/Computer%20board%20micro%20chip%20green%20by%20blickpixel%20via%20Pixabay.jpg)

ASML Holding (ASML) is standing at the heart of conversations in both technology and capital markets. Investors and analysts alike continue to take notice, recognizing the company’s unique ability to shape the digital economy. UBS has gone so far as to call ASML a “quality compounder,” a title that reflects its long-term growth potential stretching through 2027 and beyond.

Driving this confidence is the rising lithography intensity across the industry, fueled by Taiwan Semiconductor's (TSM) advanced A14 logic nodes and the steady march toward High NA extreme ultraviolet (EUV) technology. By 2030, this breakthrough platform is expected to account for 15% to 20% of ASML’s revenue, reinforcing the view that ASML’s relevance will only deepen with time.

At the same time, the company has begun to extend its reach into artificial intelligence (AI), leading Mistral AI’s Series C funding round with a €1.3 billion ($1.5 billion) investment that secured an 11% stake on a fully diluted basis. This gives ASML a window into evolving AI requirements for chips and positions it in broader policy dialogues.

Meanwhile, stock performance has mirrored these developments. On Sept. 15, shares surged 7% in a single session. By Sept. 18, the stock marked a new 52-week high at $938.68, rounding off a 15% rally over the past five trading days. The climb reflects both momentum and investor conviction.

About ASML Holding Stock

Headquartered in Veldhoven, the Netherlands, ASML operates at the frontier of semiconductor equipment manufacturing. Its portfolio includes lithography, metrology, and inspection systems, all designed to support chipmakers across the globe. This breadth of operations is reflected in its market capitalization of roughly $343 billion, a figure that speaks volumes about its reach.

ASML stock has gained ground steadily in 2025. Year-to-date (YTD), the stock is up 34%, while the past month alone has added 24%, showing resilience even as markets weigh macroeconomic uncertainties.

Current trading multiples sit at 31 times forward adjusted earnings. Although above industry peers, this level is still below the company’s own five-year average, suggesting confidence paired with valuation discipline.

Dividends remain a cornerstone of ASML’s capital strategy. Over the past nine years, payouts have increased consistently, with an annual dividend at $7.16, yielding 0.70%. The most recent quarterly dividend of $1.85 was distributed on Aug. 6 to shareholders of record on July 29.

A Closer Look at ASML Holding’s Q2 Earnings

On July 16, ASML released its second-quarter results for fiscal 2025. Net sales came in at €7.69 billion ($9.05 billion), a 23% increase from the prior year, hitting the upper end of management’s guidance and surpassing analyst forecasts of €7.52 billion ($8.85 billion).

Gross margin climbed to 53.7%, well above the guided range, thanks to robust upgrades and one-off items that lowered costs. Net profit advanced by 45% to €2.3 billion ($2.7 billion), while EPS rose 47% to €5.90.

Despite the strong results, guidance leaned cautious. Management expects Q3 net sales to fall between €7.4 billion ($8.7 billion) and €7.9 billion ($9.3 billion). Gross margin is forecast to narrow to a range of 50% to 52%, indicating pressure from shifting product mix and cyclical factors.

For the full year, however, ASML remains optimistic. Net sales growth is projected at around 15%, revising earlier guidance from €30 billion ($35.5 billion) to €35 billion ($41.4 billion). The full-year gross margin is anticipated to settle near 52%, consistent with the long-term trend of operating leverage.

Analysts continue to maintain confidence in the near-term outlook. Third-quarter EPS is projected to increase 9% year-over-year (YOY) to $6.32. For fiscal 2025, consensus estimates point to a 35% rise in the bottom line to $28.17. Looking ahead to fiscal 2026, projections edge slightly higher, with EPS estimated at $28.37.

What Do Analysts Expect for ASML Holding Stock?

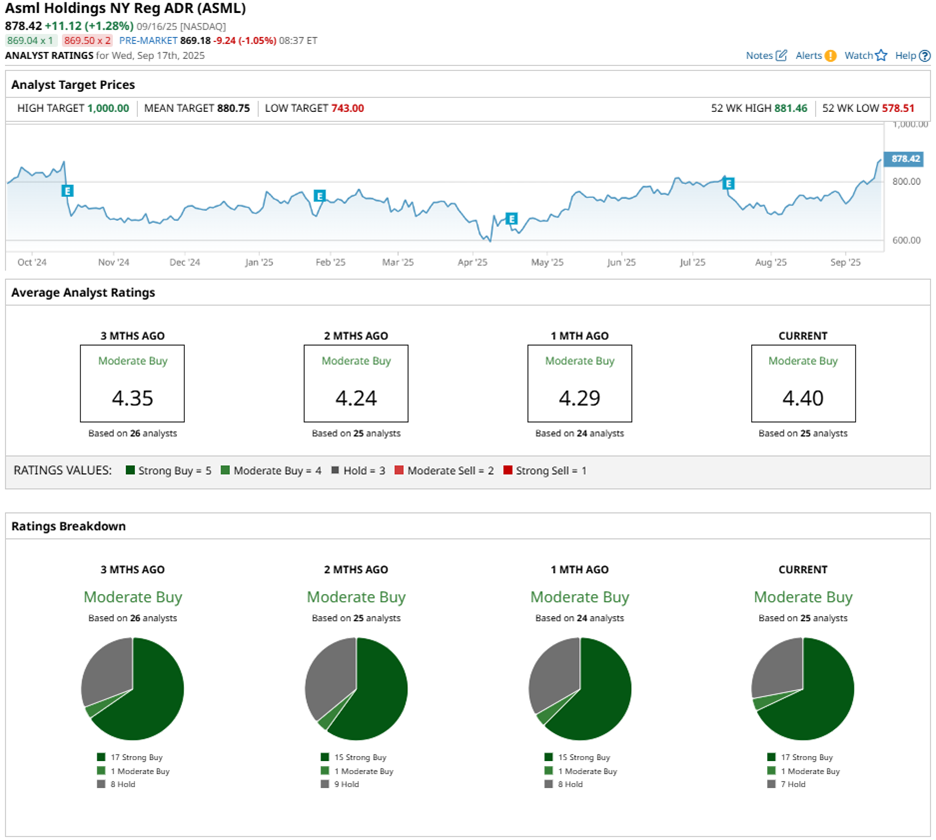

Analyst sentiment remains constructive. UBS upgraded ASML stock to a “Buy,” setting a price target of €750 ($883.52), pointing to an undervaluation relative to growth prospects. Meanwhile, Citigroup made a modest downward revision, trimming its target from €860 ($1,013.06) to €825 ($971.83) while retaining a “Buy” rating, signaling confidence despite recalibration.

Arete Research also turned positive, upgrading ASML from “Hold” to “Buy” for the first time, attaching a price target of €879 ($1,035.45). Overall, the stock enjoys a “Moderate Buy” consensus rating. Among 25 analysts, 17 recommend a “Strong Buy,” one suggests “Moderate Buy,” and seven maintain a “Hold" rating.

ASML’s average price target stands at $880.75, implying potential downside from current prices. At the higher end, projections stretch to $1,000, offering a potential gain of 8% from current levels.