/AI%20(artificial%20intelligence)/AI%20technology%20-%20by%20Wanan%20Yossingkum%20via%20iStock.jpg)

UiPath (PATH) has once again delivered a solid quarterly report, showing steady growth, expanding customer adoption, and improving profitability. The report showed how the company is combining traditional robotic process automation (RPA) methods with advanced artificial intelligence (AI) to drive customer outcomes. Nonetheless, Wall Street remains cautiously optimistic.

Let’s find out if it is time to buy, hold, or sell PATH stock.

UiPath's AI and “Agentic Automation” Driving Growth

Valued at $6.17 billion, UiPath is a software company that specializes in RPA. Its platform enables enterprises to automate repetitive, rule-based digital operations by using software "robots" (bots) that replicate human behaviors on computers.

In the second quarter of fiscal 2026, total revenue climbed 14% year-on-year (YoY) to $362 million. Annualized recurring revenue (ARR) increased 11% YoY to $1.72 billion, including $31 million in net new ARR. UiPath is not only expanding revenue but also scaling effectively, with gross margin landing at 84%. This quarter, the company recorded no profit or loss, compared to a loss of $0.15 per share in the prior-year quarter.

UiPath's innovation strategy now focuses on merging automation and AI. UiPath’s agentic AI offerings, designed to reason, plan, and act, are quickly becoming a growth engine. Deloitte, Cognizant (CTSH), and other partners are developing solutions using UiPath's agentic automation. Microsoft (MSFT) has also strengthened its partnership by calling UiPath its recommended enterprise automation platform.

UiPath ended the quarter with 10,820 customers, continuing to expand its base with new enterprises. At the same time, current customers are strengthening their commitments, with customers with more than $100,000 in ARR increasing to 2,432 and customers with more than $1 million in ARR rising to 320. The net retention rate stood at 108%.

Furthermore, the company continues to invest extensively in product development to broaden its competitive advantage. Its tools, including UiPath Maestro, Data Fabric, Playground, and API workflows, are all intended to boost adoption and make automation more scalable, safe, and developer-friendly. Despite significant investments, UiPath's balance sheet was healthy, with $1.5 billion in cash, cash equivalents, and marketable securities and no debt at the end of the quarter. Additionally, the company generated $45 million in free cash flow. While management admitted that agentic automation adoption is still in its early stages and is unlikely to have a significant impact on the top line in fiscal 2026, UiPath increased its guidance. The company predicts an increase of 12% in revenue to $1.57 million. ARR might be around $1.83 billion, with a gross margin of 85%. Comparatively, analysts predict revenue could increase by 10% in fiscal 2026, with a 25% increase in earnings. PATH stock currently trades at 17 times forward earnings, which appears to be reasonable.

The global RPA market is estimated to be worth $30.8 billion by 2030, growing at a compounded annual rate of 44% between 2025 and 2030. A recent Gartner market study revealed UiPath as the leader in the Magic Quadrant for RPA for the seventh consecutive year.

Clearly, UiPath is meeting demand for AI-powered automation through robust customer adoption, expanded collaborations, and increased profitability. Its RPA leadership position, paired with agentic AI innovation, has the potential to drive sustained long-term growth. However, competition in robotic automation and AI is stiff, with large tech players also entering the field. If UiPath fails to retain differentiation or execution discipline, growth may decelerate, which is probably why analysts are cautiously optimistic about UiPath's long-term prospects despite a strong quarter.

