Switzerland-based global healthcare company Novartis (NVS) is gaining momentum this year, thanks to solid pipeline execution, new regulatory wins, high-value license transactions, capital return to shareholders, and positive market sentiment. Novartis stock has surged 36.3% year-to-date, outperforming the broader market.

Following Sandoz’s (SDZNY) 2023 spinoff, Novartis is a pure-play innovative medicines firm focused on high-value therapeutic areas.

The company is scheduled to report its third-quarter earnings on Oct. 28. Let us see if the stock is a buy ahead of earnings.

Novartis’ Strategy Is Working

Novartis’ strategy of focusing on high-value, innovative medicines is paying off. Its priority brands rose 33%, excluding Entresto, indicating that the next generation of medicines is taking over driving growth. In the second quarter, net sales increased by 11% year-over-year, with core earnings per share rising by 24% to $2.42.

During the earnings call, CEO Vas Narasimhan cited the company’s outstanding portfolio performance, notably its newer oncology, neurology, and cardiovascular products, as significant drivers of the strong quarter. The oncology drug Kisqali stood out as the quarter’s star performer, climbing 64% and gaining total prescription (TRx) leadership in metastatic breast cancer. Narasimhan stated that Kisqali’s trajectory indicates it will become a multibillion-dollar growth engine over the next decade.

Additionally, Kesimpta, Novartis’ self-administered B-cell treatment for multiple sclerosis (MS), increased 33% in the quarter. Pluvicto, for prostate cancer, returned to robust growth in the quarter, up 30%, following the approval of its new pre-tax indication in the U.S. Furthermore, the cholesterol-lowering drug Leqvio (inclisiran) saw 61% growth and is on track to exceed $1 billion in annual sales.

The company’s blockbuster heart failure drug Entresto has continued to grow steadily. Novartis confirmed its estimate for a loss of exclusivity (LoE) in the U.S. by mid-2025, citing ongoing litigation with one generic contender. The product remains a significant global contributor, with half of revenues coming from Europe, China, and Japan, where patent rights last until 2026 and beyond. These regions are likely to continue to contribute considerable revenue throughout the decade.

Through disciplined capital allocation, Novartis repurchased $5.3 billion worth of shares in Q2 and announced a new $10 billion buyback program to be executed by the end of 2027.

New Drug Approvals and Pipeline Progress Have Caught Attention

On Sept. 30, Novartis reported that the U.S. FDA had authorized Rhapsido (remibrutinib) for chronic spontaneous urticaria (CSU), a skin allergy disorder that does not respond to traditional treatments. According to Reuters, the twice-daily pill is expected to cost $4,521 in the U.S. for 30 days.

Prior to this, Reuters reported that Novartis and Monte Rosa Therapeutics (GLUE) had signed a licensing agreement worth up to $5.7 billion to explore therapies for immune-related disorders, marking their second collaboration in less than a year. The agreement gives Novartis exclusive rights to an unnamed drug discovery target, as well as the possibility to license two more early stage immunology products from Monte Rosa’s portfolio.

This agreement follows Novartis’ $5.2 billion deal with China’s Argo Biopharmaceutical for experimental heart treatments earlier this month, showing the Swiss pharmaceutical giant’s aggressive attempt to strengthen its innovation pipeline.

Novartis’ Q2 results showed a company transforming into a leaner, faster-growing, innovation-driven pharmaceutical leader. While Entresto’s patent expires, the company’s pipeline depth, operational discipline, and innovative execution position it well for the next phase of growth over the next decade.

For the full year 2025, management expects high single-digit sales growth, with analysts estimating revenue growth of 9.4% and earnings growth of 15.3%. Revenue and earnings are predicted to grow by 2.7% and 3.9% in 2026, respectively. Novartis stock trades at a 14x premium to its expected earnings growth in 2026.

What Does Wall Street Say About Novartis Stock?

In September, Goldman Sachs analyst James Quigley downgraded Novartis stock to a “Sell” rating, citing rising headwinds that could impede the pharmaceutical company’s growth trajectory. Quigley believes the company’s valuation has become overinflated, particularly as it faces a significant loss of exclusivity (LoE) on key drugs, which could slow revenue growth after years of consistent high single-digit to low double-digit growth.

The upcoming generic competition for Entresto, one of Novartis’ best-selling products, is also expected to erode earnings growth. With a limited new pipeline over the next 12-18 months, market confidence may deteriorate further.

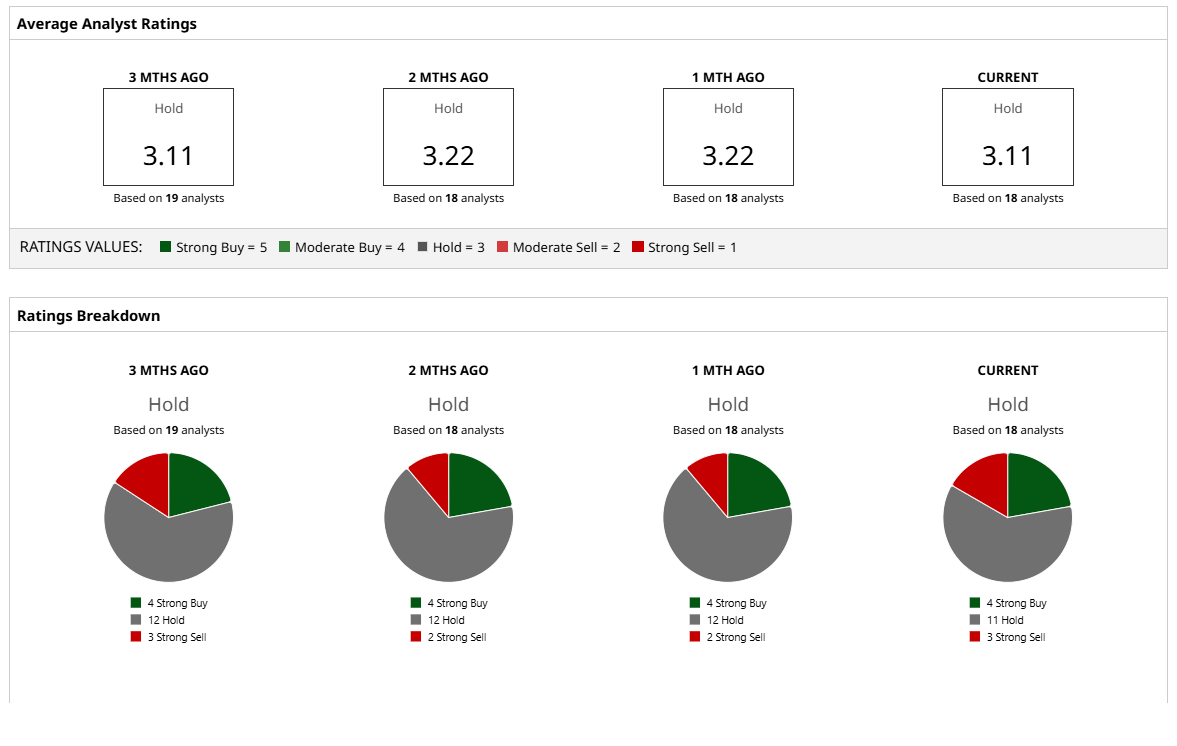

Overall, Wall Street has a cautious stance on Novartis stock, rating it a “Hold.” Of the 18 analysts covering the stock, four rate it a “Strong Buy,” 11 say it is a “Hold,” and three rate it a “Strong Sell.” The stock has surpassed its average target price of $122.43, and its high price estimate of $140 implies an upside potential of 5.7% from current levels.