/The%20CrowdStrike%20logo%20on%20an%20office%20building%20by%20bluestork%20via%20Shutterstock.jpg)

Following a high-profile July outage last year that rattled investor confidence in CrowdStrike (CRWD), the cybersecurity leader has managed to bounce back with impressive resilience in 2025. In fact, the company has been one of Wall Street’s favorites this year, and for good reason. Business momentum remains solid, and broader demand for cutting-edge security solutions is getting stronger.

At the heart of CrowdStrike’s growth story is its artificial intelligence (AI) driven Falcon platform, built to spot, prevent, and neutralize threats with real-time precision. Now, CrowdStrike is back in the spotlight after its latest earnings release. While the earnings revealed GAAP losses and a revenue guidance that came in lighter than many had hoped, the report still carried plenty of positives. Investors seemed to agree, pushing CRWD stock up 4.6% in the trading session following its Aug. 27 results. So, does this make CrowdStrike a buy right now?

About CrowdStrike Stock

With a market capitalization hovering around $106 billion, CrowdStrike is widely recognized in the cybersecurity space for its cloud-based platform, which helps protect the most critical aspects of a company’s digital operations, such as devices, cloud systems, employee identities, and sensitive data. The core of its approach is the Falcon platform, which utilizes AI to sort through massive amounts of data in real-time.

By identifying patterns in attacks, monitoring hacker techniques, and gathering signals from across networks, Falcon can quickly detect and stop threats while also highlighting areas that may be at risk. Unlike many traditional security tools, Falcon was built in the cloud from the start. That means it only requires a single lightweight agent to function, making it faster to roll out, easier to manage, and more efficient at protecting businesses without adding extra complexity.

Last July, CrowdStrike grabbed headlines for all the wrong reasons after a faulty update to its Falcon Sensor software caused nearly 8.5 million Microsoft (MSFT) Windows systems to crash worldwide. But despite that setback, CRWD stock has made a remarkable comeback, surging 75% from its September 2024 low of $242.25. So far in 2025, the momentum hasn’t slowed. Shares are up 24% year-to-date (YTD), towering over the broader S&P 500 Index’s ($SPX) 10% gain.

A Look Inside CrowdStrike Q2 Earnings Results

CrowdStrike once again proved its resilience with a robust set of fiscal 2026 second-quarter results, beating Wall Street’s expectations and showing why the firm remains a force in cybersecurity. The company reported revenue of $1.17 billion, up 21% year-over-year (YOY) and ahead of the $1.15 billion that analysts had forecast. Subscription revenue continued to be the growth engine, climbing 20% to $1.10 billion, while professional services surged 45% to $66.01 million.

Much of this strength came from accelerating enterprise adoption and steady demand for its AI-driven security solutions. For a subscription-driven model, the real highlight was annual recurring revenue (ARR), which increased a notable 20% from the previous year to $4.66 billion. Net new ARR hit a record $221 million, the highest quarterly addition in the company’s history, showcasing the stickiness of Falcon even as the company continues to navigate the aftershocks of last year’s outage.

Profitability, however, took a step back. The company reported a net loss of $0.31 per share, compared to a net income of $0.19 per share a year earlier, as operating expenses and R&D investments weighed on its results. On an adjusted basis, though, earnings were $0.93 per share, up 5.7% from last year and comfortably above Wall Street’s $0.83 estimate.

Cash generation was another area of strength. Operating cash flow reached a record $333 million, while free cash flow hit a new high of $284 million. The balance sheet appeared even stronger, with cash and cash equivalents rising to a record $4.97 billion as of July 31, 2025.

CrowdStrike also announced an acquisition aimed at strengthening its platform. The company agreed to acquire Onum, a specialist in real-time telemetry pipeline management. Onum’s stateless, in-memory architecture is expected to boost Falcon Next-Gen SIEM by improving speed, scalability, and data onboarding efficiency. Importantly, the deal enables Falcon’s AI-powered detections to be applied to third-party data sources, allowing analysis to begin before the data even enters the platform.

