/Semiconductor%20by%20Sach336699%20via%20Shutterstock.jpg)

Taiwan Semiconductor Manufacturing (TSM) stock is in focus today after the semiconductor firm reported yet another record-breaking quarter on continued robust demand for artificial intelligence (AI) chips.

The company posted NT$452 billion in net income on NT$990 billion in revenue for its financial third quarter on Thursday, both handily above Wall Street estimates.

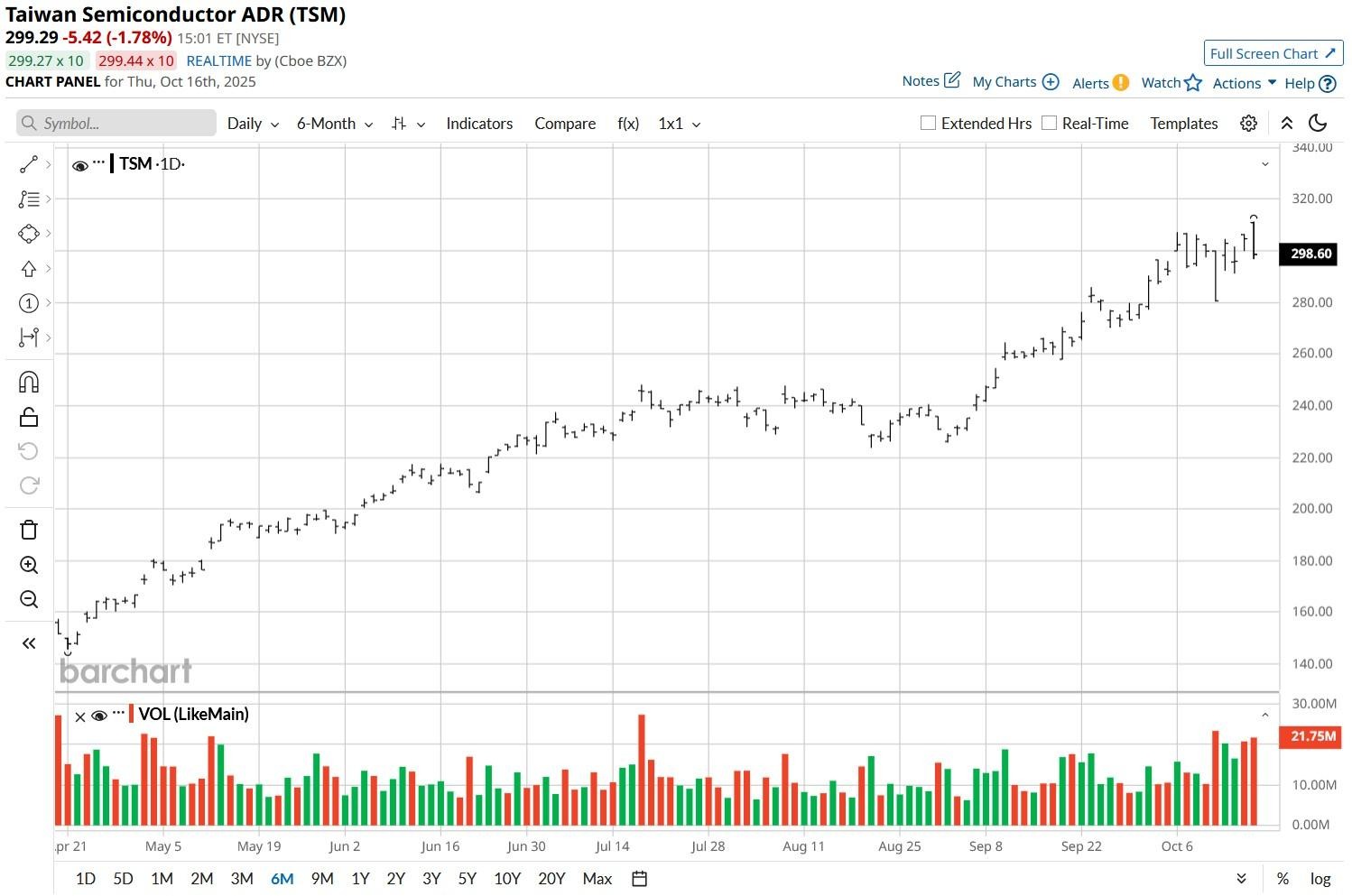

At the time of writing, TSM shares are up more than 120% versus their year-to-date low on April 7.

Jim Cramer Recommends Buying TSM Stock

Famed investor Jim Cramer recommends owning Taiwan Semi shares after the company’s earnings release since its AI exposure is evidently translating into real financial momentum.

“They were saying they saw 30% growth – now it looks like mid-30s percent growth. That’s a very big change,” he said in a recent segment of CNBC.

The “Mad Money” host particularly hailed TSMC’s guidance for roughly 60% gross margins, which he said late Intel (INTC) CEO Andy Grove once dubbed the “holy grail” of profitability.

