/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

Salesforce (CRM) hasn’t exactly been winning hearts on Wall Street this year. CRM stock has slipped out of favor as investors have grown wary of its aggressive acquisition strategy and the fact that revenue growth has slowed. Even though the company often highlights its big bets on artificial intelligence (AI) and continuous innovations across its software-as-a-service (SaaS) portfolio, Salesforce hasn’t quite ridden the AI wave the way that many of its tech peers have.

The pressure has only mounted this month. On Sept. 4, shares of the cloud software giant slid another 4.9% after Salesforce unveiled its fiscal 2026 second-quarter results the day prior. While the earnings report had its bright spots, what spooked investors was the company's s Q3 revenue outlook, which fell short of Wall Street’s forecasts. That being said, with CRM stock taking a sharp post-earnings tumble, does this dip present an attractive entry point for long-term investors? Or is it a warning sign to stay cautious?

About Salesforce Stock

California-based Salesforce has been a driving force in cloud computing since its founding in 1999. The company not only pioneered the SaaS model but also cemented its leadership in the customer relationship management (CRM) market. Today, Salesforce is doubling down on AI, pouring significant investments into tools designed to elevate customer engagement and enhance sales team efficiency.

A key piece of this strategy is Agentforce, introduced at Dreamforce 2024, which aims to automate customer interactions and help businesses scale their services while cutting back on human dependency. The company’s market capitalization presently stands at about $240 billion. However, despite its strong foundation and bold push into AI, Salesforce hasn’t managed to woo investors.

Over the past year, Salesforce shares are up just 2.7%, whereas the broader S&P 500 Index ($SPX) has surged 17.8% during the same period. And 2025 has been even worse for CRM stock, with shares crashing a notable 25% year-to-date (YTD), once again lagging behind the broader market’s modest 10% return so far this year.

Following this stretch of underperformance, Salesforce’s valuation has cooled significantly. CRM stock now trades at 28.5 times forward earnings.

Inside Salesforce’s Q2 Earnings Report

The second-quarter earnings season is finally wrapping up, with Salesforce reporting results at the tail end on Sept. 3. At first glance, the numbers looked strong. The company managed to beat Wall Street’s estimates on both the top and bottom lines. For Q2, revenue climbed about 10% year-over-year (YOY) to $10.2 billion, slightly above Wall Street’s consensus target of $10.14 billion.

Profitability also stood out as a bright spot. GAAP operating margin expanded to 22.8%, reflecting tighter cost controls and efficiency gains. Non-GAAP operating margin also increased to 34.3%, while adjusted EPS rose 13.7% YOY to $2.91, comfortably topping consensus estimates.

Breaking down the company’s revenue mix, Subscription and Support continued to serve as the backbone of the business, growing 11% annually to $9.7 billion and accounting for a massive 95% of overall sales. By contrast, revenue from the Professional Services and Other segment declined 3% to $546 million, signaling ongoing weakness in the division as clients pulled back on consulting-related spending.

Looking ahead, Salesforce’s future pipeline showed resilience. The current remaining performance obligation, a key measure of future contracted revenue, reached $29.4 billion as of July 31, representing an 11% increase from the prior year. At the same time, Salesforce reinforced its shareholder-friendly approach by returning $2.6 billion through $2.2 billion in buybacks and $399 million in dividends during the quarter.

On top of that, management doubled down on this commitment by expanding the company’s repurchase program with an additional $20 billion, bringing total authorization to a hefty $50 billion. This move underscored confidence in long-term cash generation and sent a strong signal about Salesforce’s commitment to supporting shareholder value. Still, while the Q2 report delivered plenty of positives, those still weren’t enough to ease investor concerns.

Guidance for the third quarter left markets underwhelmed, with revenue projected between $10.24 billion and $10.29 billion, the midpoint falling just short of analyst expectations. The muted outlook suggested that Salesforce’s high-profile AI initiatives would experience slower monetization, as ongoing macroeconomic uncertainty led clients to take a more cautious approach to spending.