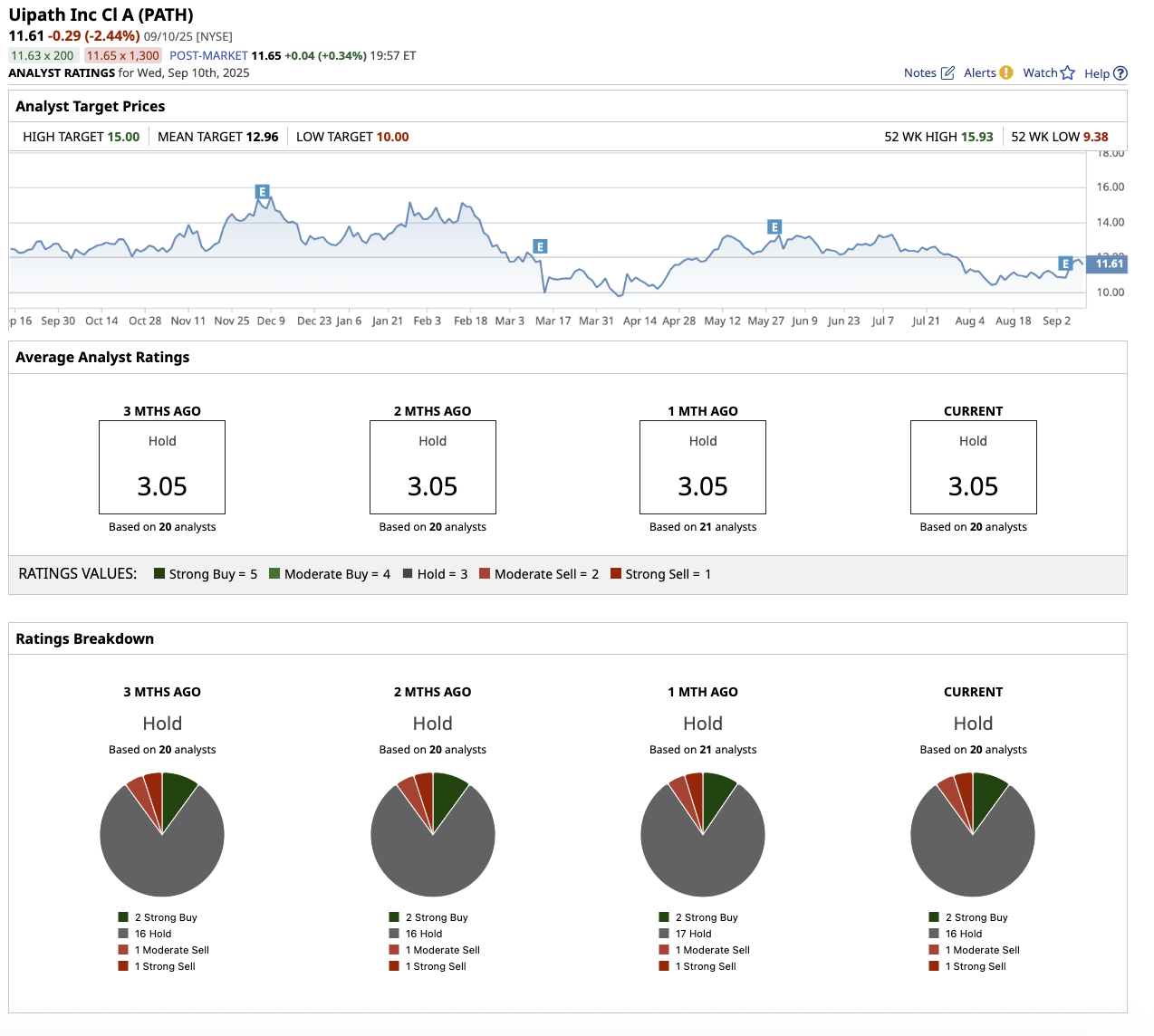

What Are Analysts Saying About PATH Stock?

Overall, Wall Street rates the stock a "Hold." Notably, TD Cowen analyst Bryan Bergin maintained a Hold rating for PATH, citing both progress and ongoing hurdles. According to Bergin, while UiPath reported a great quarter, questions remain about the company's normalized growth path and position in the competitive AI sector. He added that restructuring has improved execution and stability, and incremental ARR indicates recovery potential. However, the client base has not grown significantly, limiting growth opportunities.

More recently, Canaccord lowered its price target on PATH stock to $15 from $16 while retaining a “Buy” rating. While the results were hardly "world-beating," Canaccord emphasized stability, expanding growth indicators with large enterprises, and strong profitability.

Similarly, Barclays, RBC Capital, Evercore ISI, BMO Capital, Wells Fargo, Morgan Stanley, and many other firms maintained a “Hold” rating on the stock.

Of the 20 analysts that cover PATH stock, two rate it a “Strong Buy,” 16 suggest a “Hold,” one rates it a “Moderate Sell,” and one suggests a “Strong Sell.” Despite a strong quarter, the stock is down 8.3% year-to-date (YTD), underperforming the overall market gain. However, based on the average target price of $12.96, the stock has an upside potential of 11.6% from current levels. Its Street-high estimate of $15 further implies the stock can go as high as 29.2% in the next 12 months.

I agree with Wall Street's verdict on PATH stock. Given its early-stage AI adoption, it would be wise to hold onto it until it exhibits sustainability in ARR growth acceleration. However, investors who are bullish on AI-driven automation may see UiPath's leadership, financial discipline, and solid customer retention as reasons to accumulate shares now.