According to Cramer, the fact that Taiwan Semi serves as foundry for both Nvidia (NVDA) and Advanced Micro Devices (AMD) is a strong enough reason to own TSM stock for the long term.

Q3 Release Brought Many Good News for TSM Shares

Beyond headline numbers, the TSMC earnings release had several updates that warrant buying its stock.

For example, advanced technologies accounted for 74% of wafer revenue, underscoring the firm’s dominance in cutting-edge nodes like 3nm and 2nm.

Meanwhile, gross margins expanded to its near historic high of 59.5%, reflecting promising cost discipline. C.C. Wei, the company’s chief executive, emphasized rapid customer migration to newer nodes and robust token growth.

Taiwan Semi reaffirmed its 2nm production timeline, reinforcing its leadership in semiconductor innovation, which could drive further upside in TSM shares over time.

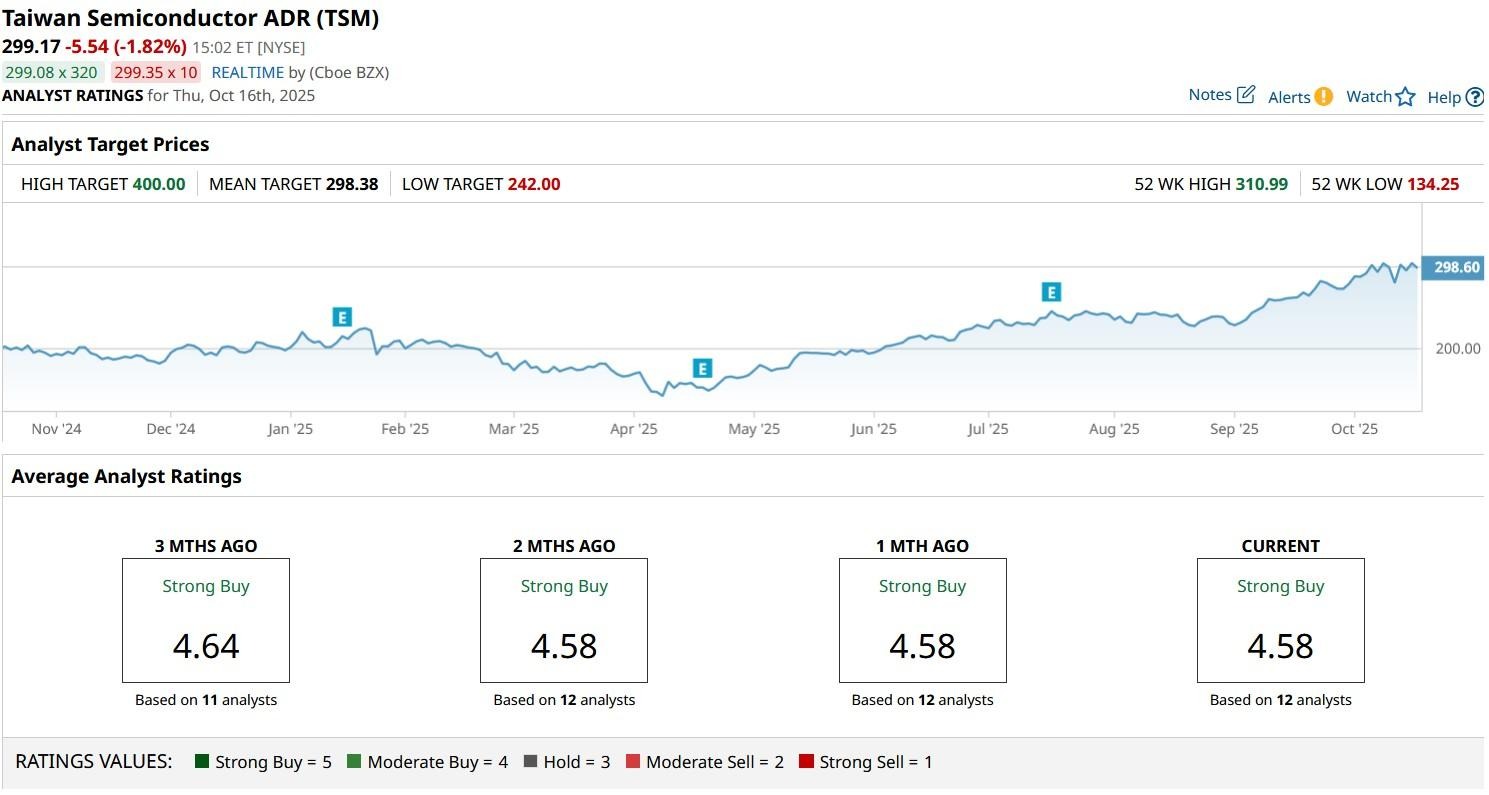

How Wall Street Recommends Playing Taiwan Semiconductor

TSMC’s third-quarter financial results reinforced Wall Street’s bullish stance on the semiconductor stock.

According to Barchart, the consensus rating on TSM shares currently sits at “Strong Buy” with price targets going as high as $400 indicating potential upside of another 33% from here.