Looking ahead, management guided Q3 revenue to be in a range of $1.208 billion to $1.218 billion. While slightly under consensus estimates of $1.23 billion, the guidance still reflects healthy double-digit growth. The caution stems from ongoing remediation and retention incentives tied to the 2024 outage. Meanwhile, adjusted EPS for the quarter is expected to be between $0.93 and $0.95, signaling a continued focus on balancing growth with profitability.

What Do Analysts Think About CrowdStrike Stock?

After CrowdStrike posted its latest earnings, Wall Street quickly adjusted expectations, but without losing faith in CRWD stock’s long-term trajectory. For instance, Jefferies trimmed its price target to $500 from $530 but reaffirmed a “Buy” rating, signaling confidence in the company’s long-term growth story despite near-term headwinds.

DA Davidson also lowered its target, cutting it to $490 from $530 while maintaining a “Buy” rating. Needham joined the group, reducing its target to $475 from $530, but maintaining its bullish stance. In short, while price targets have been adjusted downward to reflect cautious guidance, Wall Street still sees plenty of potential in CrowdStrike stock.

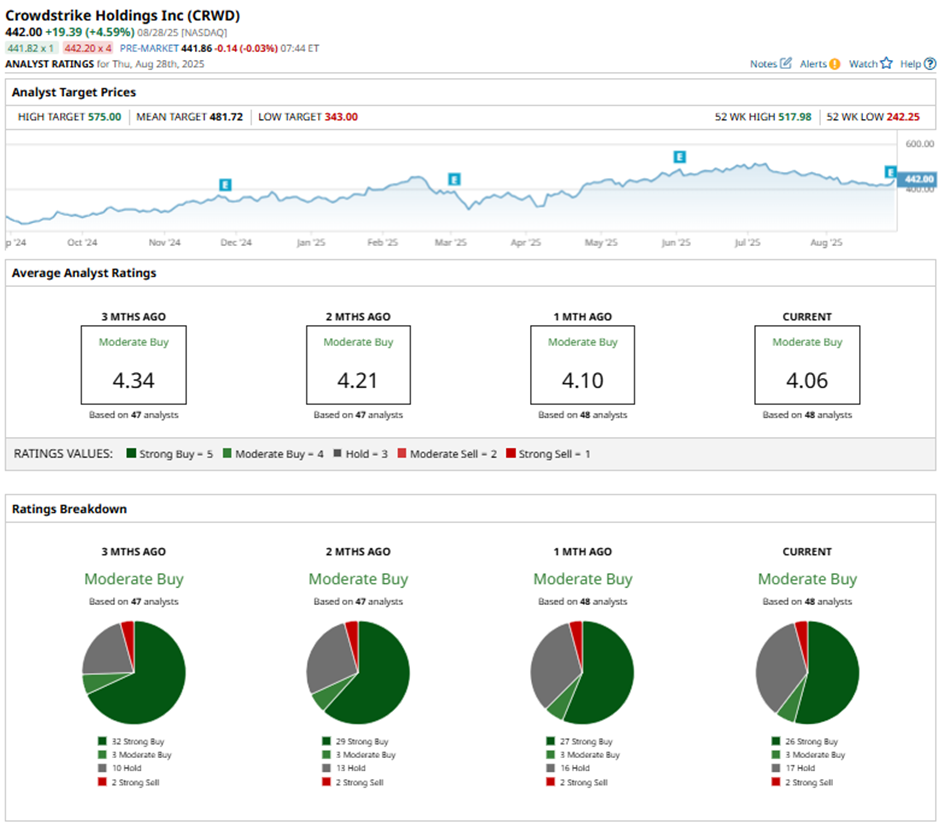

Overall, CrowdStrike still has Wall Street in its corner, carrying a "Moderate Buy” consensus rating that signals steady confidence in the cybersecurity giant. Of the 48 analysts covering the stock, a majority of 26 analysts rate it a “Strong Buy,” three suggest a “Moderate Buy,” 18 analysts play it safe with a “Hold,” and one analysts gives a “Strong Sell” rating.

CRWD stock’s average analyst price target of $469.30 signals 11% potential upside from current levels. The Street-high target of $575 implies that shares could rally as much as 36% from here.