/AI%20(artificial%20intelligence)/AI%20software%20engineering%20by%20Tapati%20Rinchumrus%20via%20Shutterstock.jpg)

GitLab (GTLB), an under-the-radar player in the burgeoning artificial intelligence (AI)-integrated DevSecOps space, has seen its stock slide after earnings release last week, sparking renewed investor scrutiny. Despite delivering solid earnings beats and raising full-year adjusted EPS forecasts, the company’s cautious revenue guidance and leadership transitions, including its announcement of CFO Brian Robins’ departure to Snowflake, rattled confidence in the near term.

Yet beneath the surface, GitLab continues to scale with the company’s ambitious push into AI, exemplified by the GitLab Duo Agent Platform designed to enhance developer productivity and enable more in-depth enterprise engagement. So, is this dip an opportunity to buy into a stealthy innovator gaining traction in AI-powered software delivery or a sign to stay on the sidelines?

About GTLB Stock

GitLab is a San Francisco–based software company developing and offering a unified DevSecOps platform, spanning planning, source code management, CI/CD, application security, deployment, monitoring, and value stream analytics, available via cloud-based SaaS or self-managed deployments. GitLab’s market cap stands at $7.6 billion.

The company has endured a challenging stretch in 2025, with GTLB stock now down 18.9% year-to-date (YTD), underperforming the broader market. Over the trailing 52 weeks, shares have declined 18.1%, and the current price is roughly 38.4% below the 52-week high of $74.18, reached Jan. 31.

GTLB stock took a further dip last week, plunging 7.4% on Sept. 4 after GitLab delivered a strong Q2 report but also announced soft forward revenue guidance and the departure of CFO Brian Robins, effective Sept. 19, to take a similar role at Snowflake (SNOW). However, the stock revived to some extent with a 4.7% surge in the last trading session (Sept. 8).

GitLab stock currently trades at a premium compared to the sector median at 9.46 times forward sales.

Gitlab's Better-Than-Expected Q2 Results

On Sept. 3, 2025, GitLab released its Q2 fiscal 2026 results, reporting an impressive 29% year-over-year (YoY) revenue increase to $236 million, higher than the consensus estimate, for the quarter ended July 31. The company also highlighted strong operational improvements, with non-GAAP operating margin expanding to 17%, up from 10% a year earlier, and operating loss narrowing significantly.

GitLab generated $49.4 million in operating cash flow and $46.5 million in non-GAAP adjusted free cash flow, a significant increase from the year-ago quarter and reinforcing its improving cash generation. The company’s non-GAAP EPS came in at $0.24, compared to $0.15 in the prior-year quarter, and surpassed the consensus estimate.

Meanwhile, its customer base continued to grow, with the number of accounts contributing over $5,000 in ARR rising 11% to 10,338, and customer accounts with over $100,000 in ARR surging 25% to 1,344; the dollar-based net retention rate stood strong at 121%, and total remaining performance obligations (RPO) climbed 32% to $988.2 million.

Strategically, GitLab announced the upcoming departure of CFO Brian Robins. He will be replaced on an interim basis by VP of Finance James Shen, a development that tempered some of the market enthusiasm. The company also announced the public beta launch of the GitLab Duo Agent Platform, signaling a deepening commitment to AI-driven DevSecOps, and signed a three-year collaboration with Amazon (AMZN) Web Services to bolster offerings for regulated industries.

Looking ahead, GitLab reaffirmed its full-year FY2026 revenue outlook of $936 million to $942 million while raising its full-year non-GAAP EPS guidance to $0.82 to $0.83 (previously $0.74 to $0.75), reflecting the company’s confidence in improving profitability despite the leadership transition. For Q3 FY2026, it forecasts revenue of $238 to $239 million, non-GAAP operating income of $31 to $32 million, and non-GAAP EPS of $0.19 to $0.20, underscoring the continued emphasis on margin expansion and measured growth execution.

Analysts predict loss per share to be around $0.28 for the current year, down 86.7% YoY, and remain flat in the next fiscal year.

What Do Analysts Expect for GTLB Stock?

Following the latest earnings release, many analysts have opted for price cuts, but overall sentiment remains moderately bullish. Recently, FBN Securities lowered its price target on GitLab to $65 from $75 but kept an “Outperform” rating after the company’s latest earnings.

Also, Truist Securities cut its price target on GitLab to $55 from $75 while maintaining a “Buy” rating, citing a cautious outlook tied to weakness in SMB demand, one-time impacts on self-managed revenue, and go-to-market strategy adjustments as the company shifts toward a hybrid seat- and consumption-based model. Plus, Piper Sandler also lowered its price target on GitLab to $70 from $85 but kept an “Overweight” rating.

