential short squeeze can send SNAP stock much, much higher.

With the aforementioned $9 call, you would have more than half-a-year for the target equity to reach its intrinsic breakeven point of $10.45. Yes, it’s an ambitious goal but it’s not unreasonable considering the power of contrarian trades.