In the fast-evolving LiDAR space — the backbone of autonomous driving — Luminar Technologies (LAZR) is one of the frontrunners. Its high-performance LiDAR powers Volvo’s ((VLVLY) EX90 and ES90, marking the first standard integration in a production vehicle, while partnerships with Nissan (NSANY) and Mercedes-Benz (MBGYY) underscore its strong foothold among automakers.

But when LAZR stock spiked 19% last Wednesday on unusually heavy volume — without a single press release or filing to explain it — investors smelled something else: A short squeeze.

This happens when traders betting against a stock rush to buy it back as prices climb, igniting a chain reaction that pushes shares even higher. It’s part panic, part momentum, and often short-lived. Yet in volatile names like Luminar, where innovation meets speculation, the line between genuine breakout and market squeeze can blur fast.

Can Luminar turn this short squeeze into lasting momentum? Or will gravity take over, making investors wonder whether it’s wiser to wait before diving in?

About Luminar Technologies Stock

Founded in 2012 and headquartered in Orlando, Florida, Luminar has emerged as a standout in the fast-moving LiDAR race. The company develops next-generation sensing solutions designed to elevate vehicle safety and autonomy. Its breakthrough LiDAR systems, already featured in the Volvo EX90 and ES90, mark the first high-performance LiDAR to debut as standard in a global production vehicle.

Backed by other partnerships with Nissan and Mercedes-Benz, Luminar is expanding its reach beyond passenger vehicles into commercial, defense, and drone markets. This diversification, supported by its powerful 1550-nanometer LiDAR technology, positions Luminar as a key force driving the future of autonomous mobility. Luminar's market capitalization currently stands at $129.9 million.