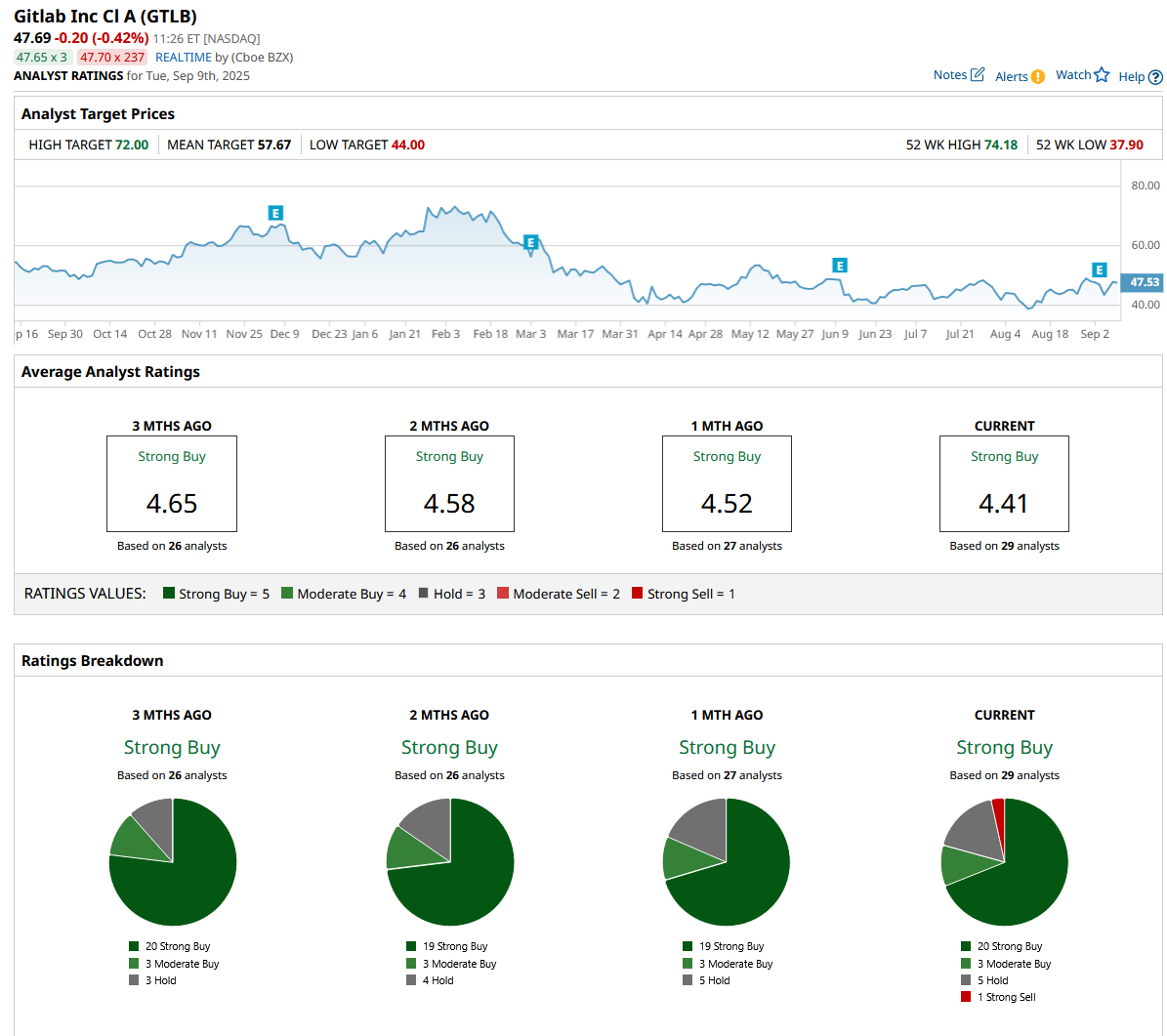

Overall, GTLB has a consensus “Moderate Buy” rating. Of the 29 analysts covering the stock, 20 advise a “Strong Buy,” three suggest a “Moderate Buy,” five analysts are on the sidelines, giving it a “Hold” rating, while one gives a “Strong Sell.”

The average analyst price target for GTLB is $57.67, indicating a potential upside of 20%. The Street-high target price of $72 suggests that the stock could rally as much as 50%.