What Do Analysts Think About Salesforce Stock?

Following Salesforce’s Q2 stumble, analysts trimmed their price targets but kept faith in the long-term story. For example, JPMorgan lowered its target to $365 from $380, yet maintained an “Overweight” rating. The firm highlighted strong traction in Salesforce’s AI portfolio, including Agentforce, and cited the company's s recent investment in Genesys as a key growth driver. JPMorgan also emphasized that shares are trading at historically low levels and at a steep discount to peers, making CRM stock more compelling despite growth not accelerating just yet.

CFRA took a somewhat similar stance, cutting its target to $300 from $375 but keeping its “Strong Buy” rating intact. The firm noted that the Agentic AI platform is gaining momentum, with a 60% sequential jump in customers moving from pilot to production. This expansion of use cases signals scaling, adoption and long-term potential. Moreover, CFRA sees CRM’s valuation as “highly enticing” and reaffirmed its view that Salesforce could remain a standout winner in the SaaS space, even amid industry-wide turbulence.

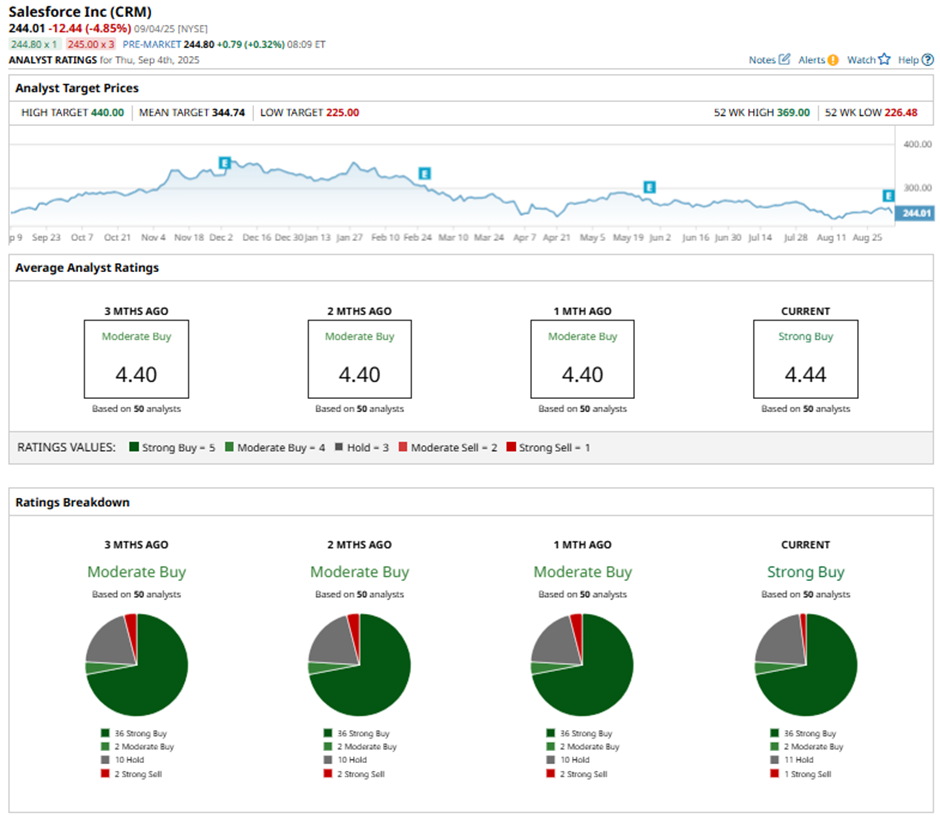

Overall, Wall Street is still leaning bullish on CRM stock, with a consensus “Strong Buy” rating. Of the 50 analysts offering recommendations, a majority of 36 analysts advocate a “Strong Buy,” two give a “Moderate Buy,” 11 advise a “Hold,” and one analyst suggests a “Strong Sell.” The average analyst price target of $336.06 represents potential upside of 34%, while the Street-high target of $430 suggests a 72% rally from current levels.