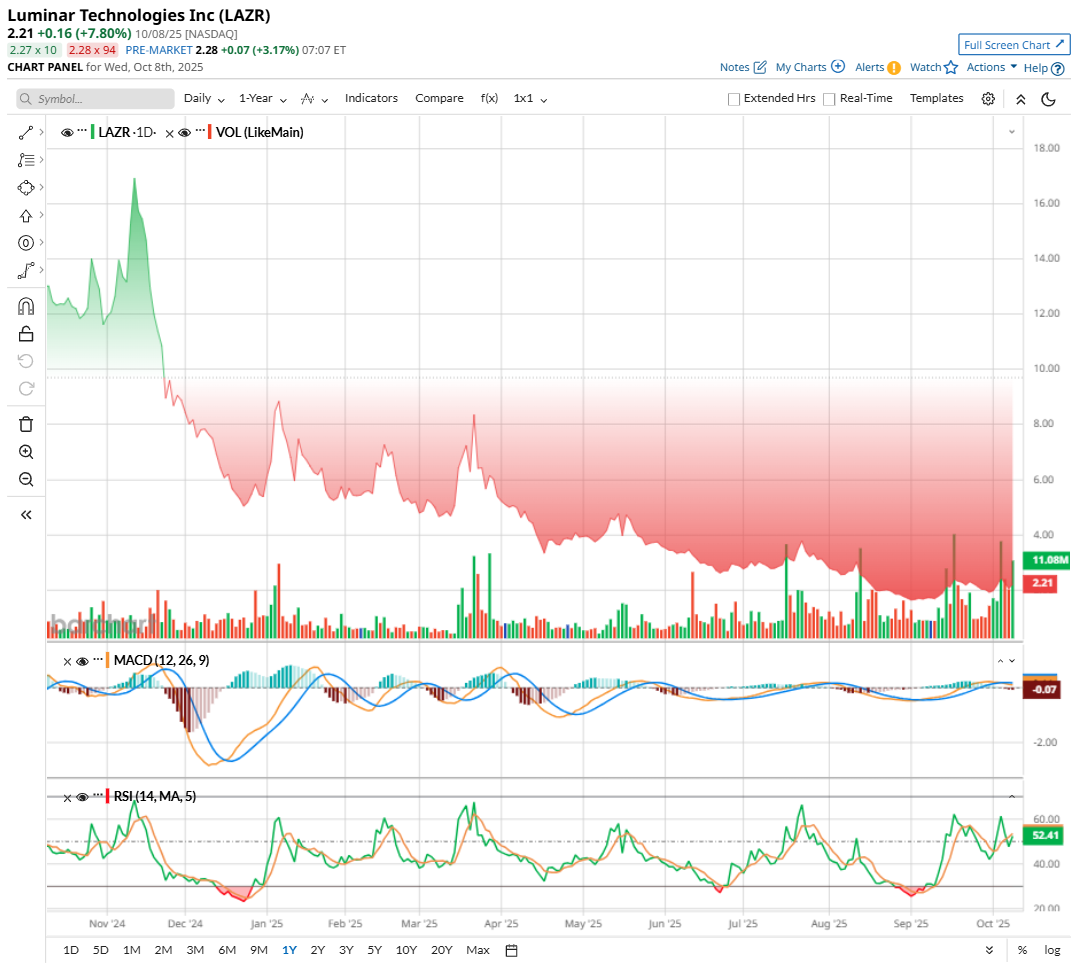

Luminar has been volatile over the past year. Back in November 2024, LAZR stock hit a 52-week high of $18.60. Fast forward to today, though, and it’s trading at $1.94 per share – an 89% drop from its high. The decline has been steep, with shares down 64% year-to-date (YTD) and 40% over the past three months, even touching a low of $1.58 on Sept. 2.

Still, lately there has been a noticeable change. LAZR stock recently bounced from its lows, ending the Oct. 8 session up by 8%. The surge came with heavy trading volumes — well above average — and even sparked chatter of a short squeeze, especially with short interest hovering around 20% of total float. LAZR also closed Oct. 13 up by 8%.

From a technical perspective, momentum indicators paint a mixed picture. The moving average convergence divergence (MACD) still leans bearish to neutral, with the orange MACD line below the blue signal line, and both trending sideways to slightly lower. This setup signals fading bullish momentum, suggesting that recent gains could cool off unless stronger buying pressure returns. Meanwhile, the MACD histogram shows minimal divergence, further hinting at indecision among traders. LAZR stock’s technicals reflect a tug-of-war between fading bears and wary bulls, a pause that could set the stage for the next decisive move.

LAZR stock, trading at just 1.84 times forward sales, hints at cautious optimism. While slightly above peers, it mirrors execution struggles. Yet, as revenue growth accelerates, the stock could close the gap, turning today’s discount into tomorrow’s reward, reflecting its long-term potential.

Luminar Technologies' Q2 Snapshot

Luminar’s second-quarter earnings report, unveiled on Aug. 12, was mixed. Revenue came in at just $15.6 million, down 5% year-over-year (YOY) and falling short of Wall Street’s expectations. The headline number tells a story of softness in non-recurring engineering (NRE) revenue and a slowdown with its lead customer. Shipments of Iris sensors dropped to roughly 5,000 units from 6,000 in Q1, with most heading to Volvo, highlighting a sequential decline driven by lower demand. Adding fuel to the fire, the “wind-down of a non-data contract” shaved revenue further, contributing to a 17% sequential top-line drop.

Meanwhile, non-GAAP net loss hit $1.49 per share, 44% narrower annually and more than what analysts had penciled in. Gross margins remained firmly in the red, with a non-GAAP gross loss of $10.8 million, reflecting poor unit economics and ongoing operational challenges.

Cash burn is steep, and with about $430 million in long-term debt, the specter of dilution looms as equity raises continue. On the bright side, Luminar still ended Q2 with $107.6 million in cash and marketable securities, not counting $50 million in undrawn credit, $180 million in equity financing, and $165 million available via convertible preferred facilities. Non-GAAP free cash flow shrank 31% YOY to -$53.8 million, underscoring the cash-intensive path of scaling its technology.

