/The%20DocuSign%20headquarters%20by%20Tada%20Images%20via%20Shutterstock.jpg)

DocuSign (DOCU) shares are attempting a reversal in 2025, up 16% in the past month after the leader in the e-signatures space announced second-quarter results that exceeded Wall Street expectations. The sharp rebound has been based on intensifying demand in its eSignature, Contract Lifecycle Management (CLM), and Identity and Access Management (IAM) product segments, segments DocuSign is now reinforcing with artificial intelligence.

CEO Allan Thygesen described the quarter as being among the company’s highest growth and profitability periods in recent years, and Q3 revenue guidance exceeded consensus expectations. Nevertheless, after falling nearly 20% from its 2025 highs, DOCU stock is in a sensitive area and investors are questioning the sustainability of this rebound.

Broader tech stocks have snapped out of their summer volatility, but enterprise software players like DocuSign remain under pressure. DocuSign’s strong cash flow, high-margin model, and expanding monetization of artificial intelligence products, however, merits taking a closer look at DOCU stock here.

About DocuSign Stock

DocuSign is a San Francisco-based software-as-a-service (SaaS) company that is perhaps most well-known for its electronic signature solutions. The company, with a market capitalization of some $16.5 billion, also sells digital agreement workflows, contract lifecycle management, and identity verification solutions. DocuSign boasts more than 1 million customers globally across enterprises, governments, and small companies.

DocuSign shares have traveled in a highly volatile range in the last 52 weeks from $54.31 to $107.86. Despite recent strength, shares remain far from their pandemic highs. So far this year, the stock is down 10.7%.

Valuation-wise, DocuSign trades at forward price-earning multiple of 68.26x and forward price-sales multiple of 5.42x. Both are richer than the sector averages and arguably deserved in view of its net margin of 35.87% and strong cash generation. However, at the price-cash flow multiple of 27.3x and PEG ratio of around 30x, the stock is fully priced unless growth reaccelerates sharply.

DocuSign Beats on Earnings

DocuSign had a respectable Q2 FY2026 with the company beating revenue as well as earnings estimates. The revenue was at $800.6 million, up by 9% from the previous year, with subscription revenue climbing 9% to $784.4 million. Billings increased 13% to $818 million, indicating growing demand from customers despite macro headwinds.

Diluted GAAP EPS was $0.30 and non-GAAP EPS was $0.92, both exceeding consensus estimates. Free cash flow grew to $217.6 million from $197.9 million in the prior-year period, and repurchased stock was valued at $201.5 million during the quarter.

For Q3, DocuSign is guiding for revenue between $804 million and $808 million, beating the $797 million Street consensus. This again shows sustained demand and initial traction from its products that use artificial intelligence. Notably, management forecasts continued strong free cash flow generation through the remainder of its FY2026.

While the take-up of the company’s AI was the big focus during the call, the company also highlighted growing sales productivity and incremental enterprise wins within regulated verticals such as the financial services and healthcare sectors.

What Analysts Expect from DocuSign Stock

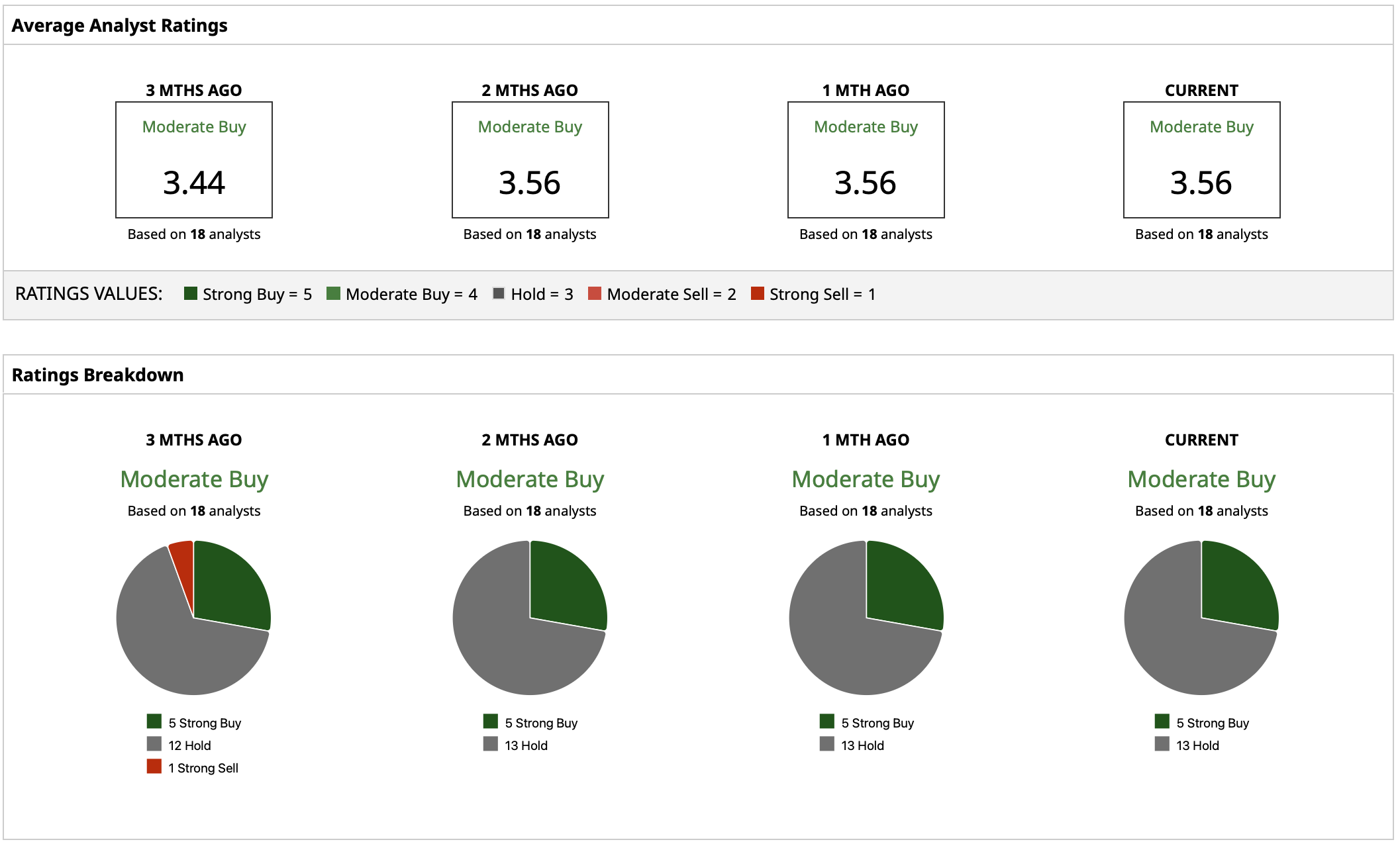

Wall Street is relatively bullish on DocuSign. The stock has a consensus rating of “Moderate Buy” based on 18 analysts in coverage.

The average target price for DOCU stock is at $92.93, promising a possible gain of 15% from the current level. The top target is at $124, representing a gain of 55%.