A bold new prediction from BNP Paribas analysts has the commodities world buzzing. After the brokerage firm predicted that silver will hit $100 by the end of next year, Market on Close host John Rowland broke down what that would actually mean for the markets — and how it ties into one of the most important but often-overlooked relationships in commodities: the gold–silver ratio.

The Gold–Silver Ratio: What It Tells Us

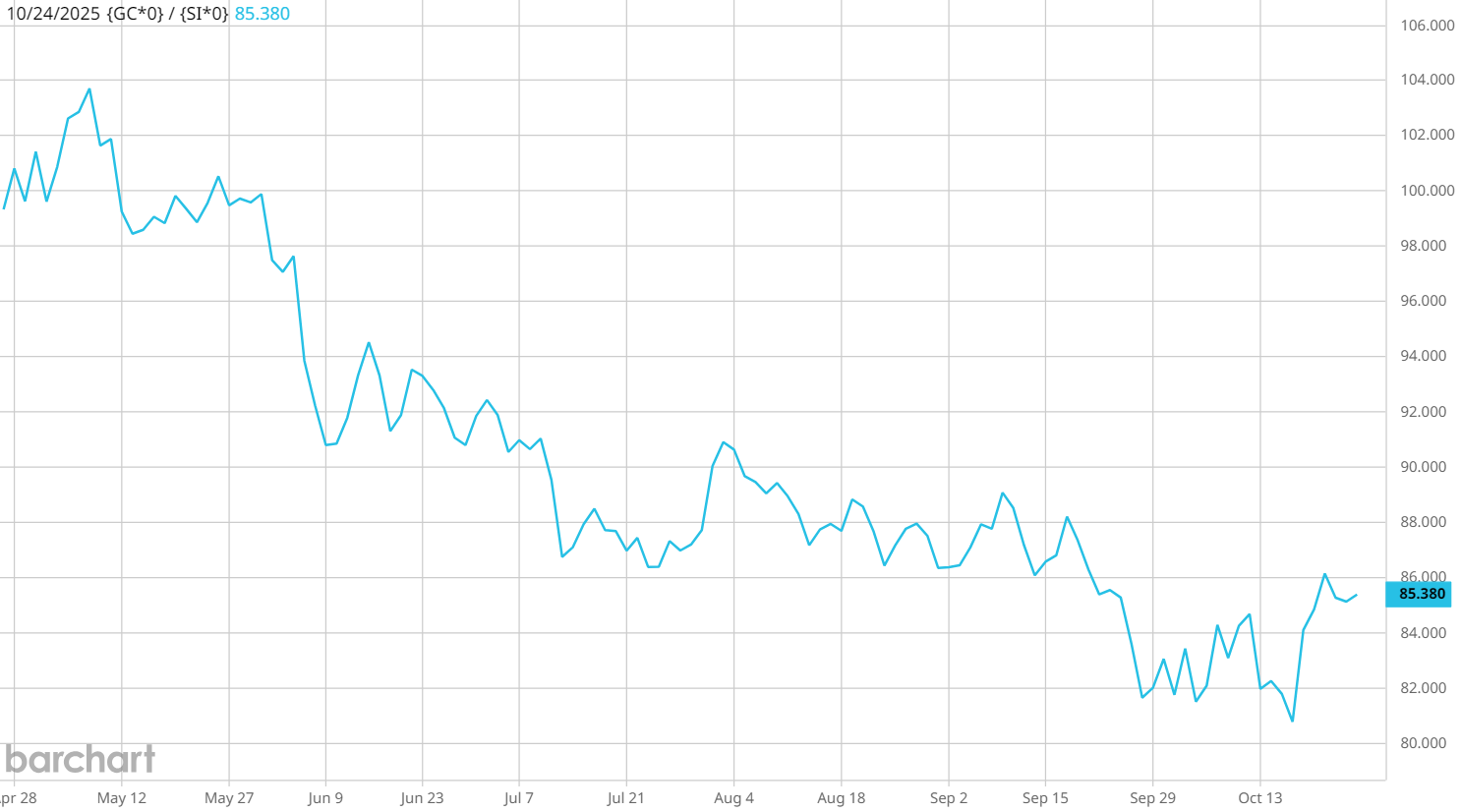

The gold–silver ratio measures how many ounces of silver it takes to buy one ounce of gold.