Looking ahead, management expects Q3 revenue between $17 million and $19 million, while 2025 revenue guidance has been lowered to $67 million to $74 million range from the prior range of $82 million to $90 million. Non-GAAP gross losses are projected to hover between $5 million and $10 million per quarter, likely leaning higher due to the winding down of the high-margin data contract. Sensor shipments are now expected at 20,000 to 23,000 units for fiscal 2025, down from an earlier 30,000 to 33,000 forecast.

Luminar is taking steps to address costs. Manufacturing is moving from Mexico to Thailand to lower unit expenses, and restructuring initiatives are projected to save $23 million annually starting in 2026. With over $500 million in liquidity available across cash, credit, and equity programs, the company has runway, but investors will be watching execution closely as growth ambitions collide with persistent operational headwinds.

Luminar Technologies may be turning a financial corner if analyst forecasts hold true. They expect the company’s losses to shrink sharply by 64% YOY to $4.91 in fiscal 2025, then ease another 26% annually to a loss of $3.61 in fiscal 2026.

What Do Analysts Expect for Luminar Stock?

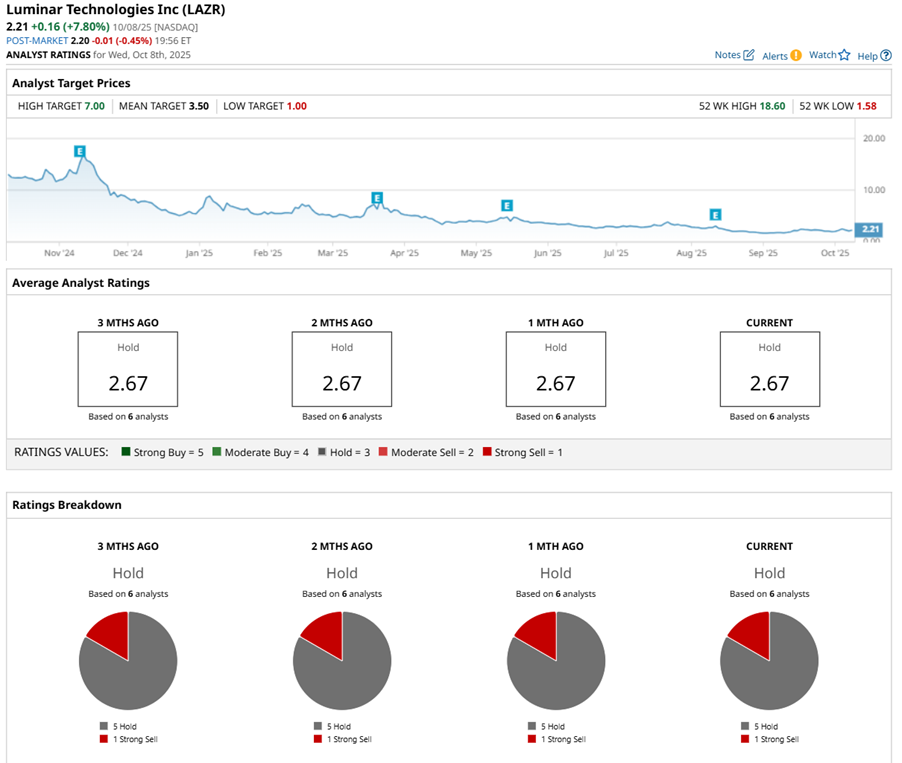

Wall Street is not exactly cheering or booing Luminar, but it does have more of a cautious tone. Out of six analysts tracking the stock, five play it safe with a “Hold” while one is skeptical with a “Strong Sell," amounting to a consensus “Hold” rating overall.

Still, price targets suggest there is some spark left. The mean price target of $3.50 suggests a potential 80% rebound. Meanwhile, the most bullish call shoots as high as $7, suggesting 261% potential upside if Luminar can keep its glimmer from fading.