/AI%20(artificial%20intelligence)/Close-%20up%20of%20computer%20chip%20with%20AI%20sign%20by%20YAKOBCHUK%20V%20via%20Shutterstock.jpg)

Semiconductor firm Astera Labs (ALAB) saw a sharp drop in its stock price on Oct. 14. The decline came after chip giant Advanced Micro Devices (AMD) formed a partnership with Oracle (ORCL) to deploy 50,000 GPUs starting in the second half of 2026.

ALAB stock also dropped sharply back in September after Morgan Stanley said the deal between Intel (INTC) and Nvidia (NVDA) to develop PC and data center chips would affect Astera Labs' business. This AMD-Oracle deal seems to have reignited fears that business is being taken away from the company.

Astera Labs stock dropped 19% intraday on Oct. 14 on the news. Should you buy the dip in shares?

About Astera Labs Stock

Established in 2017 and based in Santa Clara, California, Astera Labs is a prominent fabless semiconductor company focused on creating high-speed connectivity solutions for AI and cloud infrastructure. The firm develops specialized semiconductors designed to tackle data bottlenecks in data centers and AI systems.

In March 2024, Astera Labs made its public debut under the ticker symbol ALAB, marking a significant milestone. The company has since expanded operations, including opening new design centers and bolstering its research and development efforts, solidifying its role as a key innovator in semiconductor connectivity technologies for large-scale AI and cloud applications. The company has a market capitalization of $27.4 billion.

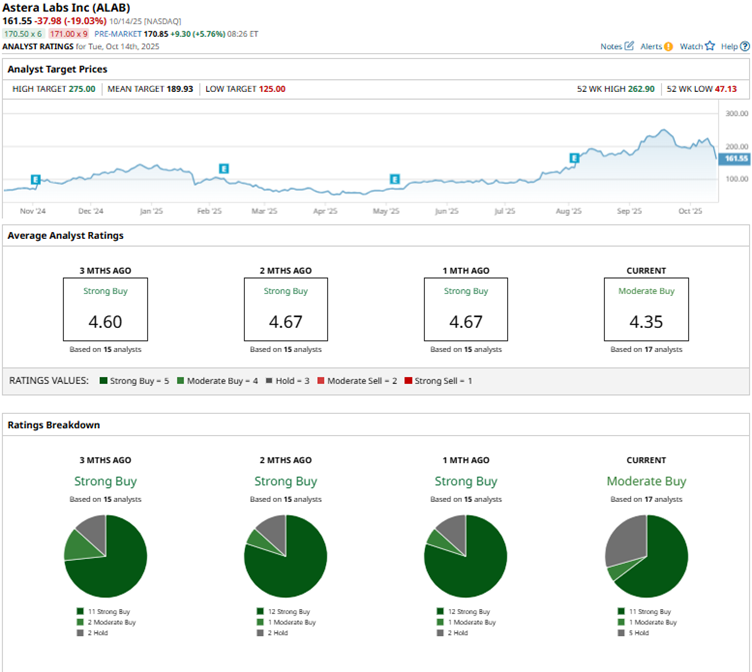

The stock has been on a tear over the past year, driven by strong demand for its products, rising revenues, and optimism about the company. Over the past 52 weeks, ALAB stock has gained 135%, while it is up 25% year-to-date (YTD). Shares reached a 52-week high of $262.90 in September, but they are currently down 37% from that level.

ALAB stock is currently trading at an eye-watering valuation. Its price-to-sales ratio is 68.6, which is considerably stretched compared to the industry average.

Astera’s Financials Are Robustly Growing

On Aug. 5, Astera Labs reported robust second-quarter results. Revenue increased 150% year-over-year (YOY) to a record $191.9 million. The topline also increased 20% sequentially.

During the quarter, the company expanded its collaboration with Nvidia to advance the NVLink Fusion ecosystem. Astera also announced a partnership with ASIC firm Alchip Technologies to “advance the silicon ecosystem” for artificial intelligence (AI) rack-scale infrastructure.

The company’s net income increased considerably from a loss of $7.55 million in Q2 2024 to an income of $51.22 million. Its EPS also grew from a loss of $0.05 to an income of $0.29 over the same period. On a non-GAAP basis, its EPS increased 238% from the year-ago quarter to $0.44.

For the third quarter, Astera expects revenue to be in the range of $203 million to $210 million, while non-GAAP EPS is projected to be in the range of $0.38 to $0.39.

Wall Street analysts are exceptionally optimistic about Astera’s future earnings. They expect the company’s EPS to climb 650% YOY to $0.22 in the third quarter. For the current fiscal year, EPS is projected to surge 217% annually to $0.83, followed by a 36% growth to $1.13 in the next fiscal year.

What Do Analysts Think About Astera Labs Stock?

Wall Street analysts have kept a favorable view on Astera Labs’ stock. Recently, analysts at Citi maintained a “Buy” rating on ALAB stock and raised the price target to a Street-high of $275. Citi analysts believe Astera is poised to gain from the deal between AMD and OpenAI, as the company is likely to supply critical networking infrastructure for the upcoming AMD Helios platform.

In September, analysts at Deutsche Bank raised Astera Labs’ stock price target to $200 while maintaining a “Buy” rating, reflecting positive sentiments after the company showcased its AI infrastructure at the Deutsche Bank 2025 Technology Conference.

In August, Morgan Stanley analyst Joseph Moore also raised Astera’s price target from $155 to $200, while keeping an “Overweight” rating. Moore believes the company has bought into an untapped opportunity worth $17 billion. In the same month, Barclays analyst Tom O'Malley maintained an “Overweight” rating while raising the price target from $75 to $155.

Wall Street analysts are soundly bullish on ALAB stock, awarding it a consensus “Moderate Buy” rating. Of the 17 analysts rating the stock, a majority of 10 analysts rate it a “Strong Buy,” one analyst suggests a “Moderate Buy,” and six analysts play it safe with a “Hold” rating. The consensus price target of $190.67 represents 16% potential upside from current levels. Meanwhile, the Street-high Citi-given price target of $275 indicates 67% potential upside.

Key Takeaways

Astera Labs' financials are robustly growing, and Wall Street analysts are optimistic about the company’s future. Its operations are on the uptick, and strategic partnerships are expected to harness its expansion. Therefore, it might be wise to buy into the ALAB stock dip now.