Using the formula f(x) tool on Barchart’s Interactive charts, insert {GC*0} / {SI*0} into the expressions field.

Right now, that ratio sits around 85 to 1 — meaning gold is roughly 85 times more expensive than silver.

Historically, the ratio has fluctuated:

- In periods of strong economic growth and industrial demand, it tends to narrow (silver outperforms).

- In risk-off or deflationary environments, it tends to widen (gold outperforms).

So, what would happen to this historical relationship between the precious metals if silver really hits $100?

The Math Behind the Prediction

John ran the numbers live on air:

“If silver goes to $100 and the ratio stays at 85, that puts gold around $8,500 per ounce,” he said.

While those numbers may sound “inconceivable,” John pointed out that traders said the same thing about $4,000 gold earlier this year — and at the time, the metal was sitting near $2,700.

Plus, as John recently observed, precious metals have disconnected from their traditional technical behavior – and are starting to behave more like momentum-driven meme names, with the recent ramp to new highs followed by high-velocity selling earlier this week.

But our Senior Market Strategist says it’s worth considering the math from the other side of the equation. The calculation based on predictions for gold to reach $5,000 – and based on the gold/silver ratio’s recent historical low-end range of 75 – would equate to silver prices of about $67.

“This is a more probable outcome in the realm of reality,” says John. “But in times of economic growth and with current record industrial demand – given that silver is tied to a lot of AI, power, and industrial uses, compounded by automotive EVs, medical, water purification, and speciality chemicals – means that higher average prices are more likely over the medium term (1-3 years).”

In short, investors may want to prepare for a new paradigm when it comes to the gold & silver trade.

What a $100 Silver Scenario Could Mean

If silver were to reach $100, it wouldn’t just be a bullish story for precious metals. It would signal a major realignment of global capital and inflation expectations.

Here’s what that could mean across markets:

- Gold as a $60 trillion asset class: Co-host “Twitter Tom” noted that gold recently surpassed $30 trillion in global value. Doubling that would reshape the balance between hard assets, housing, and equities.

- Industrial demand surge: Silver is essential for solar panels, EV batteries, and electronics — all booming sectors.

- Inflation hedge revival: Persistent inflation and geopolitical tensions continue to drive investors toward metals as safe havens.

“If gold gets to $8,500,” Tom said, “you’re looking at a total asset class worth more than $60 trillion. Housing is around $100 trillion. It’s incredible to even imagine.”

How to Track the Trend

Traders and investors can monitor this developing story directly on Barchart:

- Gold Futures Overview →

- Silver Futures Overview →

- Save the Gold–Silver Ratio Chart →

- Track Gold & Silver ETFs & Stocks →

The Takeaway

Is $100 silver realistic? Maybe not soon — but the momentum, demand, and money flow behind commodities suggest we’re entering a new chapter for metals.

“When we talked about $4,000 gold months ago, that seemed impossible too,” John said.

Whether or not $100 silver happens, the setup shows just how powerful the combination of monetary policy, AI-driven industrial demand, and scarcity narratives can be.

And, according to John, it’s a scenario that’s potentially very risky for those unfamiliar with silver’s reputation:

“Silver is very volatile,” explains Rowland. “From my years trading on the COMEX, it was jokingly referred to as the ‘Widow Maker’ because of its speculative nature and leverage of 5000 oz per contract, versus gold's 100 oz.”

Watch the Clip: Silver to $100? John Rowland Breaks It Down →

- Stream the Full Market on Close Episode

- Track Gold & Silver Futures on Barchart